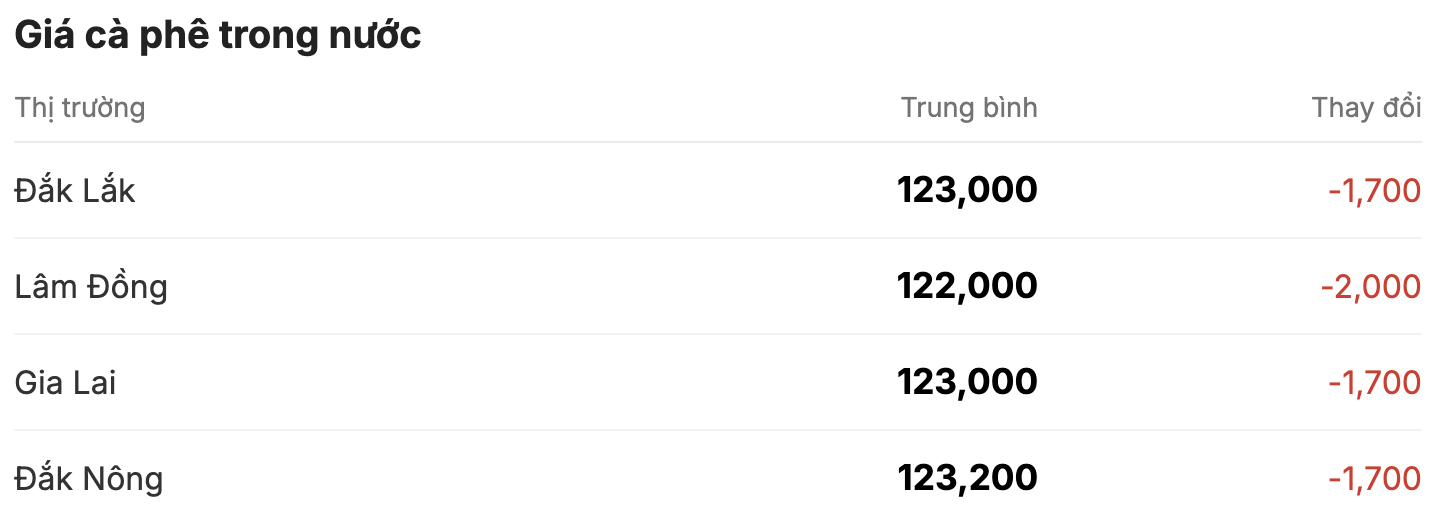

As of 11:30 a.m. today (December 12), the domestic coffee market suddenly "turned around", decreasing by an average of VND1,700/kg per session, currently fluctuating between VND122,000 - VND123,200/kg. The average coffee purchase price in the Central Highlands provinces today is VND123,100/kg.

Lam Dong is still the province with the lowest coffee purchasing price in the Central Highlands. Compared to the closing price yesterday (December 11), coffee prices in this region decreased the most by VND2,000/kg among coffee growing areas, standing at VND122,000/kg.

In the same direction, coffee purchasing prices in Gia Lai and Dak Lak provinces today ranked second on the chart, down 1,700 VND/kg, listed at 123,000 VND/kg.

Notably, Dak Nong has always maintained a stable performance, firmly holding the leading position in the province and city with the highest coffee purchasing price in the country, setting the mark of 123,200 VND/kg.

On the London and New York exchanges, the coffee market suddenly turned sharply down in all terms. The contract for delivery in January 2025 fell 2.03% (equivalent to 107 USD/ton), standing at 5,161 USD/ton. The contract for delivery in March 2025 fell sharply by 2.50%, remaining at 5,101 USD/ton.

Similarly, in the New York Arabica coffee market, futures for delivery in March 2025 decreased by more than 4% (equivalent to 13.95 cents/lb), listed at 320.10 cents/lb. Futures for delivery in May 2025 decreased by 4.15% (equivalent to 13.75 cents/lb), trading around 317.80 cents/lb.

The biggest concern for the global coffee market today remains the European Deforestation Regulation (EUDR). This regulation requires transparency and compliance with new monitoring requirements for the coffee supply chain. However, to comply with this regulation, coffee producers and exporters will face higher compliance costs, including the cost of origin certification, environmental monitoring, and improved technological infrastructure to track the production process.

The EUDR could limit coffee supplies to Europe as some producers fail to meet the strict requirements. Coffee-producing countries, especially those with unsustainable farming practices or insufficient monitoring capacity, could face the risk of being denied access to the European market. The resulting reduction in supply from these producers could lead to an increase in global coffee prices, and in particular coffee imports into Europe.