According to data from the Vietnam Bond Market Association (VBMA), in December 2024, there were 54 private corporate bond issuances worth VND56,793 billion and 1 public issuance worth VND800 billion.

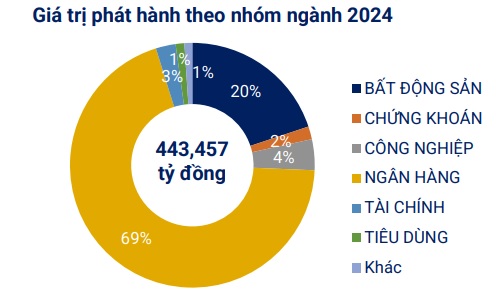

In 2024, there will be 429 private issuances worth VND410,544 billion and 22 public issuances worth VND32,913 billion. Thus, the total value of newly issued corporate bonds in 2024 will reach VND443,457 billion.

Regarding the issuance structure by industry group, banking was the dominant group in terms of issuance value last year, accounting for 69%, equivalent to nearly 306,000 billion VND. This was followed by the real estate group at about 20%, equivalent to 88,700 billion VND. The remaining industry groups such as industry, securities, and finance accounted for an insignificant proportion, at 2-4%.

Notably, the value of bonds bought back in December decreased significantly compared to the same period last year, reaching nearly VND27,500 billion, 36% lower than the same period.

Regarding the situation of unusual information disclosure, there are 3 new late interest payment bond codes with a total value of 80,300 billion VND.

According to VBMA, there are expected to be 2 notable corporate bond issuances in the coming time. Accordingly, VNDIRECT Securities Corporation (HoSE: VND), when the Board of Directors approved the plan to issue individual bonds divided into 2 batches in 2025 with a maximum total value of 2,000 billion VND. These are non-convertible bonds, without warrants, without collateral, with a face value of 100,000 VND/bond. The bonds have a maximum term of 3 years with an initial interest rate of 8.3%/year.

Along with that, TTC Land (Saigon Thuong Tin Real Estate JSC, HOSE: SCR), with a plan to issue individual bonds in December 2024 with a maximum total value of VND 850 billion. These are non-convertible bonds, without warrants, with collateral, face value of VND 100 million/bond. The bonds have a term of 5 years and an interest rate of 8.5%/year for the first year, guaranteed by Orient Commercial Joint Stock Bank (OCB) - Ho Chi Minh City branch.

In 2025, it is estimated that there will be about VND 217,000 billion of bonds maturing, mostly in the real estate group with nearly VND 121,000 billion, accounting for 55.6% of the total value of maturing bonds.