Vietnam Computerized Lottery Company (Vietlott) organized the awarding of the Vietlott Lotto 5/35 lottery jackpot QSMT issue No. 00392 with a value of 20,017,635,500 VND to Mr. N.H.T, who registered to participate in the prize in Cao Bang province.

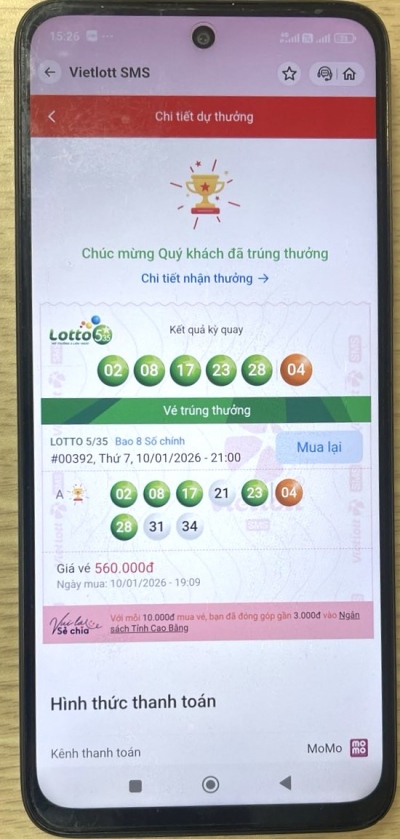

Mr. N.H.T is a Viettel subscriber, buying Vietlott lottery tickets through the phone distribution channel (Vietlott SMS platform).

Winning tickets purchased via Vietlott SMS

Through checking the self-selected lottery business data system and personal records, Vietlott confirmed that Mr. N.H.T was the winner of the Lotto jackpot 5/35 draw QSMT 00392.

The lucky ticket was bought by him on the Vietlott SMS platform, registering the place to participate in the prize is Cao Bang province.

Cao Bang Gen Z youth win Vietlott lottery

Mr. T. is a Gen Z young man from Cao Bang, currently working in Ho Chi Minh City. He said that he has participated in Vietlott lottery for more than a year, often buying products with large prize values such as Mega 6/45, Power 6/55 and Lotto 5/35.

Each time, he usually buys from 2–3 rows of numbers, the rows of numbers are randomly selected.

Buy many tickets when the jackpot prize exceeds 12 billion VND.

Mr. T. shared that he had previously won some small prizes of Lotto 5/35 and realized that the prize value was higher because he was additionally divided from the jackpot prize.

When he saw that the value of the jackpot exceeded 12 billion VND and no one had won, he bought more numbers in the prize-sharing period. When he received a message informing him that he had won the jackpot, he said he was very surprised and happy.

After winning the prize, Mr. T. plans to continue working and plan to use the money reasonably.

Winning Vietlott lottery, donating 500 million VND for charity

At the award ceremony, Mr. N.H.T donated 500 million VND to implement social security programs through the Tam Tai Viet fund, demonstrating the spirit of social responsibility of Vietlott lottery players.

Tax obligations when winning Vietlott lottery

According to regulations, Mr. N.H.T has an obligation to pay personal income tax of more than 2 billion VND, equivalent to 10% of the winning prize value exceeding 10 million VND.

This tax amount is deducted immediately upon receiving the prize and paid at the place of registration to participate in the prize, which is Cao Bang province.