Domestic silver price

As of 9:40 a.m. on May 1, the price of 999 silver bars at Phu Quy Jewelry Group was listed at VND1.247 - VND1.286 million/tael (buy - sell); down VND33,000/tael for buying and down VND34,000/tael for selling compared to early this morning.

At the same time, the price of 999 taels of silver at Phu Quy Jewelry Group was listed at 1.247 - 1.286 million VND/tael (buy - sell); down 33,000 VND/tael for buying and down 34,000 VND/tael for selling compared to early this morning.

The price of 999 (1kilo) gold bars at Phu Quy Jewelry Group was listed at 33.253 - 34.293 million VND/kg (buy - sell); down 880,000 VND/kg for buying and down 906,000 VND/kg for selling compared to early this morning.

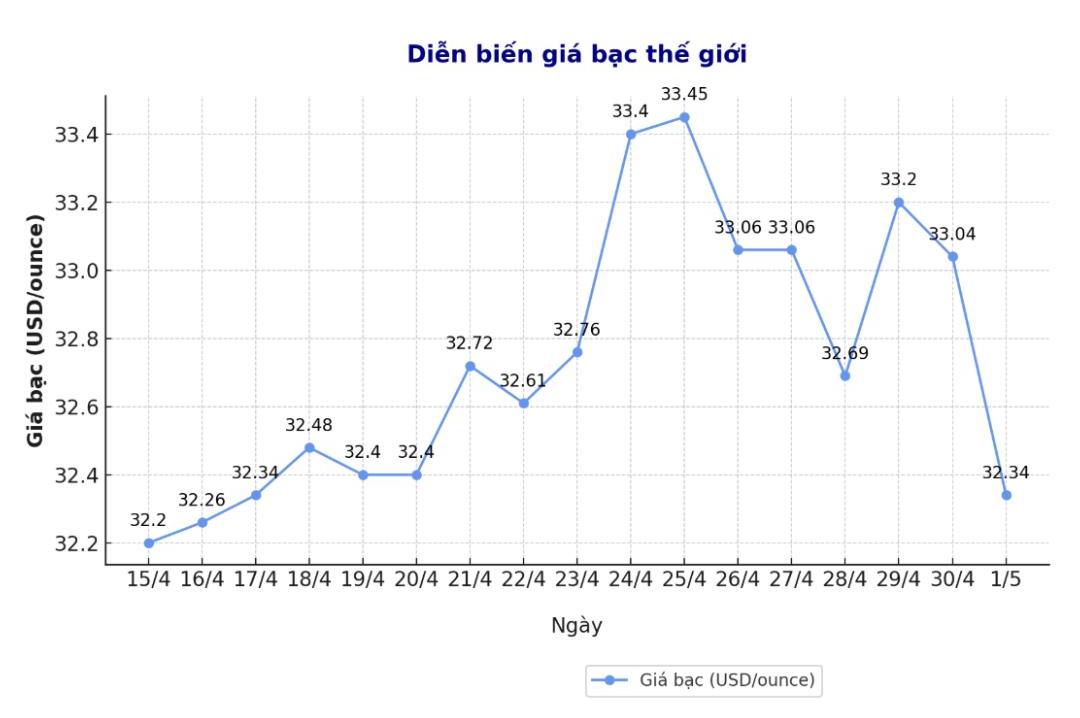

World silver price

On the world market, as of 9:45 a.m. on January 1 (Vietnam time), the world silver price listed on Goldprice.org was at 32.34 USD/ounce; down 0.7 USD compared to early this morning.

Causes and predictions

James Hyerczyk, a market analyst at FX Empire, said that silver prices fell as important US economic reports rocked investor sentiment and increased Treasury yields.

"With GDP falling and inflation rising again, silver is affected by a combination of high interest rates, a safe haven, and a stronger dollar due to rising bond yields," he said.

In addition, according to Kitco, silver prices fell below $33/ounce due to concerns that a global economic recession would affect the consumption of this precious metal in the industry.

Analysts at BMO Capital Markets said that recent data shows that the new psychological support level for silver will be around 30 USD/ounce.

"We believe that the $30/ounce threshold will be maintained despite the market still having a deficit," analysts at BMO Capital Markets emphasized.

In the long term, these analysts said that the solar energy sector will play a leading role in the silver market - as the demand for cheap renewable energy continues to increase globally.

Siliver is an important raw material in the production of solar panels. The supply of silver is expected to be in short supply in the coming time, as cash flow shifts from investment to industrial consumption" - said analysts from BMO Capital Markets.

See more news related to silver prices HERE...