Update deposit interest rates at Agribank

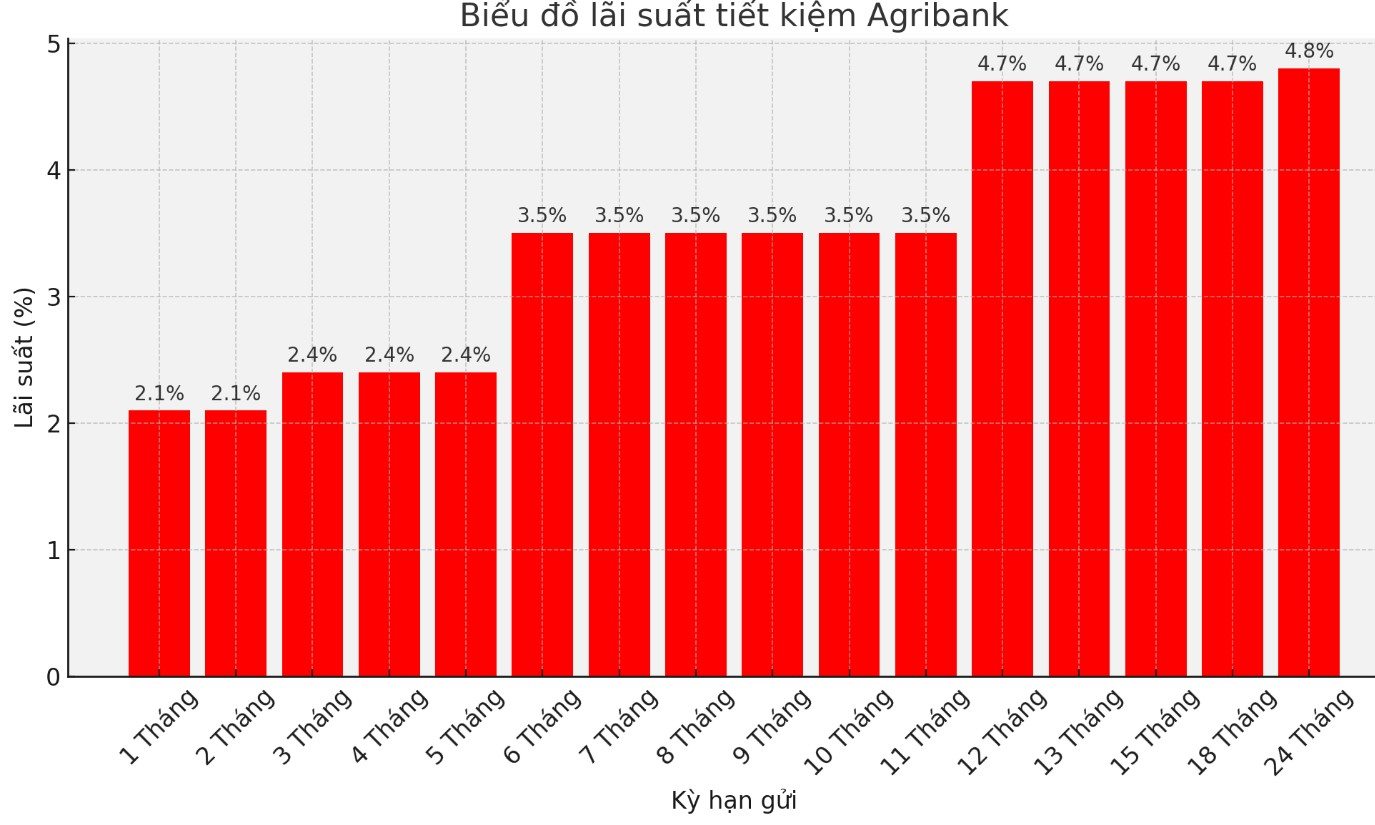

On March 27, the Bank for Agriculture and Rural Development of Vietnam (Agribank) adjusted savings interest rates with a reduction for some short-term terms, while long-term terms kept interest rates unchanged from before.

The 1-month and 2-month savings interest rates have decreased from 2.2% to 2.1%, down 0.1%. The 3-month, 4-month and 5-month terms also recorded a decrease of 0.1%, from 2.5% to 2.4%.

For longer terms, 6 months or more, interest rates remain unchanged. The 6-month, 7-month, 8-month, 9-month and 10-month terms have unchanged interest rates, all at 3.5%. Longer terms such as 12 months, 13 months, 15 months, 18 months and 24 months also maintain the old interest rates, ranging from 4.7% to 4.8%.

