Enterprises need time to adjust and adapt

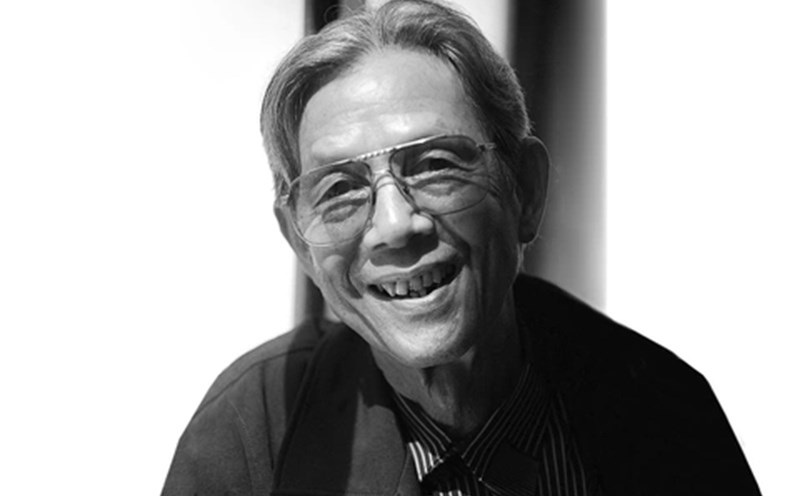

Mr. Dau Anh Tuan, Deputy General Secretary and Head of the Legal Committee of VCCI, said that the development of a special consumption tax policy needs to come from practice, ensuring efficiency in state management, while creating conditions for solutions to support businesses to become practical, contributing to promoting growth momentum from institutions, including the special consumption tax policy (TTDB).

Regarding the macroeconomic situation, Dr. Can Van Luc, Chief Economist of BIDV and Director of BIDV Training and Research Institute, commented that businesses are still facing many difficulties due to the instability of the global macro economy, trade - technology war, high input and logistics costs, uneven and unsustainable recoveries...

Meanwhile, both options of increasing special consumption tax in the Draft Law on Special Consumption Tax for industries such as cigarettes, beer, soft drinks, and pick-up cars carrying double-cabin goods all lead to very high tax increases in a short time, causing great concerns about the stability of the domestic manufacturing industry.

For the tobacco industry, to facilitate the tobacco industry in implementing Resolution 25/NQ-CP of the Government, the Vietnam Tobacco Association and the business community propose that the National Assembly stipulate the absolute tax rate as follows:

The absolute tax rate will increase by VND 2,000/bag every two years from 2026 and reach a maximum of VND 6,000/bag by 2030.

This is a tax rate that is sufficient to ensure consumption reduction, while businesses have more time to adapt, adjust production, improve technology, and limit the development of the smuggling cigarette market.

Appropriate tax increase roadmap is needed

Tobacco businesses hope that the National Assembly, the National Assembly Standing Committee and the Economic - Financial Committee will listen to the opinions of the Vietnam Tobacco Association and the business community, carefully consider the roadmap to increase special consumption tax on tobacco.

At the same time, it is necessary to combine smuggling tobacco control measures and communication to raise consumer awareness, in line with the direction of National Assembly Chairman Tran Thanh Man at the 43rd session of the 15th National Assembly Standing Committee on March 10. The National Assembly Chairman emphasized that it is necessary to listen to businesses' opinions, calculate carefully to avoid harming the legal manufacturing industry and avoid the risk of unintentionally creating conditions for the development of smuggled cigarettes.

Previously, for this item, the proposals in the Draft Law on Special Consumption Tax with an absolute tax increase of VND 10,000/pack by 2030 received many criticisms from the business community and associations. Option 2 of the Draft is considered a shocking increase, when in the first year it increased by VND 5,000/pack, causing heavy pressure on businesses and the legal market, as well as creating "price shock" for consumers and unintentionally pushing them to smuggle cigarettes. Option 1, although having a slight increase of VND 2,000/pack in the first year, still maintains a continuous increase roadmap every year, still putting pressure on the entire legal tobacco industry.

Avoid increasing the risk of smuggled cigarettes

In terms of economy, Mr. Nguyen Chi Nhan - General Secretary of the Vietnam Tobacco Association (VTA) affirmed that in the context that sectors, fields and localities are making efforts to implement Resolution 25/NQ-CP of the Government, with the goal of economic growth of 8% or more in 2025 and maintaining double-digit growth in the following years.

The total capital of enterprises in the tobacco industry is about VND18,000 billion and total assets are nearly VND40,000 billion. 100% of the value of this capital and assets belong to state-owned enterprises with 100% capital. In 2024, cigarette manufacturing enterprises contributed VND26,060 billion to the budget (EIA tax: VND23,500 billion; Import tax: VND1,800 billion; Tobacco Harm Prevention Fund: VND500 billion; Environmental Protection Fund: VND260 billion). The tobacco industry is currently creating jobs for 11,000 direct workers; investing and supporting more than 90,000 tobacco farmers.

At the 8th session of the 15th National Assembly, many delegates expressed their opinion on the need to review the tax rate of tobacco to avoid negative impacts on society, and increase smuggled cigarettes that cause budget losses. The tobacco industry has also sent many documents to the Ministry of Finance, the Government and the National Assembly agencies, but the issue of special consumption tax rates has not been considered.