According to Lao Dong, the first month of 2025 recorded 7 banks increasing deposit interest rates, including: Agribank, Bac A Bank, NCB, MBV, Eximbank, KienlongBank, VietBank.

In particular, the market recorded Eximbank listing an "unimaginably" high deposit interest rate of up to 6.6 - 6.8%/year for a 36-month term. This is an unexpectedly high interest rate when there is no deposit requirement. Previously, to enjoy an interest rate of 6.5%/year, customers often had to meet the minimum deposit requirement of billions of VND.

Interest rates will increase slightly and remain stable

Vietcombank Securities Company (VCBS) predicts that interest rates for medium and long-term deposits will increase slightly by 0.2 - 0.3 percentage points by the end of 2024, then remain stable in 2025. Lending interest rates are expected to increase by 0.5 - 0.7% as credit demand increases thanks to economic recovery, especially when businesses begin to expand production and business activities after the period affected by the pandemic.

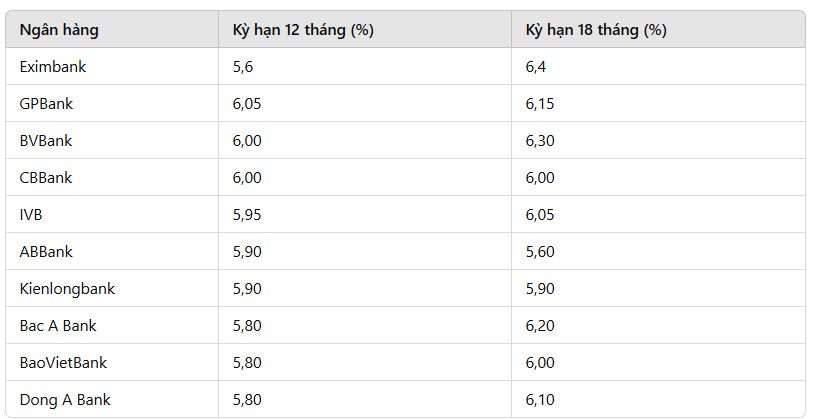

Deposit interest rates at banks have started to increase slightly since mid-2024, and this trend has spread to longer terms. However, the differentiation between banking groups is quite clear. Small banks often apply interest rates 1% to 3% higher than large banks for the same term. Currently, the highest deposit interest rates are concentrated on 12- and 18-month terms, exceeding 6%/year at some banks.

In addition, the USD - VND exchange rate has remained high since the end of October last year, fluctuating around 25,400 VND/USD, putting pressure on interest rates. According to experts' forecasts, the average deposit interest rate may increase by about 0.5% in 2025, from the current 5.2% to about 5.7%. However, this increase is not expected to have too much of an impact on lending rates.

VCBS believes that the State Bank will continue to maintain a flexible monetary policy to support economic growth while controlling inflation well. Factors such as fiscal policy, fluctuating raw material prices, and the speed of global economic recovery will be the main factors affecting interest rates in 2025.

The government also plans to apply support policies to minimize the negative impact of interest rate hikes, especially on the manufacturing and export sectors.

A series of banks compete to pay deposit interest from 7%/year?

According to Lao Dong, with a special interest rate, the highest in the market is the interest rate of 9.0%/year listed at PVcomBank. PVcomBank customers will enjoy a special interest rate of 9.0%/year when having a new deposit balance of 2,000 billion VND or more.

HDBank also listed an interest rate of 8.1%/year for a 13-month term. Applicable to savings of at least VND500 billion/savings card, not applicable to mobilization in the form of initial interest or periodic interest.

Dong A Bank is listing a special interest rate of 7.5%/year for customers depositing for a term of 13 months or more, with interest at the end of the term for deposits of VND 200 billion or more, for a period of 365 days/year.

MSB currently offers a special interest rate of 7.0%/year to customers with newly opened savings books or savings books opened from January 1, 2018, automatically renewed with a deposit term of 12 months, 13 months and a deposit amount of VND 500 billion or more.

In addition, lower savings rates, from 7.0%/year, are also listed at many banks.