Tet bonus 2026 is personal income taxable

According to the provisions of point e, clause 2, Article 2 of Circular 111/2013/TT-BTC on income subject to personal income tax (PIT) from salaries and wages, the 2026 Tet bonus is not one of the bonuses deductible when determining income subject to personal income tax.

Therefore, the 2026 Tet bonus is determined to be the income subject to personal income tax.

Tet bonus 2026 calculated for tax in 2025 or 2026?

According to point b, clause 2, Article 8 of Circular 111/2013/TT-BTC:

2. Taxable income from salaries and wages

a) Taxable income from salaries and wages is determined by the total amount of salary, wages, remuneration, and other incomes of salary and wage nature that taxpayers receive during the tax period as guided in Clause 2, Article 2 of this Circular.

b) Time to determine taxable income.

The time to determine taxable income for income from salaries and wages is the time when organizations and individuals pay income to taxpayers.

Specifically, the time to determine taxable income for the premium for purchasing accumulated insurance products according to the guidance in point d.2, clause 2, Article 2 of this Circular is the time when the insurance business and the right-of-property fund management company voluntarily pay insurance premiums.

Accordingly, the time to determine taxable income for income from salaries and wages is the time when organizations and individuals pay income to taxpayers.

Thus, if the 2026 Tet bonus is paid in January 2026, the PIT is calculated for the 2026 tax calculation period.

How to calculate PIT bonuses for Tet 2026 according to the 5-stage tax schedule and new family reduction levels

Based on Article 7 of Circular 111/2013/TT-BTC amended in Clause 6, Article 25 of Circular 92/2015/TT-BTC stipulating the method of calculating PIT 2026 according to the new personal income tax deduction level with detailed examples, as follows:

Personal income tax on income from business, from salaries, wages is the total tax calculated according to each income grade. The tax calculated according to each income grade is equal to the taxable income of the income grade multiplied (×) by the corresponding tax rate of that income grade.

Accordingly, the 2026 PIT calculation formula according to the new personal income tax deduction level, specifically as follows:

PIT payable = Taxable income x Tax rate

In which:

- Taxable income = Taxable income - Deductions (familial deductions; insurance contributions, voluntary pension funds; charity, humanitarian, and scholarship contributions);

Resolution 110/2025/UBTVQH15 increases the family circumstance deduction from 2026, specifically as follows:

- The deduction level for taxpayers is 15.5 million VND/month (186 million VND/year);

- The deduction level for each dependent person is 6.2 million VND/month.

- Tax rate:

