Bond maturity

VPBank and MB clarify information about the bond lots being inspected

|

After the conclusion of the Government Inspectorate on bonds, VPBank and MB have spoken out to explain and emphasize their obligations to investors.

Real estate market recovers, reducing pressure on bond debt

|

The recovery of the real estate market is an important support contributing to reducing concerns about bond debt pressure of enterprises in the industry.

Difficult problem of real estate enterprises when calling for capital in bonds

|

The story of real estate businesses calling for capital through bonds will be very "hot" in the coming time with maturity pressure and new criteria.

Real estate businesses struggle to repay bond debt

|

Difficulties in cash flow, while the great maturity pressure has caused delays in paying principal and interest on bonds, have so far mostly belonged to the real estate sector.

Real estate businesses find it difficult to turn around bond repayment

|

A large number of bonds that have been late in payment in previous years will continue to put pressure on issuers, especially real estate enterprises, in 2025.

Many violations in announcing information about outstanding bonds

|

Many businesses operating in the real estate sector are "silent" in publishing information about maturing bond lots.

20 sets of Setra Corp bonds have expired, risks increase

|

Ho Chi Minh City Service - Trading Joint Stock Company (Setra Corp) has just announced information about the delay in paying principal and interest of 20 bond lots.

Real estate businesses strive to repay bond debt

|

HCMC - Many businesses in the real estate sector are still actively clearing bond debt.

Overcoming the crisis, confidence returns to the bond channel

|

The situation of bonds with delayed principal and interest payments has improved, contributing to creating confidence for investors to return to the market.

Real estate businesses race to issue bonds

|

Bond issuance activities of real estate enterprises have become active again to improve capital flows for the recovery period.

Pressure gradually eases on real estate bond channel

|

The story of late-payment bonds in 2025 will gradually fade away, not as remarkable as the previous period.

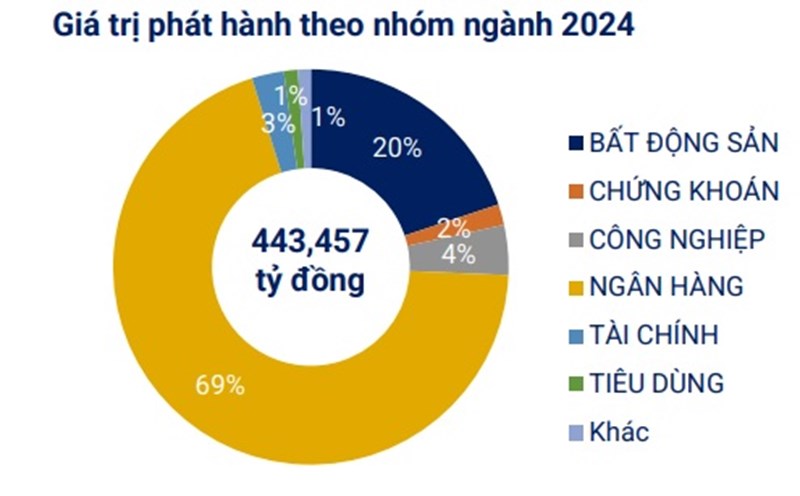

More than 443,000 billion VND of new corporate bonds issued in 2024

|

In 2024, there will be 429 private corporate bond issuances and 22 public issuances with a total new issuance value in 2024 reaching VND 443,457 billion.

Real estate businesses' thirst for capital has not yet subsided

|

Many real estate businesses are still lacking capital even though real estate credit has increased sharply.

The "business giants" mobilize the most bond capital

|

Banks continue to be a bright spot in the corporate bond market, with many banks leading the issuance volume across the market.