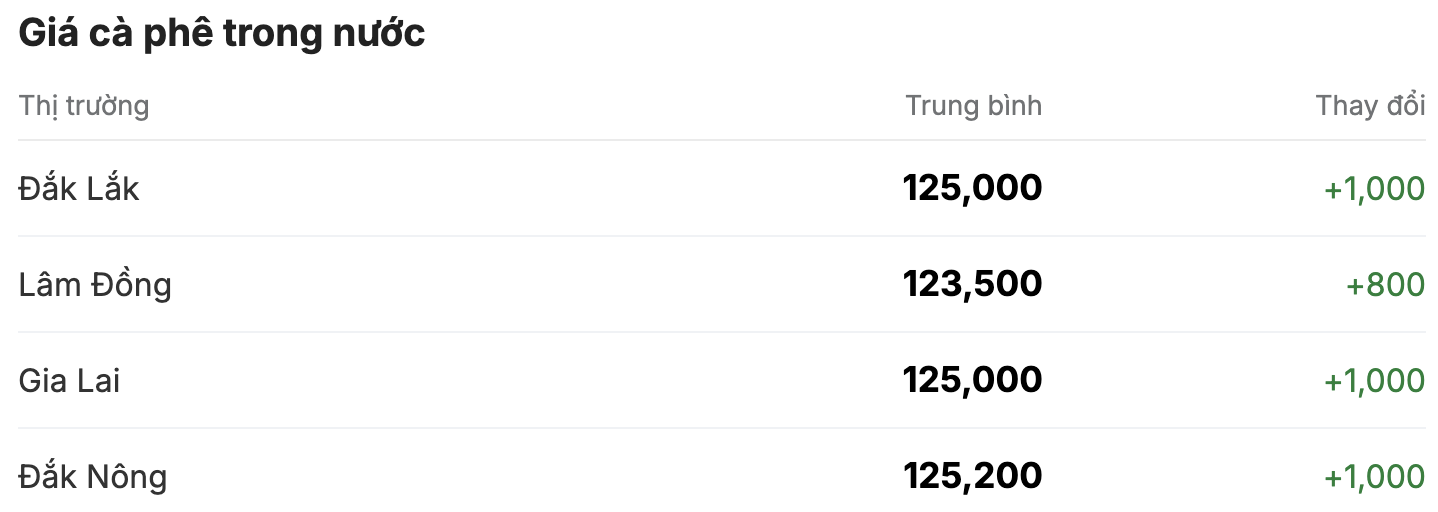

As of 11:30 a.m. today (December 14), the domestic coffee market has continued to increase sharply, increasing by an average of VND1,000/kg per session, currently fluctuating between VND123,500 - VND125,200/kg. The average coffee purchase price in the Central Highlands provinces today is VND12,100/kg.

Lam Dong is still the province with the lowest coffee purchasing price in the Central Highlands. Compared to the closing price yesterday (December 13), coffee prices in this region increased by at least VND800/kg in coffee growing areas, standing at VND123,500/kg.

In the same direction, coffee purchasing prices in Gia Lai and Dak Lak provinces today ranked second on the chart, increasing by 1,000 VND/kg, both listed at 125,000 VND/kg.

Notably, Dak Nong has always maintained a stable performance, firmly holding the leading position in the province and city with the highest coffee purchasing price in the country, setting the mark of 125,200 VND/kg.

