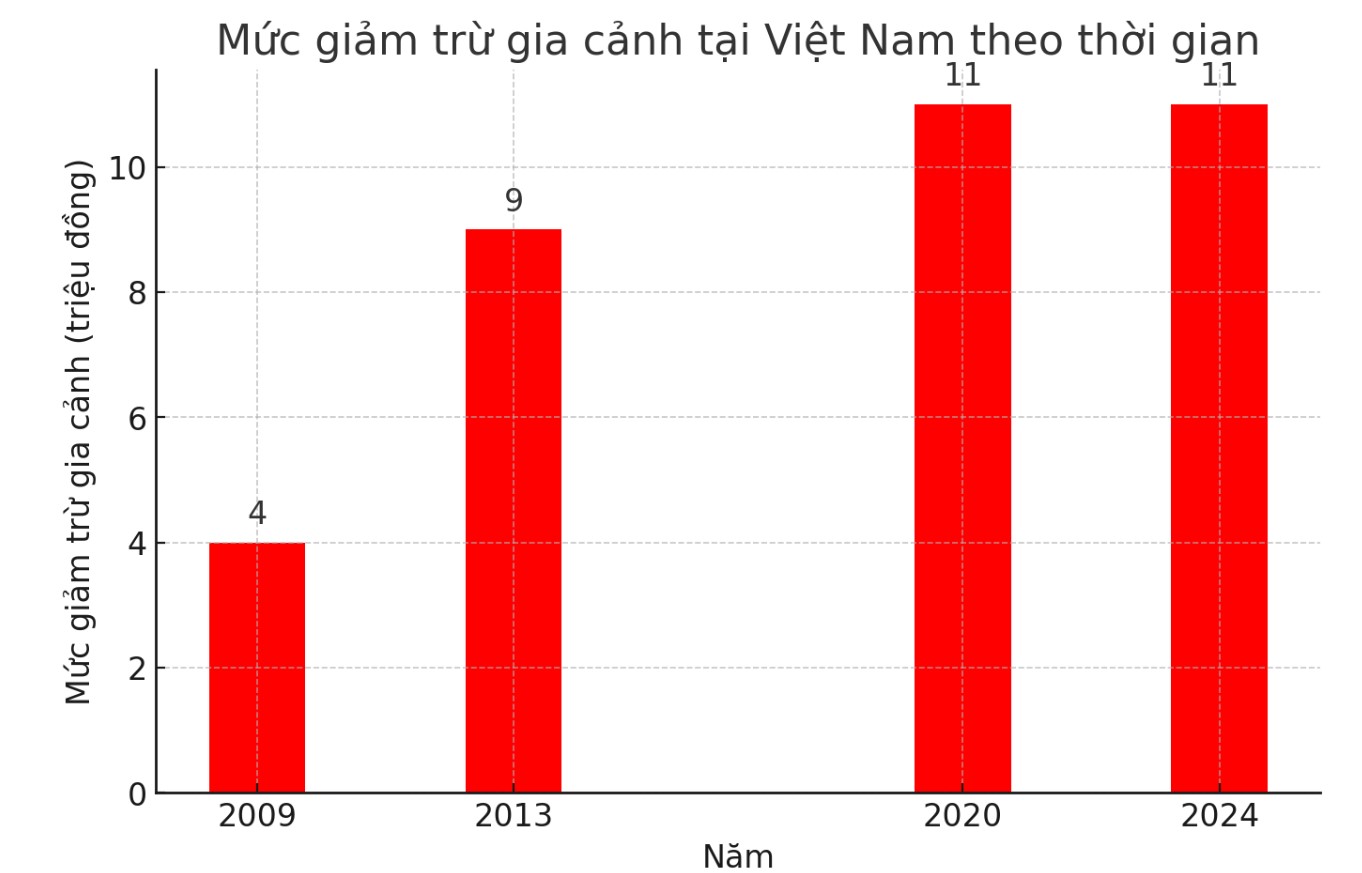

Vietnam's family deduction level over time

The Law on Personal Income Tax of Vietnam has been in effect since 2009, marking the first time the official family deduction level has been applied.

Initially, the personal deduction for taxpayers was 4 million VND/month (48 million VND/year) and 1.6 million VND/month for each dependent.

By 2013, the personal deduction was adjusted to 9 million VND/month (108 million VND/year) and 3.6 million VND/month/dependent.

In 2020, the deduction level continued to be raised to 11 million VND/month (132 million VND/year) for oneself and 4.4 million VND/month/dependent, and remained the same until 2024.

Sharing at the Personal Income Tax Law Workshop - Ensuring fairness, promoting growth", Associate Professor, Dr. Le Xuan Truong - Head of the Faculty of Taxation and Customs, Academy of Finance said that, looking at the adjustment process, it can be seen that after each period of 6 to 7 years, the new family deduction level is updated. This adjustment puts the deduction at risk of falling behind the actual living standard, especially when inflation and prices increase.

An objective approach to assessing the family deduction level is to compare it with the average GDP per capita over each period. In 2009, the personal deduction was 2.25 times higher than the GDP per capita.

Before the 2013 adjustment, this ratio decreased to 1.17 times GDP. After the 2013 adjustment, the deduction increased to 2.64 times the GDP per capita.

By 2019, before the next adjustment, this level had decreased to 1.37 times and after the 2020 adjustment, the deduction was 1.52 times GDP. In 2024, this figure will continue to decrease to about 1.15 times GDP.

The above data shows that the family deduction in Vietnam is tending to decrease compared to the average GDP per capita, raising the issue that needs to be considered for adjustment to ensure it is suitable for the actual standard of living.

In other countries, the family deduction is very diverse. In the US, the personal deduction is $14,600, equivalent to 0.17 times GDP per capita. In Germany, this is 11,604 EUR (12,000 USD), equal to 0.22 times the GDP per capita. Meanwhile, in Vietnam, the current self-depreciation rate is about 1.15 times the GDP per capita, much higher than many Southeast Asian countries such as Indonesia or Thailand.

In addition to the deduction, countries also apply flexible policies such as additional deductions for people with disabilities or the elderly. Some countries such as the US and Singapore have also deducted from medical, educational and even domestic travel expenses (Thailand). The annual adjustment of deductions according to the consumer price index (CPI) is also a popular trend in developed countries to ensure the deduction level is suitable for reality.

Vietnam needs to adjust more flexibly

Although the family deduction in Vietnam is high, there is no flexible mechanism for regular adjustment. According to current regulations, only when the CPI fluctuates above 20%, will the family deduction be considered for adjustment. This leads to the deduction level being outdated compared to economic reality, reducing the effect of supporting workers.

To improve, it is necessary to recalculate the deduction level in the direction of linking GDP per capita. Accordingly, it is possible to maintain a personal deduction of about 1.5 times GDP per capita to ensure suitability with economic conditions.

In addition, it is advisable to add deductions for vulnerable groups such as people with disabilities or dependents who are elderly. More importantly, it is necessary to change the mechanism for adjusting annual deductions based on CPI to avoid the situation where the deduction level is outdated compared to reality.

Reducing family deductions is an important tool to help maintain tax fairness and ensure a minimum living standard for workers. However, in the context of economic fluctuations, there needs to be reasonable adjustments to maintain the effectiveness of this policy.