According to the latest record of labor, many banks are listing the interest rate of over 6%/year for long deposit terms. Notably, most of them do not require minimum deposits.

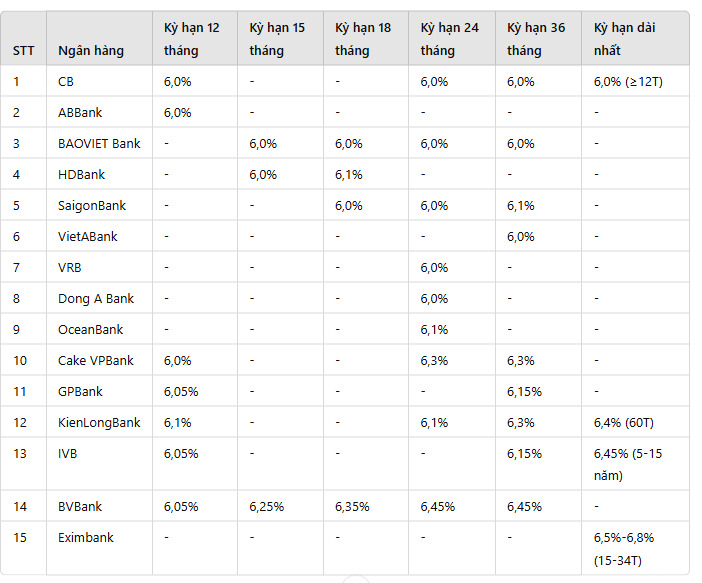

CB applies the interest rate of 6%/year for all terms of 12 months or more. ABBank applies 6% for 12 -month term. BAOVIET Bank applies 6% for terms 15, 18, 24 and 36 months.

HDBank applies 6%/year interest rate for 15 -month term and 6.1% for 18 -month term. Saigonbank offers 6% for terms 13, 18 and 24 months, and applies 6.1% for 36 -month term. VietABank applied 6% for 36 months.

VRB and Dong A Bank together with interest rates 6%/year for 24 -month term. Oceanbank applies 6.1%/year for 24 -month term. Cake by VPBank applies 6%/year interest rate for 12-18 months and 6.3% for 24-36 months.

GPBank offers 6.05%/year for 12 -month term and 6.15%/year for terms from 13 to 36 months. Kienlongbank applies 6.1%/year for term 12-24 months, 6.3% for 36-month term and 6.4% for 60-month term.

IVB has the highest interest rate of up to 6.45%/year for terms from 5 to 15 years. For 48 months term, the interest rate is 6.25%/year. Meanwhile, the 36 -month term interest rate is 6.15% and the 12 -month term is 6.05%/year.

BVBank offers 6.05%/year for 12-month term, 6.25% for 15-month term, 6.35% for 18-month term and 6.45% for 24-36 months term. Eximbank applies the interest rate from 6.5% to 6.8%/year for terms of terms of 15 to 34 months.

According to research groups, interest rates in 2025 are expected to have slight fluctuations, reflecting the adjustment of financial markets and monetary policies.

Vietcombank Securities Company (VCBS) said that the mobilization interest rate level will continue the tendency to increase slightly by the end of 2024, due to the pressure of exchange rate and inflation, especially under the impact of stresses. geopolitical. However, in 2025, interest rates are expected to pass, maintain at a stable level to support economic growth.

KB Vietnam Securities Company (KBSV) forecasts that the State Bank will continue to maintain a loose monetary policy in 2025, keeping interest rates low to promote economic growth. Accordingly, the mobilized interest rate may increase slightly from 0.3 to 1 percentage point, depending on the bank group. The loan interest rate is expected to go sideways in the first half of 2025 and may rise again in the second half of the year, reflecting the increasing credit demand when the economy recovers.

Overall, forecasts show that deposit and lending interest rates in 2025 will tend to increase slightly, but still be controlled to support economic growth.