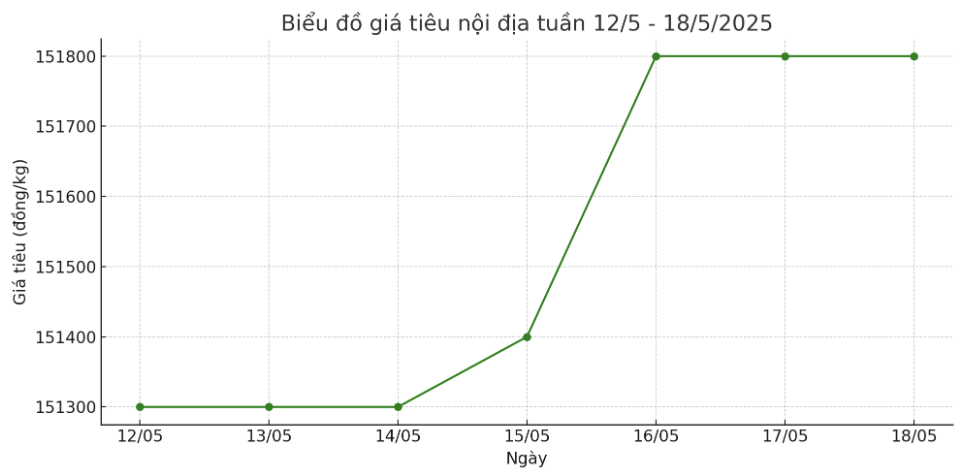

Domestic pepper prices: Average increase of 500 VND/kg

As of 11:30 today (18.), domestic pepper prices are still trading in the range of 151,000 - 153,000 VND/kg, an increase of 500 VND/kg compared to the closing price of the previous session.

To summarize last week, domestic pepper prices have not fluctuated much, pepper prices in Dak Lak and Dak Nong provinces are being purchased by dealers at 153,000 VND/kg, an increase of 2,000 VND/kg compared to last week. Gia Lai recorded an unchanged price of 151,000 VND/kg.

In the Southeast region, pepper prices in Binh Phuoc decreased by 500 VND/kg last week, down to 151,000 VND/kg. In the same direction, in Ba Ria - Vung Tau and Dong Nai, pepper prices decreased by VND 1,000/kg, down to VND 151,000/kg.

World pepper prices: Weather changes

Over the past week, pepper prices in most major exporting countries have generally remained stable, except for Indonesia, which recorded slight fluctuations.

According to the International Pepper Company (IPC), Indonesia's black pepper prices were listed at 7,301 USD/ton, down 0.3% (equivalent to 22 USD/ton) compared to last week.

Meanwhile, Malaysia's black pepper prices remained stable at 9,200 USD/ton throughout the past week. Brazilian black pepper ASTA 570 is traded at 6,800 USD/ton. In Vietnam, the price of black pepper of 500 g/l and 550 g/l has not changed, ranging from 6,700 - 6,800 USD/ton.

At the same time of the survey, the price of Indonesian white pepper last week increased by 1.34% (133 USD/ton), to 10,051 USD/ton.

Meanwhile, the prices of Vietnamese white pepper and Malaysia ASTA white pepper remained unchanged at 9,700 USD/ton and 11,900 USD/ton.

Assessment and forecast

Pepper prices, although not fluctuating much, are still at a high level, reflecting the trend of scarce supply after the harvest, while demand from the Middle Eastern and European markets is forecast to increase sharply in the second quarter. However, domestic purchasing power is still sluggish, causing the market to not have a clear price boost.

However, competitive pressure is rising as the US implements new tax policies. In the second quarter, Vietnamese pepper in this market will be subject to a tax of 10%, and this figure may increase to 25 - 30% from the third quarter, causing Vietnamese pepper to fall behind Brazil and Indonesia - two opponents with significantly lower tax rates.

To minimize risks, the Government has directed ministries and branches to study plans to support temporary storage purchases, not only for pepper but also for key products such as coffee and rice. The goal is to ensure output and stabilize income for farmers during the harvest season.