The State Budget revenue target for the 2021-2025 period according to Resolution 23 is VND 8.3 million billion. By the end of 2024, it is estimated to reach VND 7.1 million billion, reaching 86.2% of the plan. The tax sector alone will reach VND 6.1 million billion, exceeding the estimate by 18.6%.

2021 - 2025 is also the period when businesses are hit hardest by the COVID-19 pandemic and unprecedented global geopolitical changes. Maintaining a balance between tax policies and policies to support people and businesses is an extremely challenging problem that the tax sector and relevant authorities have worked together to solve.

Collecting correctly and fully The above tax collection achievements do not come from oppression of businesses and people, but from collecting correctly and fully from economic activities.

Expanding the tax base and collecting taxes fully on activities that the tax sector has not previously "touched" is the approach that tax authorities have been diligently pursuing in recent years.

Tax is a sensitive industry because it is directly related to the interests of each entity in the economy, even the smallest ones such as individuals doing small business, or large, multinational economic corporations with complex operating networks.

Without talking much about technological achievements, the tax industry is quietly applying these achievements in managing a huge database. From there, each economic component is considered, creating conditions for paying taxes correctly and sufficiently, avoiding unnecessary troubles and congestion.

Evaluating Vietnam's electronic tax system, Mr. Noguchi Daisuke - Chief Project Advisor (Japan International Cooperation Agency) said that this system "is not inferior to other countries and contributes to promoting global business activities".

“Vietnam’s tax management meeting international standards will increase confidence from foreign investors, thereby promoting sustainable economic growth,” added Mr. Noguchi Daisuke.

With the philosophy of leniency, creating conditions for people and businesses to do business healthily, the tax sector is also making efforts to come up with solutions to exempt and extend tax payments.

During the 2021-2024 period, the tax sector has exempted, reduced, and extended tax payments for nearly 3.7 million taxpayers with 8 types of taxes and 36 types of fees with a total amount of nearly 730,000 billion VND. This policy has reduced the financial burden on businesses and people, activated the internal strength of production and business, created momentum for recovery and promoted economic growth, contributing to ensuring the "dual goal" of both supporting businesses and people and ensuring the budget revenue target.

The tax incentives of hundreds of thousands of billions of VND in a short period of time are unprecedented for the tax sector. This is the result of consultation between the General Department of Taxation and Ministries, Departments and Branches when finding solutions to promote economic growth in the context of Vietnam and the world facing many difficulties and disadvantages.

