According to the report data, in December 2024, there were only 2 bonds that were late for the first payment. Both were bonds of Nova Real Estate Investment Group Joint Stock Company (Novaland) with a total bond principal value of 830 billion VND.

According to the information announcement on January 3, 2025, Novaland is negotiating with bondholders. There is currently no information on the payment progress of this amount. Previously, Novaland's Board of Directors also announced information on the repurchase of 21 company bonds with a total maximum value of VND 7,000 billion, including the above 2 bonds.

In 2024, there were 11 issuers late paying principal/interest on bonds for the first time, a significant decrease compared to the number of 79 issuers late paying principal/interest in 2023.

The cumulative delinquency rate at the end of December 2024 remained at 14.5%. The Energy group had the highest delinquency rate at 43%, while the Real Estate - Housing group accounted for 62% of the total delinquent bonds.

85% of the overdue bond principal repaid in December 2024 came from issuers in the Real Estate - Housing group with a total principal value of VND 2.3 trillion. As a result, the overdue bond recovery rate of the Real Estate - Housing group increased by 1.4% to 22.7% by the end of December 2024. The overdue bond recovery rate of the entire corporate bond market increased by 1% compared to 22.9% at the end of November 2024.

According to VIS Rating statistics, the number of newly issued organizations with delayed principal/interest payments has decreased significantly in 2024 and in the fourth quarter of 2024. However, bonds that have been delayed, are in the process of being processed, have to be extended or are negotiating with bondholders to restructure debt are still there.

It is estimated that the total amount of corporate bonds that have been delayed to date is about 190,000 billion VND. This continues to be a problem that needs to be addressed, there will be businesses that cannot recover, are no longer able to repay their debts, causing losses for investors and bondholders of those bonds. This also partly affects investor sentiment, as well as investors' assets.

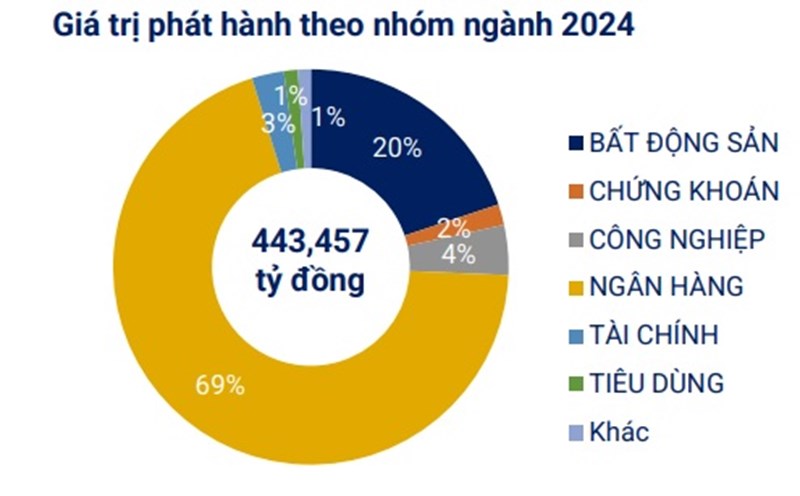

According to experts, private placement activities in 2025 will continue to grow based on two factors. First, market sentiment is restored, reflected in the return of private placement activities and corporate bond issuance in general in 2024, with a significant increase compared to 2023. Second, the credit environment is improving. With these two driving forces, the scale of private placement will continue to increase compared to 2024.

Dr. Nguyen Duy Phuong, Investment Director of DG Capital, commented that with the issuance of individual bonds, the amended Securities Law provides clearer and stricter regulations on the distribution of privately issued bonds to professional individual investors.

Privately issued bonds, if they want to be distributed to professional individual investors, must meet the following conditions: have a credit rating and have collateral or a payment guarantee from a credit institution. Privately issued bonds that are only sold to professional institutional investors do not need to meet such conditions.

The amended Securities Law has a transitional provision, according to which, private bonds issued before January 1, 2026 will follow the old regulations, that is, they will still be distributed to professional investors, including individual and institutional investors.

"Therefore, the conditions applicable to previously issued bonds and those issued in 2025 have not changed. Issuing organizations have 1 year to prepare for the new regulations, so the above amendments will not shock the market," Dr. Phuong stated.