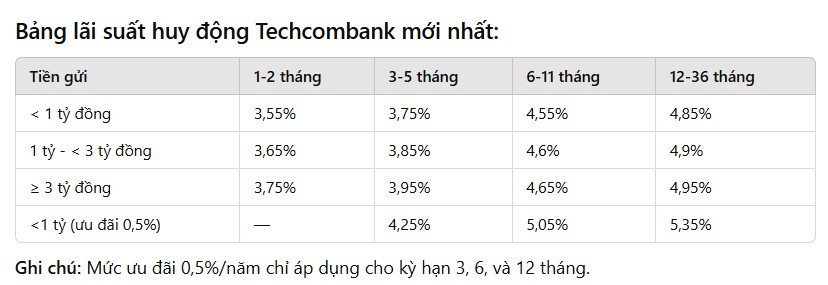

According to Lao Dong, on December 18, Techcombank increased interest rates for deposits with terms of 1-6 months, with an increase of 0.1%-0.2%/year.

This bank also adds 0.5%/year interest rate for newly opened deposit accounts or increased balances during the month, bringing the highest interest rate up to 5.45%/year (12-month term, deposit from 3 billion VND).

Interest rates remain stable

Economists predict that banks will maintain stable deposit interest rates, with a slight increase of about 0.2%/year by the end of the year. This is largely due to the stability of the economy and control of inflation, combined with the fact that international central banks, such as the US Federal Reserve, have reduced interest rates, creating little pressure on domestic interest rates.

In addition, although large banks may not change their interest rates much, some small banks may still maintain higher interest rates to attract customers. This creates differentiation between banks and allows depositors to choose savings products with higher interest rates from small banks, even though the difference is not too large.

While the general trend is for interest rates to remain stable, if the economy recovers strongly or there is a surge in credit growth, there could be slight adjustments in interest rates in 2025.

However, up to now, savings interest rates are still at a reasonable level and bring stable profits to depositors in the short term.

A series of banks compete to pay deposit interest from 7%/year?

According to Lao Dong, with a special interest rate, the highest in the market is the interest rate of 9.5%/year listed at PVcomBank. PVcomBank customers will enjoy a special interest rate of 9.5%/year when having a new deposit balance of 2,000 billion VND or more.

HDBank also listed an interest rate of 8.1%/year for a 13-month term. Applicable to savings of at least VND500 billion/savings card, not applicable to mobilization in the form of initial interest or periodic interest.

Dong A Bank is listing a special interest rate of 7.5%/year for customers depositing for a term of 13 months or more, with interest at the end of the term for deposits of VND 200 billion or more, for a period of 365 days/year.

MSB currently offers a special interest rate of 7.0%/year to customers with newly opened savings books or savings books opened from January 1, 2018, automatically renewed with a deposit term of 12 months, 13 months and a deposit amount of VND 500 billion or more.

In addition, lower savings rates, from 7.0%/year, are also listed at many banks.

See more daily bank interest rate updates HERE.