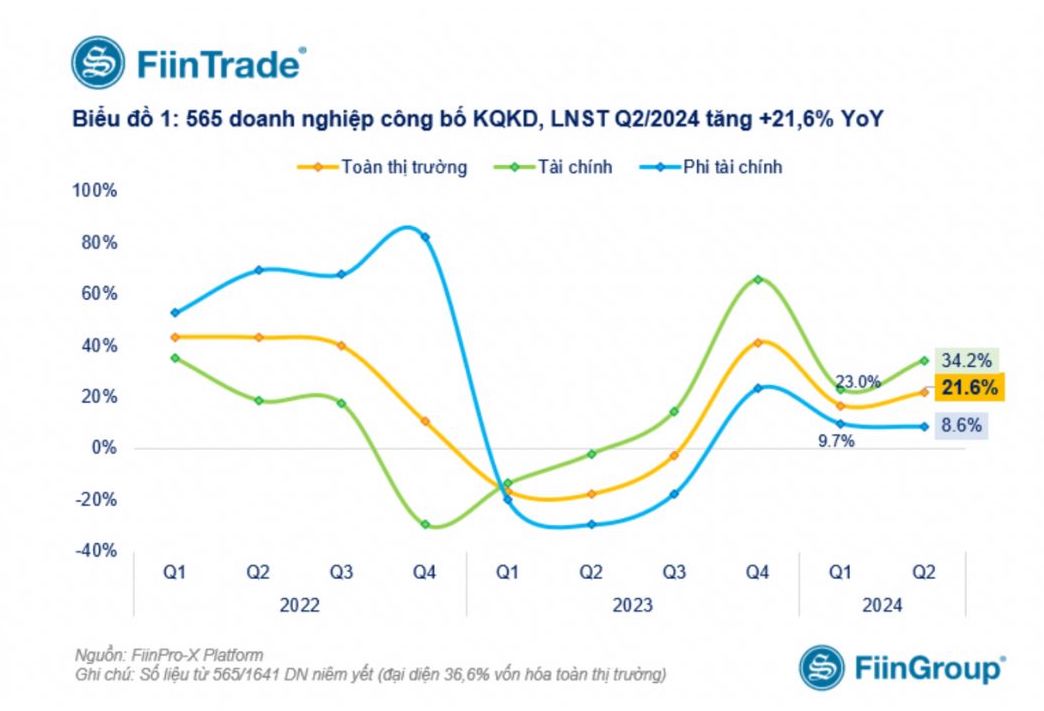

Statistics from FiinTrade show that as of the morning of July 25, 2024, there were 565 businesses (representing 36.6% of total capitalization value on HOSE, HNX and UPCoM) providing estimates of business results or publishing reports. Financial report for the second quarter of 2024. In particular, the after-tax profit growth of these 565 enterprises reached 21.6% over the same period in the second quarter of 2024, higher than the previous first quarter's growth rate of 16.7%.

The highlight is that the financial group continues to contribute mainly to this growth with profit after tax increasing by 34.2% over the same period, mainly thanks to banks. Many places confirmed record profits, such as ACB recording pre-tax profit in the second quarter of VND 5,598 billion, up 15.8% over the same period last year. Profit after tax was 4,468 billion VND, an increase of 15.6%.

Or SeABank also set a record with pre-tax profit in the second quarter of 2024 estimated at 1,732 billion VND, an increase of 83% over the same period. Profit after tax also increased by 83%, reaching 1,381 billion VND.

LPBank leads in profit growth rate. In the second quarter, this bank achieved a pre-tax profit of 3,033 billion VND, nearly 3.5 times higher than the same period in 2023. Net profit was more than 2,400 billion VND in the second quarter, more than three times higher than the same period thanks to promoting lending.

Techcombank also had double-digit growth with net profit in the second quarter reaching 6,270 billion VND, an increase of nearly 40%.

According to assessments from experts from MB Securities Company (MBS), NIM will continue to be under downward pressure when lending interest rates are expected to decrease further while deposit interest rates have increased slightly in most banks. MBS forecasts that credit growth in the second quarter will be better than the first quarter but still lower than the same period. Therefore, in general, net interest income has not yet been able to increase strongly.

Non-interest income is still bleak and has not been able to recover as it relies mainly on fee collection and debt settlement. Foreign exchange and stock trading activities are not expected to have high growth rates as the market situation becomes increasingly difficult. Provision costs will continue to increase when bad debt shows signs of increasing again in the second quarter. NPL increase and LLR decrease is the general trend of the whole industry.

"Banks' after-tax profits will not have a high growth rate. The increase is notable in some banks with good credit growth such as LPB, VPB, HDB. Some banks recorded an increase in after-tax profits negative growth due to high profit after tax in the same period last year like STB and BID" - MBS said.

VNDIRECT Securities Company forecasts that net profit growth of the entire banking industry in 2024 will reach about 23.8% over the same period. Among them, VPBank, LPBank and Vietinbank will likely be the banks with the highest growth rates in the industry.

VNDIRECT emphasizes that this is a good time to continue to accumulate banking stocks selectively based on growth prospects. Successful credit growth and capital raising will attract investors' attention by demonstrating each bank's resilience, growth potential of its business model, and ability to withstand economic fluctuations. row.