Domestic pepper prices: Extending the stable days

As of 1:00 p.m. today (May 22), the domestic pepper market remains unchanged in the two areas with the highest purchasing prices in the country. Currently, the purchase price of pepper is recorded at a price of 150,000 - 152,000 VND/kg.

Pepper prices in Dak Lak and Dak Nong both remained at 152,000 VND/kg, down 1,000 VND/kg.

Notably, Binh Phuoc and Ba Ria - Vung Tau kept the same price of 151,000 VND/kg. In the same direction, pepper purchasing prices in Gia Lai province are still recorded at 150,000 VND/kg.

World pepper prices: intertwined increases and decreases

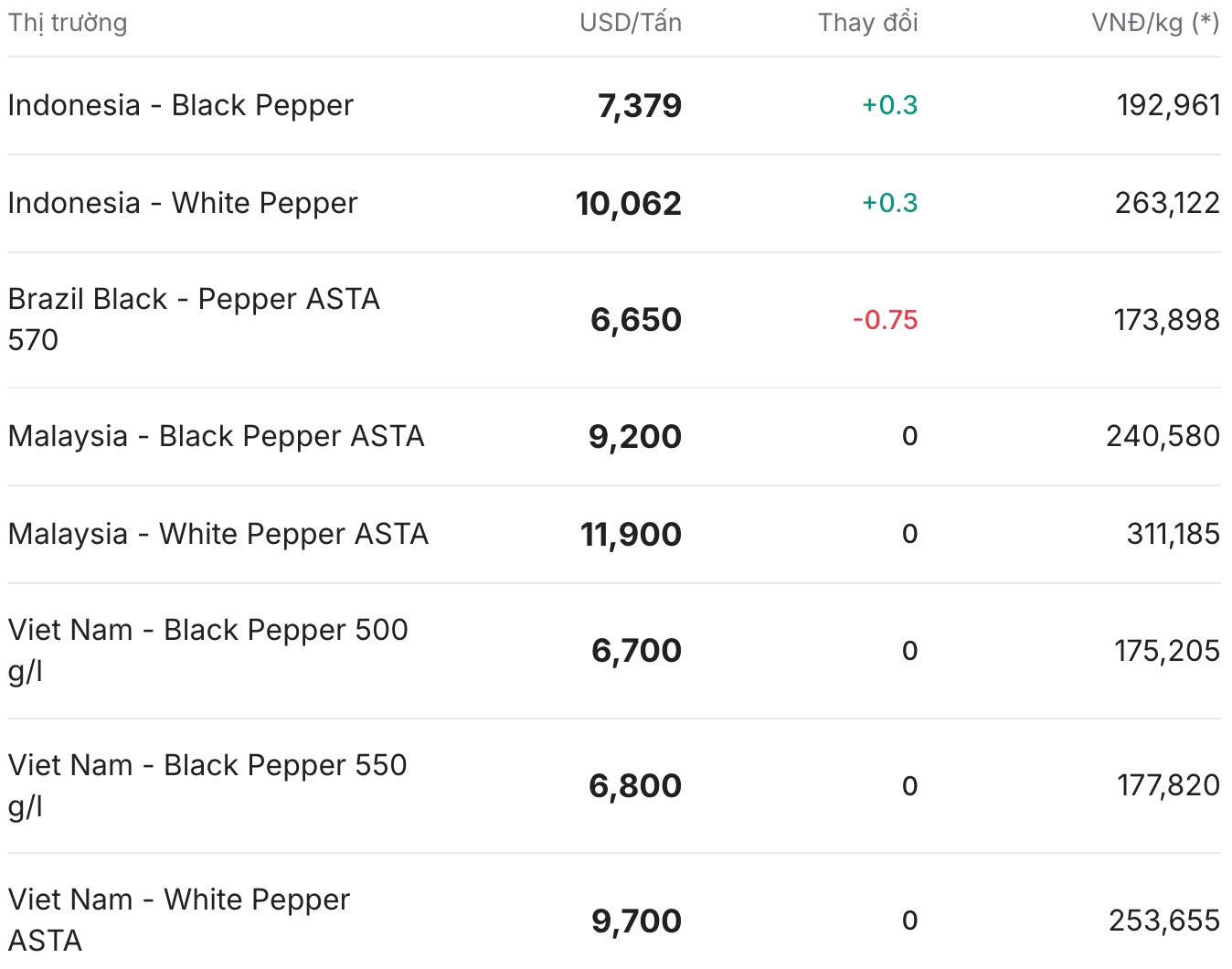

In the world market, pepper prices generally fluctuated slightly in some regions. In particular, in the Indonesian market - one of the most vibrant exchanges, the increase was still 0.3%. Currently, these two items are listed at 7,379 USD/ton (equivalent to 192,961 VND/kg); white pepper is listed at 10,062 USD/ton (about 263,122 VND/kg).

In Vietnam, the export price of black pepper of 500 g/l and 550 g/l remains unchanged at 6,700 - 6,800 USD/ton (equivalent to 175,205 - 177,820 VND/kg). ASTA white pepper prices also remain unchanged, at 9,700 USD/ton (about 253,655 VND/kg).

In the same direction, the Brazilian market also maintained a decrease of 0.75%, reaching 6.650 USD/ton (equivalent to about 173.898 VND/kg).

The Malaysian exchange did not record any fluctuations. Malaysia's white rice continues to hold the highest price globally at 11,900 USD/ton (equivalent to 311,185 VND/kg).

Assessment and forecast

Maintaining the decrease in the two provinces with the highest pepper purchasing prices in the country, Dak Lak and Dak Nong, shows that the signal from supply-demand pressure is changing slightly. Purchasing power from exporting enterprises is still quite good, not really a breakthrough in the context of unpredictable fluctuations in the world market.

The consecutive price increase in Indonesia could put competitive pressure on Vietnamese pepper, especially if orders change direction due to price factors. On the contrary, the sharp decline in Brazil could open up opportunities for Vietnam to maintain an export market share if quality and delivery are maintained stably.