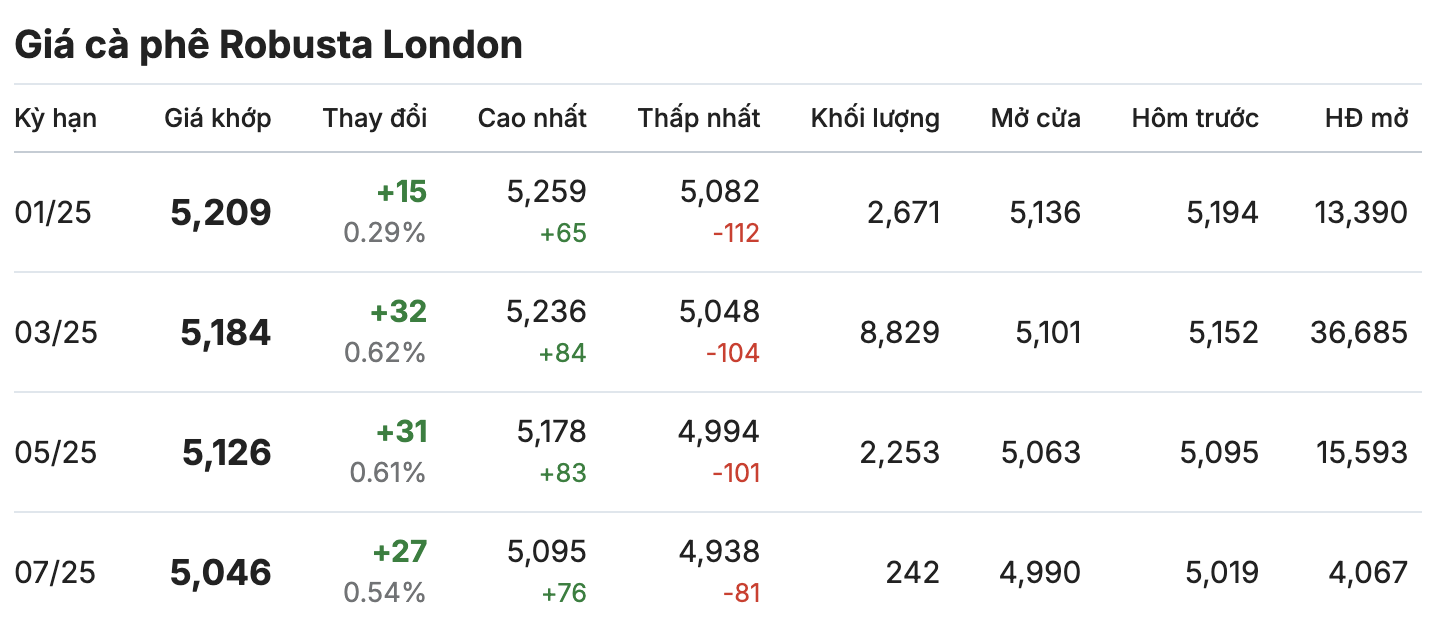

On the London and New York exchanges, the coffee market moved in opposite directions across terms. The January 2025 contract increased slightly by 0.29% (equivalent to 15 USD/ton), standing at 5,209 USD/ton. The March 2025 contract increased by 0.62%, remaining at 5,184 USD/ton.

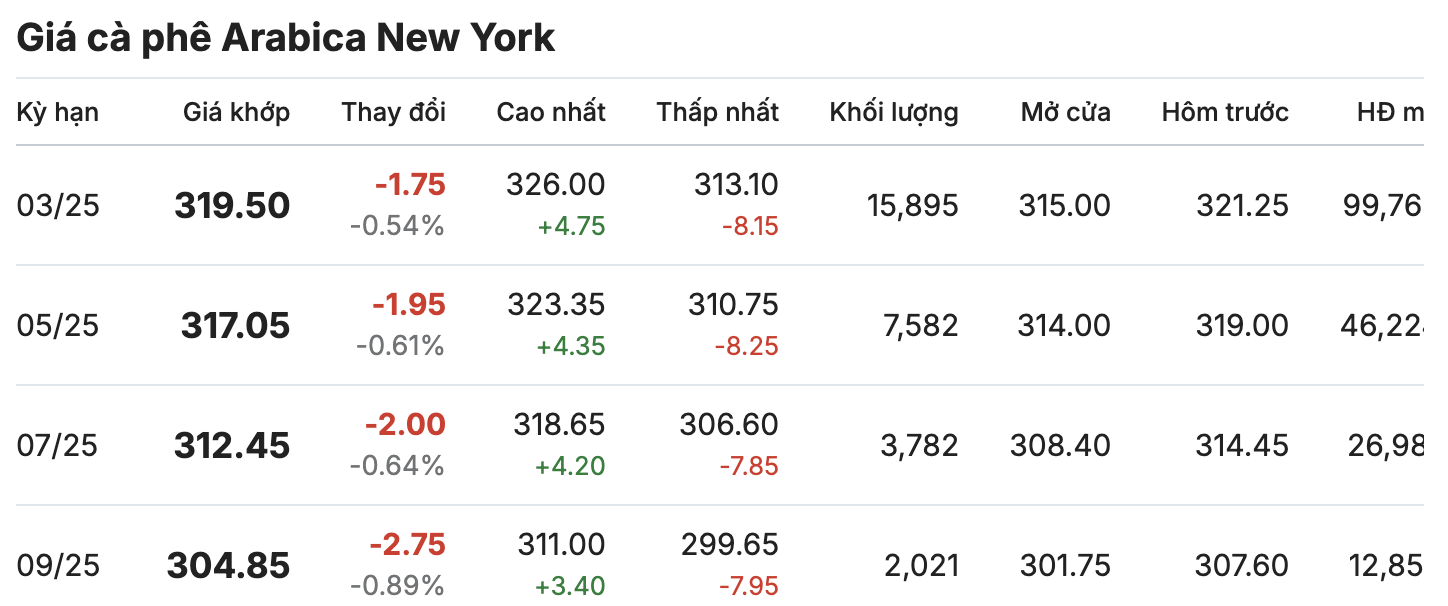

Meanwhile, the New York Arabica coffee market showed red, with slight decreases in all terms. The March 2025 delivery term decreased by nearly 1% (equivalent to 1.75 cents/lb), listed at 319.50 cents/lb. The May 2025 delivery term decreased by 0.61% (equivalent to 1.95 cents/lb), trading around 317.05 cents/lb.

Coffee prices on the two exchanges moved in opposite directions at the end of the week. While Robusta coffee maintained its upward momentum, Arabica fell slightly due to the weak Brazilian currency, which dragged Arabica down on the exchange.

Since the beginning of the domestic harvest, coffee prices have remained high, averaging over VND120,000/kg. However, farmers in growing areas have not rushed to sell their coffee after harvest, waiting for prices to continue to rise or when they have financial needs to sell to the market.

According to a report from the Vietnam Coffee and Cocoa Association (VICOFA), Vietnam's coffee output in the 2024-2025 crop year is expected to be around 26.67 - 28.33 million bags. This data is considered quite modest compared to the average of 28.5 million bags that many independent organizations have forecast. The report also said that Vietnam's domestic coffee consumption in the current crop year is expected to reach between 4.5 and 5 million bags.