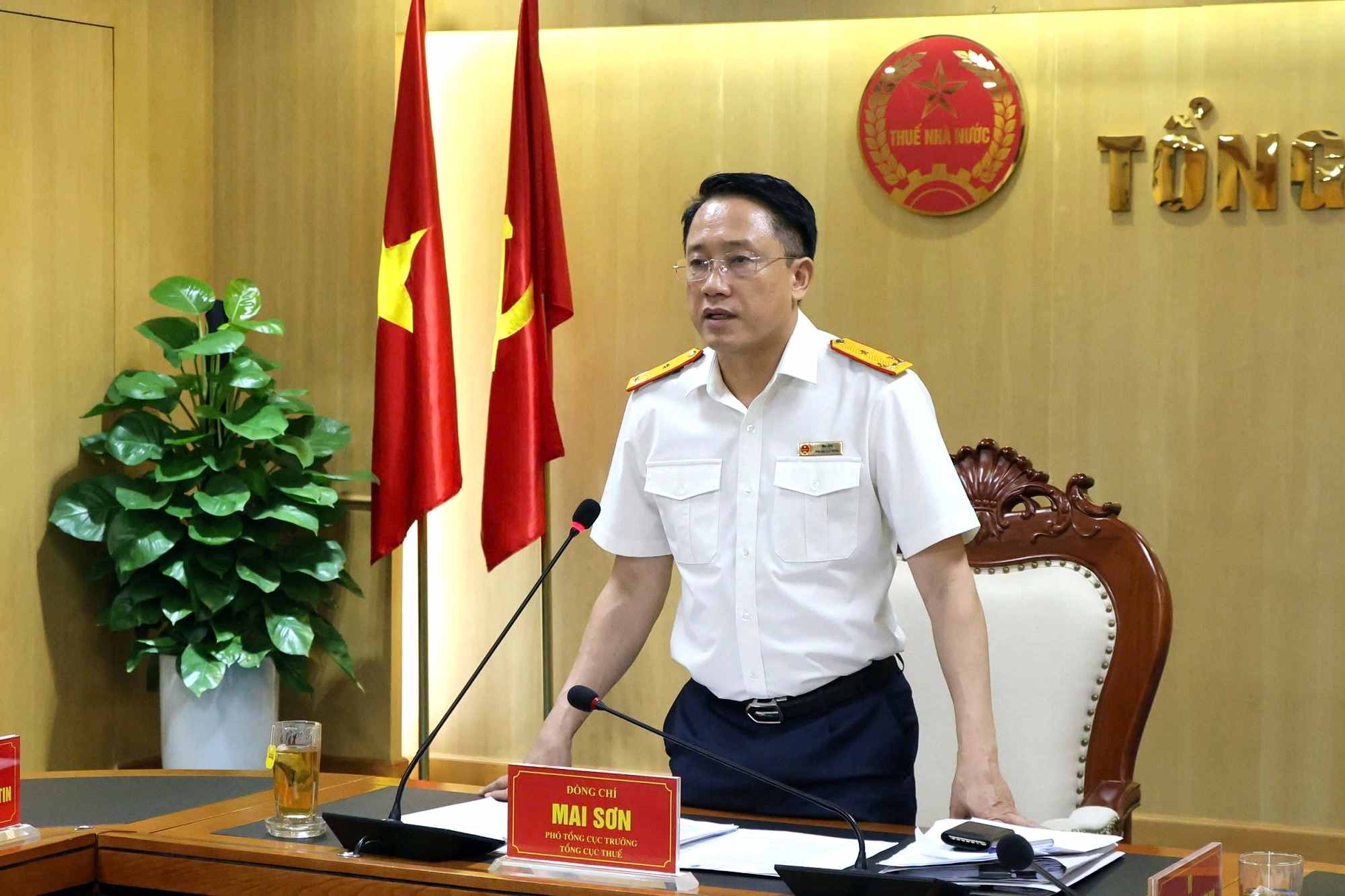

“In that context, the Ministry of Finance directed the Tax Department to closely monitor the health of enterprises, economic developments in the world and in the country, assess the impact on each revenue item, tax, and locality, promptly identify risks, promptly advise the Government and the National Assembly to promulgate and synchronously implement expansionary fiscal policy packages from the beginning of 2021 to present on a large scale,” said Mr. Mai Son.

Regarding the policies to support businesses, Mr. Hoang Quang Phong - Vice President of the Vietnam Federation of Commerce and Industry - VCCI said: "The business community has responded very positively. That is a very valuable companionship and sharing between the management agency and the beneficiaries. In particular, the tax sector applies modern management tools to operations as well as propaganda work to support taxpayers is carried out synchronously from the central agency to the provinces and cities, making the business community trust and expect that these policies will continue to be implemented in the coming time".

Prevent fraud, create a healthy business environment

Preventing fraud in tax collection not only helps the tax sector achieve budget collection achievements, but also helps create a fair and healthy business environment. Contributing to the budget and benefiting from the budget through various forms of support are the rights and responsibilities of each economic entity.

From there, the tax industry has been urging the implementation of tax fraud prevention work. It is also an increasingly difficult task, due to the continuous change of business forms, while the database is becoming more and more complex and difficult to manage.

Inspection, examination and anti-tax loss work in areas such as minerals, petroleum, catering services, accommodation, etc. have also been drastically implemented, contributing to increasing state budget revenue by more than VND 41,000 billion in the period 2021-2024.

Debt collection and enforcement of tax debts were also carried out seriously, recovering to the State budget about 176,400 billion VND in debt from taxes, fees, charges and revenues from land and mineral exploitation rights.

Mr. Pham Quang Toan - Director of the Department of Information Technology - General Department of Taxation said: "Up to now, the tax sector has built a tax database on an integrated platform and a big data platform, to provide complete information for direction and operation, connecting and exchanging information to serve tax management and compliance management; Connecting and exchanging information with units, ministries (Ministry of Public Security, Ministry of Planning and Investment, Ministry of Natural Resources and Environment, Commercial Banks, Notary Offices, etc.) to collect and build a complete database of information about taxpayers, including information connected to the national database on population, electronic household registration books, information on business registration, Land use right certificates, real estate transactions, tax payment documents, etc.)".

With such extensive connectivity, it can be said that all economic activities of entities are within the sights of tax authorities. Tax fraud, although not yet completely eliminated, has been more tightly controlled. This control will continue to be effective in the future with the support of AI.

Sharing with Lao Dong, Mr. Mai Son - Deputy General Director of the General Department of Taxation - said: “We have cleaned up the database of individuals and business households. In the coming time, we will convert the tax codes of individuals and business households to match the database of residents. Thereby, we will unify the use of the code of taxpayers (of individuals, business households) which is the code on the citizen identification card. This will create favorable conditions for both taxpayers, helping them to manage their codes less and thereby, all State management agencies will also unify this identification issue. We believe that this will reduce social costs, costs for taxpayers and management agencies”.