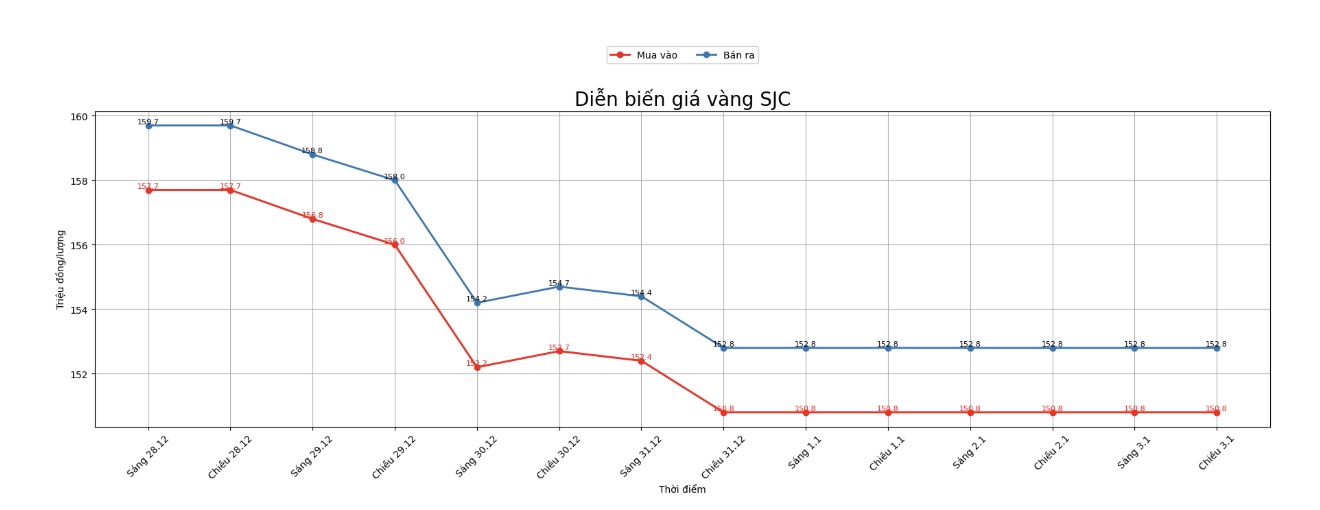

SJC gold bar price

As of 6:00 AM, SJC gold bar prices were listed by DOJI Group at the threshold of 150.8-152.8 million VND/tael (buying - selling), going sideways in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

SJC gold bar price is listed by Bao Tin Minh Chau at the threshold of 150.8-152.8 million VND/tael (buying - selling), going sideways in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed SJC gold bar prices at the threshold of 150.3-152.8 million VND/tael (buying - selling), going sideways in both directions. The difference between buying and selling prices is at the threshold of 2.5 million VND/tael.

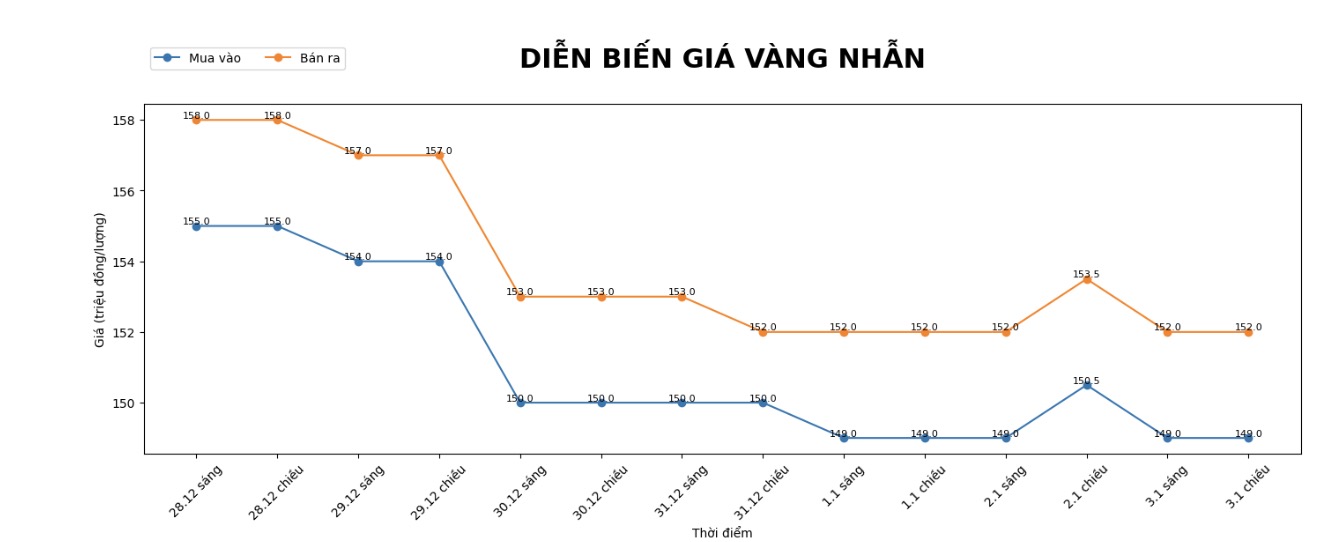

9999 gold ring price

As of 6:00 AM, DOJI Group listed the price of plain gold rings at the threshold of 149-152 million VND/tael (buying - selling), going sideways in both directions. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at the threshold of 152-155 million VND/tael (buying - selling), going sideways in both directions. The difference between buying and selling is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at the threshold of 149.8-152.8 million VND/tael (buying - selling), going sideways in both directions. The buying - selling difference is at 3 million VND/tael.

