According to Lao Dong, recently, many commercial banks have launched credit programs on the market for young people under the age of 35. These programs are advertised with preferential interest rates, long loan terms and simple procedures.

Attractive incentives are actively promoted by banks

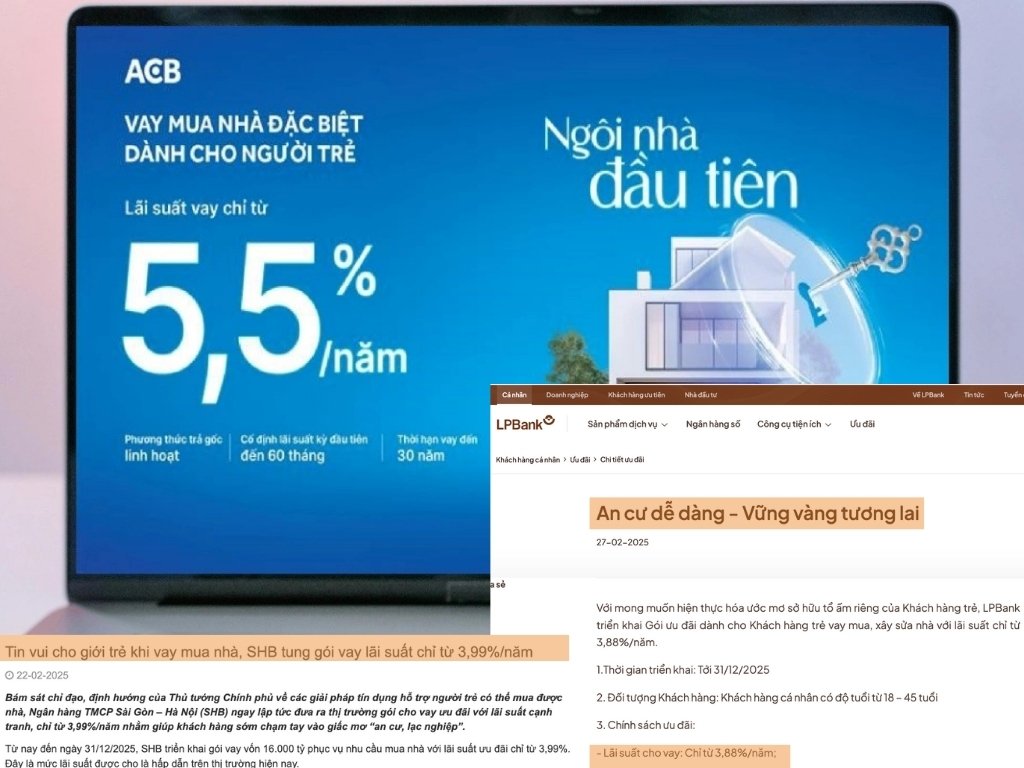

According to a survey by reporters, from 2025 to now, up to 12 banks have announced separate loan packages or attractive incentives for people under 35 years old with fixed interest rates for the first period fluctuating strongly. From 0% in the first month (Kienlongbank), around 3.6-3.99%/year (PVcomBank, SHB, TPBank, LPBank) to 5-5.85% in large and international commercial banks such as BIDV, ACB, Shinhan.

As one of the pioneering banks launching a low-interest home loans program to the market, Asia Commercial Joint Stock Bank (ACB) announced on the media the "First House" loan package for young people under 40 years old. With a long loan term of up to 30 years, the first interest rate fixing period is up to 5 years, simple and flexible procedures with preferential loan interest rates from only 5.5%/year.

The promises on ACB's official website and media channel have made many young people rush to learn and dream of settling down.

Or at Saigon - Hanoi Commercial Joint Stock Bank (SHB) with the name of the credit program "Dream House", this bank also launched a preferential lending package with competitive interest rates to help customers soon touch the dream of "settling down, making a living".

According to advertisements, credit users will be able to borrow up to 90% of the value of assets they plan to buy, without limiting the loan amount with an interest rate of only 3.99%/year. In addition, customers are also exempted from paying the principal for the first 60 months - equivalent to 5 years and are given a credit card/attractive payment limit.

Loc Phat Commercial Joint Stock Bank (LPBank) also launched a preferential package for young customers to borrow to buy, build and repair houses with lower interest rates, from only 3.88%/year. LPBank's "Easy settlement - Golden future" program targets young customers under the age of 45, with a loan term of 35 years, super-fast approval, lending level up to 100% of capital needs.

These programs are implemented by banks in the context of the Government's credit support policy to remove housing difficulties for young people. At the Government Standing Committee Conference on February 11, 2025, the Prime Minister directed the State Bank to coordinate with relevant ministries and branches to promote credit programs to serve young people who buy or rent houses, in which the target group is under 35 years old.

Need to calculate financial costs when borrowing

However, according to a survey by reporters, not all young people are eligible to access or bear long-term loans despite preferential interest rates.

Ms. Le Phuong Anh, 25 years old, is a young person who is making continuous efforts with the hope of soon settling down in the big city. While taking on a full-time job in the media industry, she took advantage of teaching and training part-time MC skills, all with the desire to maintain a good source of income and stay in Hanoi.

Working day, working night, and taking extra days off are what the young girl is trying every day to prepare for getting married at the end of this year. With the desire to own the first house as soon as possible, Ms. Phuong Anh and her husband have consulted many preferential credit programs to buy a house for young people under 35 years old.

However, the main source of income from the couple's salary is still a constant concern, causing Ms. Phuong Anh to worry every time she thinks about the prospect of high bank loan interest rates after the fixed interest rate incentives expire.

After listening to advice and consulting many banks, Ms. Phuong Anh said that the current interest rate is still beyond the financial capacity of the couple.

"There are banks that offer us the principal payment of only under VND 100,000/month. However, when calculating back, with an interest rate of 7%, after a fixed period of 24 months, the loan to repay is still a burden, the first house is still a distant dream" - Ms. Phuong Anh sadly shared.

Speaking to reporters, Associate Professor, Dr. Dang Ngoc Duc - Head of the Faculty of Finance - Banking, Dai Nam University (former Director of the Institute of Banking and Finance, National Economics University) said that young people rushing to buy a house can create financial pressure. Because not everyone can be proactive in their income when they are quite young.

According to Associate Professor, Dr. Dang Ngoc Duc, interest rates are not a key issue for those who need to borrow capital. "Because the actual cost of a loan is always much higher than the interest rate" - Mr. Duc pointed out.