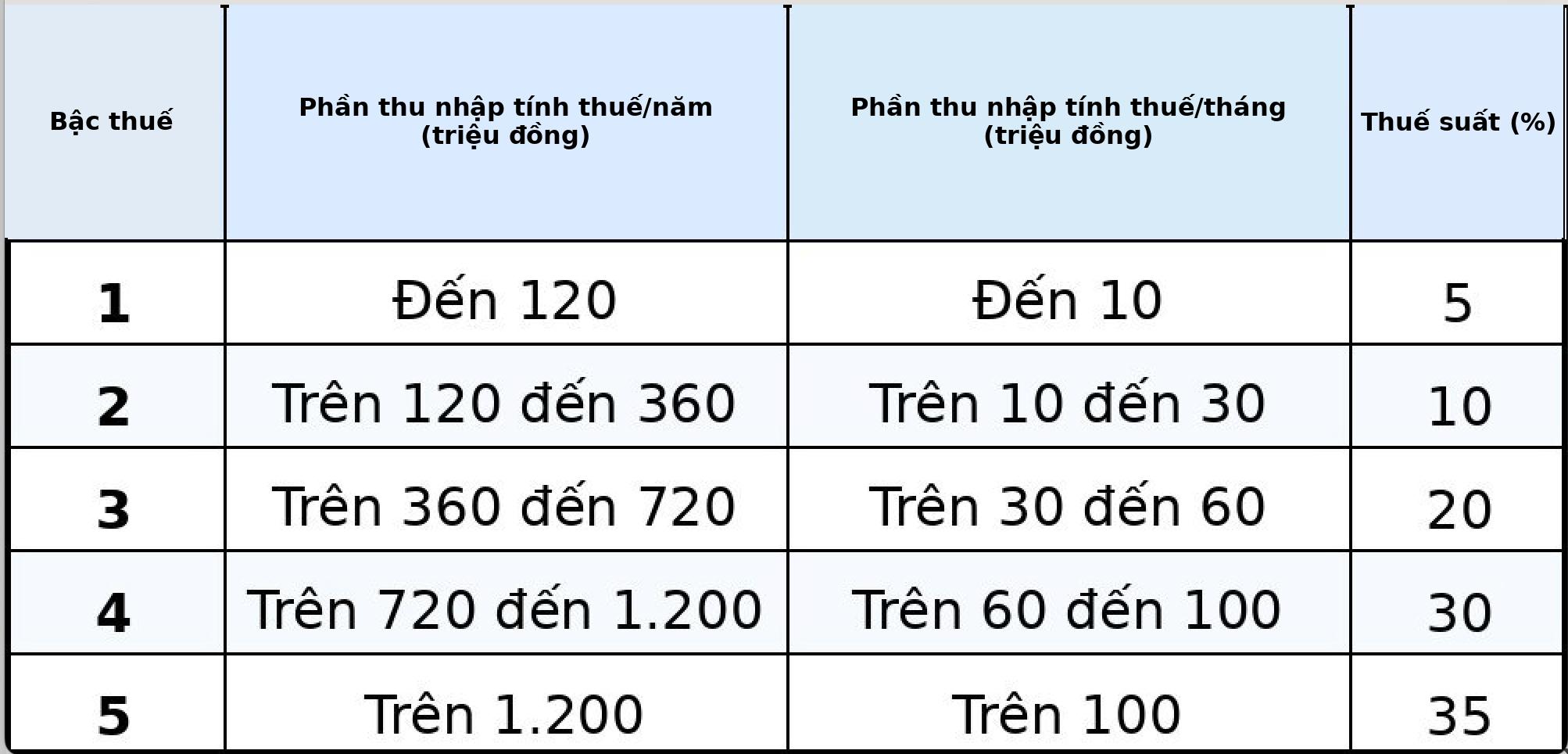

The progressive tax schedule of 5 levels is newly applied from the tax period of 2026, i.e. from January 1, 2026 as follows:

For example, how to calculate PIT bonuses for Tet 2026 according to the 5-stage tax schedule and new family reduction levels:

Ms. C has income from salary and wages in the month of 50 million VND and Tet bonus 2026 of 30 million VND and pays insurance amounts of: 8% social insurance, 1.5% health insurance and 1% unemployment insurance on salary. Ms. C raises 2 children under 18 years old, in the month Ms. C does not contribute to charity, humanitarian work, or education promotion. Personal income tax temporarily paid in the month of Ms. C is calculated as follows:

- Ms. C's taxable income is 50 million VND + 30 million VND = 80 million VND.

- Ms. C is entitled to deduct the following amounts:

+ Discount for personal circumstances: 15.5 million VND

+ Family circumstance reduction for 02 dependents (2 children):

6.2 million VND × 2 = 12.4 million VND

+ Social insurance, health insurance, unemployment insurance:

50 million VND × (8% + 1.5% + 1%) = 5.25 million VND

Total deductible amounts:

15.5 million VND + 12.4 million VND + 5.25 million VND = 33.15 million VND

- Ms. C's taxable income is:

80 million VND - 33.15 million VND = 46.85 million VND

- Tax amount to be paid:

The amount of tax payable is calculated according to each step of the new progressive tax schedule:

+ Step 1: taxable income up to 10 million VND, tax rate 5%:

10 million VND × 5% = 0.5 million VND

+ Step 2: taxable income over 10 million VND to 30 million VND, tax rate 10%:

(30 million VND - 10 million VND) × 10% = 2 million VND

+ Step 3: taxable income from 30 million VND to 60 million VND, tax rate of 20%:

(46.85 million VND - 30 million VND) × 20% = 3.37 million VND

- The total amount of tax Ms. C must temporarily pay in the month is:

0.5 million VND + 2 million VND + 3.37 million VND = 5.87 million VND