The high buying - selling gap increases the risk for individual investors. Individual investors, especially those with a "surfing" mentality, need to consider carefully before spending money.

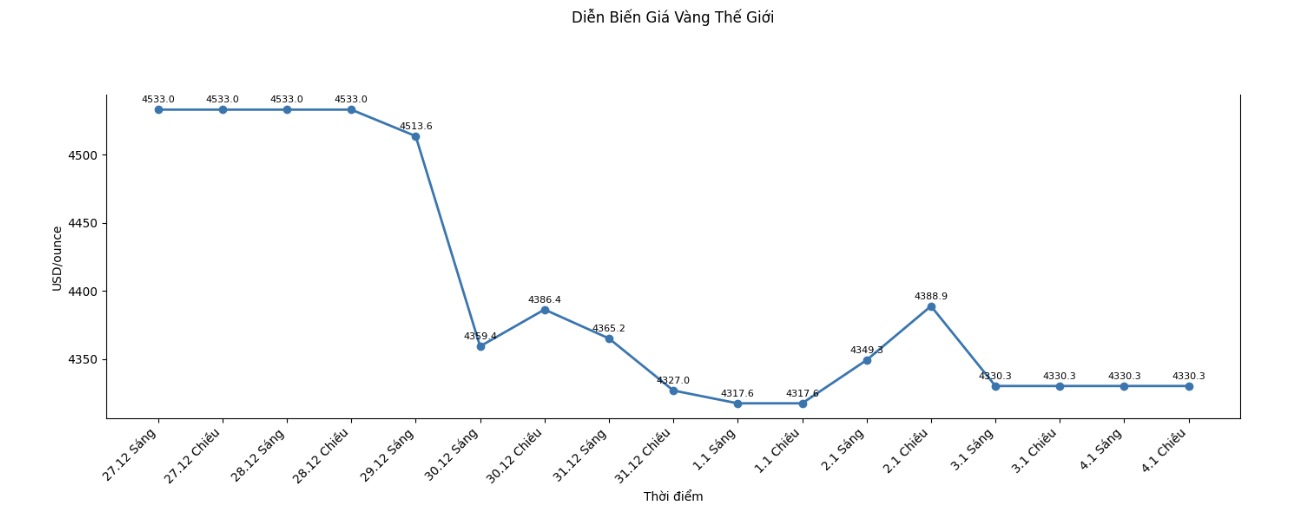

World gold price

World gold price listed at 6:00 am at the threshold of 4,330.3 USD/ounce.

Gold price forecast

In 2026, gold prices are becoming the focus of attention from global investors as a series of large financial institutions and individual investors have made very optimistic forecasts.

Analysis shows that the driving force for the price increase of this precious metal comes not only from traditional factors such as geopolitical risks or inflation, but is also strongly strengthened by the increasingly widespread trend of asset diversification.

According to Goldman Sachs, gold is the most positive commodity in the commodity group in 2026. This bank forecasts that the demand for gold purchases from central banks will continue to be maintained at a very high level, averaging about 70 tons per month.

Three key factors emphasized include: changing perceptions of geopolitical risks after Russia's reserves freeze in 2022; the proportion of gold in the reserves of many emerging economies is still low; and surveys show that central bank demand for gold is at a record level.

On that basis, Goldman Sachs forecasts that gold prices may adjust to the 4,200 USD/ounce range in Q1/2026 before gradually increasing and reaching about 4,900 USD/ounce by the end of the year, even higher if private investors participate in asset diversification more strongly.

Sharing the same optimistic view, J.P. Morgan believes that the gold price increase cycle is still not over. This bank expects investment demand to remain high, while central banks may buy an average of about 585 tons of gold per quarter in 2026.

Notably, J.P. Morgan believes that large insurance corporations in China and the cryptocurrency community will become new sources of demand, capable of pushing gold prices above the 5,055 USD/ounce mark by the end of the year.

In a more optimistic scenario, if only 0.5% of foreign investors' USD holdings in the US were converted to gold, the price of this precious metal could even reach the 6,000 USD/ounce range.

Not only large organizations, individual investors also show very strong confidence. Surveys show that most retail investors expect gold prices in 2026 to exceed 5,000 USD/ounce, of which nearly 30% predict a milestone above 6,000 USD/ounce. This reflects widespread optimism in the market.

In addition, UBS also believes that low real yields, global economic instability and political risks in the US will continue to support gold prices. According to UBS, in case these risks escalate, gold could completely increase to the 5,400 USD/ounce range.

Summarizing forecasts shows that, although there may be short-term fluctuations, the long-term trend of gold prices in 2026 still clearly leans towards the upside.

Gold price data is compared to the previous day.

The world gold market operates through two main valuation mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

Second is the futures contract market, where prices are set for futures delivery. Due to year-end book closing activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...