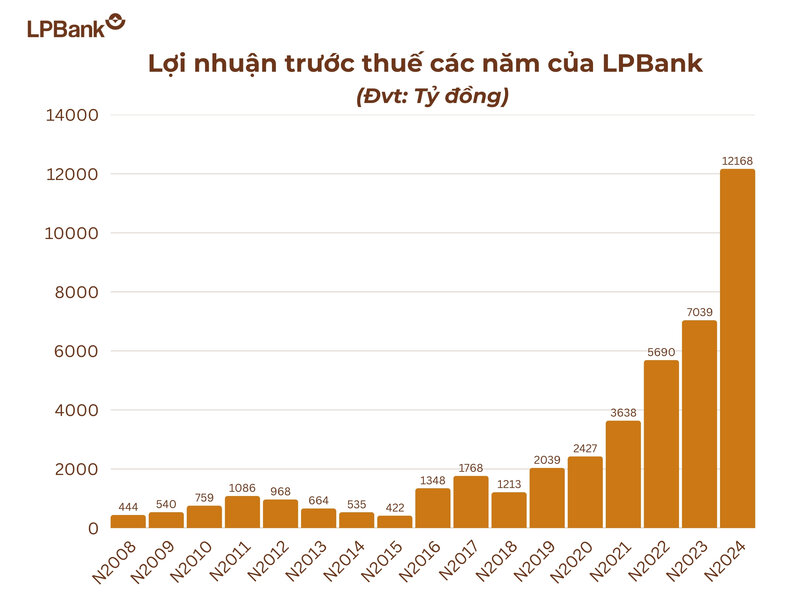

At the end of 2024, LPBank announced pre-tax profit of VND 12,168 billion, completing 116% of the profit plan approved by the General Meeting of Shareholders, officially entering the group of enterprises with profits of over VND 10,000 billion.

The total assets of this Bank at the end of 2024 will reach over 508 trillion VND, an increase of 33% compared to the end of 2023, not only marking remarkable growth but also affirming LPBank's increasingly solid position in the system of commercial banks in Vietnam.

LPBank's financial picture in 2024 is also highlighted by impressive credit growth. Outstanding credit balance as of December 31, 2024 reached VND 331,606 billion, an increase of more than 20% over the same period in 2023. LPBank has proactively disbursed loans since the first months of the year. Instead of waiting, the Bank has quickly implemented credit solutions to meet the borrowing needs of businesses and individuals, especially in priority areas. As a result, the Bank's outstanding credit balance has grown strongly since the first quarter of 2024, creating momentum for increased profits in the following quarters.

In 2024, LPBank recorded many milestones in business activities thanks to continuing to vigorously and synchronously implement strategic projects such as digital banking, risk management, launching digital products for corporate customers and personal financial products focusing on the retail segment...

As a result, LPBank's capital mobilization in market 1 as of December 31, 2024 reached VND 338,662 billion, an increase of VND 53,319 billion compared to the previous year, equivalent to a growth of 18.69%.

In terms of asset quality, LPBank's bad debt ratio by the end of 2024 reached 1.51%, although it increased compared to the end of 2023 at 1.34%, but it is still much lower than the State Bank's prescribed rate of <3% and is among the banks with the lowest bad debt ratio in the system. In addition, LPBank's safety ratios, especially the minimum capital adequacy ratio (CAR) at the end of 2024, reached 13.38%, higher than in 2023 (12.24%) and much higher than the prescribed rate of 8%.

LPBank's good profit growth is also thanks to the promotion of diversifying revenue sources, notably revenue from service fees contributing more than 16% of total revenue, the cost-to-income ratio (CIR) has sharply decreased to 29%. This result demonstrates the success of the process of streamlining the apparatus, simplifying processes, applying technology to operations, and operating excellently. Thanks to these efforts, LPBank has entered the Top 4 of the Top 50 most effective businesses in Vietnam.

Mr. Nguyen Duc Thuy, Chairman of LPBank's Board of Directors, shared: “LPBank has always proactively followed the directions of the Party, the Government and the State Bank to resolutely and synchronously deploy solutions to comprehensively complete business targets and comply with safety ratios in banking operations. In particular, with the revolution of streamlining the apparatus, LPBank has streamlined from 17 Business Blocks to 8 Business Blocks and officially implemented operations under the new model from December 16, 2024. The impressive growth in profit and total assets that LPBank has achieved in the context of focusing on comprehensive transformation shows a clear and consistent strategic orientation, focusing on customers”.

This outstanding result was achieved thanks to the strategic orientation of focusing on the retail segment - which is assessed to have high growth potential and lower risk. The return on equity (ROE) reached 25.1%, showing the bank's outstanding profitability and capital efficiency. Last year, LPBank was also the leading bank in the top 10 banks with the highest ROE in the first 9 months of 2024.