Continuing the 9th Session, the National Assembly listened to Member of the National Assembly Standing Committee (NASC) Phan Van Mai present the Report on explanation, acceptance, and revision of the draft Law on Special Consumption Tax (SCT).

Sugary soft drinks are subject to special consumption tax

Presenting a report to the National Assembly, Member of the Standing Committee of the Standing Committee Phan Van Mua said that proposing taxpayers for soft drinks is the first step in the process of implementing solutions to limit the production and consumption of products with high sugar in food and beverage, contributing to production and consumption orientation.

This is one of the main causes of overweight, obesity and non-communicable diseases related to the diet.

"Therefore, the Standing Committee asked the National Assembly to keep as the draft law, and asked the Government to continue studying international experiences to be able to consider the possibility of adding other products containing sugar to be subject to SCT," said members of the Standing Committee of the Standing Committee of Phan Van Mai.

In commenting on the draft Law, many National Assembly delegates proposed that sugary soft drinks be added to the taxable list, so there needs to be a roadmap for implementation so that businesses have time to adapt, adjust production and business plans, and gradually switch to products with low sugar content.

Acquiring opinions of the MPA, the Standing Committee agreed with the proposal of the drafting agency to revise the draft law in the direction of the implementation roadmap: From 2027, the tax rate of 8%, from 2028, applies the tax rate of 10%.

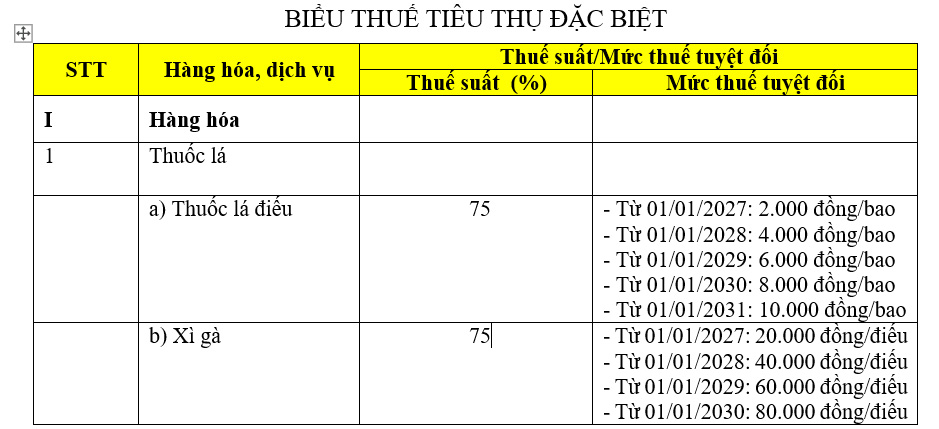

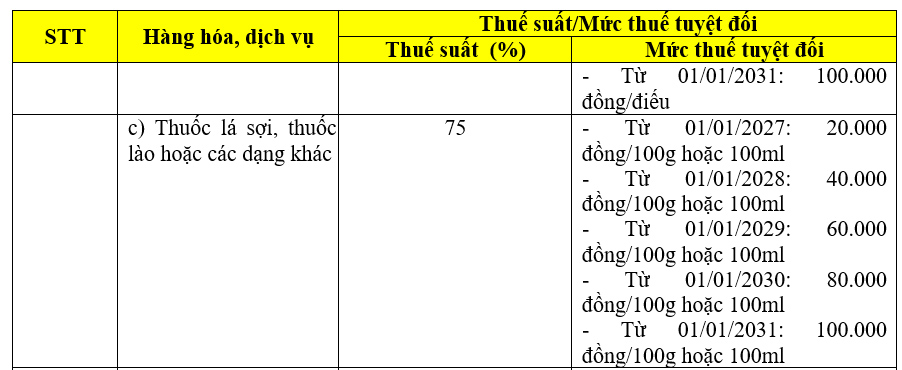

Tax rates for alcohol, beer, tobacco

According to Member of the National Assembly Standing Committee Phan Van Mai, the draft Law submitted to the National Assembly at the 8th Session proposed to increase taxes more completely on alcohol, beer, and tobacco.

At that time, the National Assembly Standing Committee said that the above tax was aimed at having a strong impact on the selling price of goods that were harmful to health, reducing consumption, overcoming serious consequences of alcohol, beer and tobacco use.

However, in the current socio-economic context, along with the growth target of 8% or more, the Government proposes to apply a lower tax rate than the plan to increase taxes thoroughly and start applying it from 2027 to suit the new context and situation.

"Therefore, the Standing Committee asked the National Assembly to adjust the draft law as proposed by the Government (the content shown at Article 8 of the Draft Law)," said Member of the Standing Committee of the Standing Committee of Phan Van Mai.

Regarding the authority to amend and supplement tax subjects, the subjects are not taxable, according to the Standing Committee of the Standing Committee, the regulations related to the tax subject, the non -tax subjects are important contents of the law, related to the rights and obligations of tax payment of citizens. Therefore, to ensure compliance with the provisions of the Constitution, the Standing Committee of the Standing Committee would like to absorb the MPA to revise the draft law in the direction, as follows:

In case it is necessary to amend and supplement taxable and non-taxable subjects to suit the socio-economic context in each period, the Government shall submit to the Standing Committee for consideration, decision and synthesize them into the Government's Report to report to the National Assembly at the most recent session...

The draft Law on Special Consumption Tax (amended) is continuing to be discussed by the National Assembly. If approved by the National Assembly, this Law will take effect from January 1, 2026.