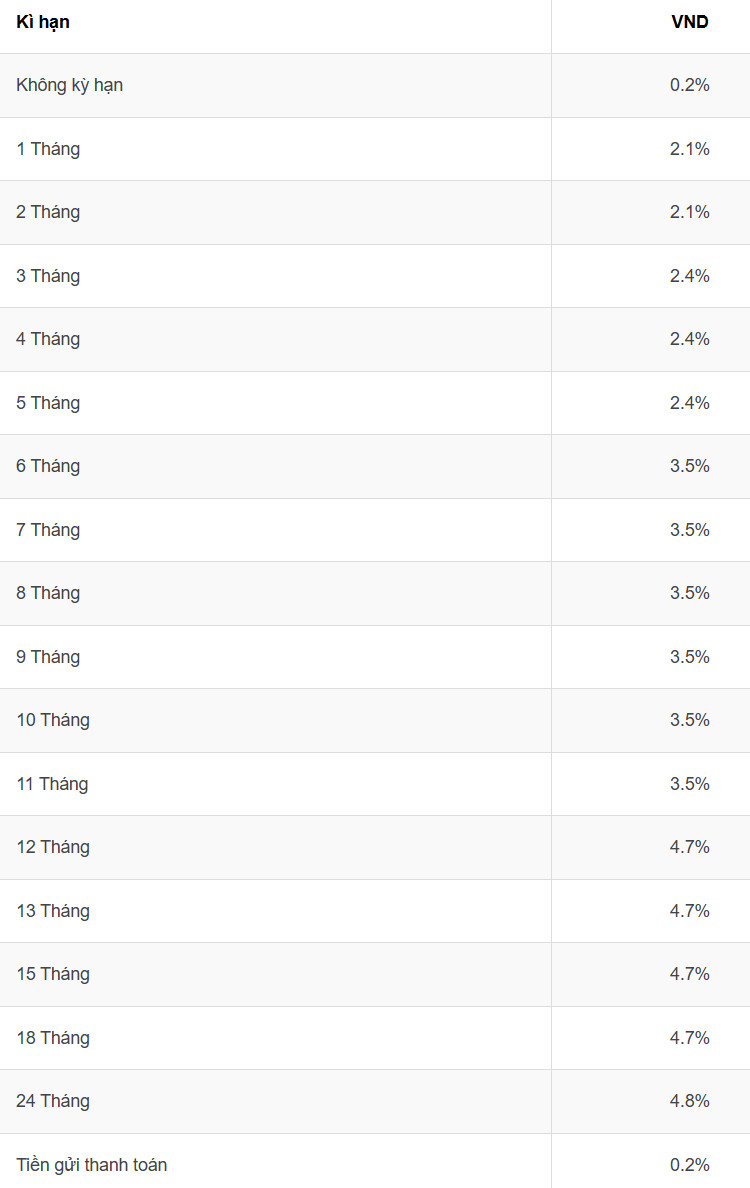

Below is the table of savings interest rates for individual customers at Agribank on March 27, 2025:

How to receive interest if you deposit 100 million VND at Agribank

Formula for calculating bank deposit interest:

Interest = Deposit x interest rate (%)/12 months x deposit term

With a deposit of 100 million VND at Agribank, customers can receive the following interest:

Note that the above interest amount is calculated according to the interest payment method at the end of the term and is for reference only. For the most detailed and updated information, customers should contact the nearest Agribank branch directly or visit the bank's official website.

Choosing a deposit term depends on your financial needs. If you need flexibility, you should choose a short term such as 1-6 months to easily withdraw money when needed without losing interest. However, short-term interest rates are often lower.

On the contrary, if you have a long-term idle amount and do not plan to use it in the near future, you should choose a long term such as 12-24 months to enjoy a higher interest rate. However, the disadvantage of long terms is that deposits cannot be withdrawn ahead of schedule without affecting interest rates. Therefore, before deciding, consider between liquidity and profit to make the right choice.

Some banks with the highest interest rates

The highest interest rate is up to 7.5-9.65%, but to enjoy this interest rate, customers must meet special conditions.

ABBank leads in special interest rates, at 9.65%/year for newly opened/repetited customers with savings deposits of VND1,500 billion or more, term of 13 months.

PVcomBank also applies a special interest rate of 9%/year for a term of 12-13 months when depositing money at the counter. The applicable condition is that customers must maintain a minimum balance of VND 2,000 billion.

HDBank applies an interest rate of 8.1%/year for a 13-month term and 7.7%/year for a 12-month term, with the condition of maintaining a minimum balance of VND500 billion. In addition, the 18-month term is subject to a 6% interest rate.

Vikki Bank applies an interest rate of 7.5%/year for term deposits of 13 months or more, with a minimum amount of 999 billion VND; Bac A Bank is listing the highest interest rate of 6% for a term of 18-36 months for deposits over 1 billion VND; IVB applies an interest rate of 6.15% for a term of 36 months, with conditions applied to deposits of 1,500 billion VND or more.

ACB applies an interest rate of 6%/year for a 13-month term with interest paid at the end of the term when customers have a deposit balance of VND200 billion or more.

At LPBank, for deposits of VND300 billion or more, the mobilization interest rate applied to customers receiving interest at the end of the term is 6.5%/year, receiving monthly interest of 6.3%/year and receiving interest at the beginning of the term is 6.07%/year.

Currently, interest rates above 6%/year are being listed by some banks for long-term deposits but do not require a minimum deposit amount.

BVBank applies an interest rate of 6% for an 18-month term, 6.05% for a 24-month term; Cake by VPBank applies an interest rate of 6%/year for a 12-18 month term and 6.3%/year for a 24-36 month term.

Vikki Bank applies an interest rate of 6% for a 24-month term; VietABank applies an interest rate of 6% for a 18- and 24-month term at 6%/year, 6.1% for a 36-month term.

See more news related to interest rates HERE...