Domestic silver price

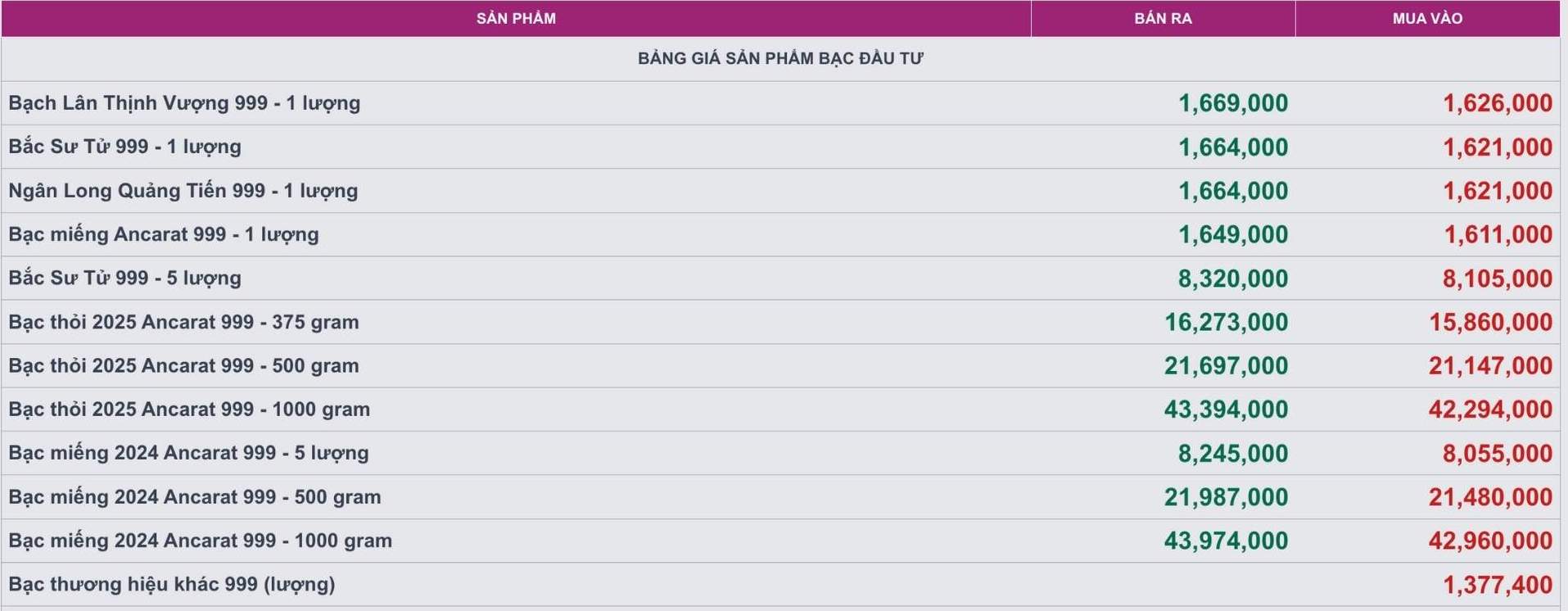

As of 11:10 a.m. on September 15, the price of 999 999 coins (1 tael) at Ancarat Golden Rooster Company was listed at 1.611 - 1.649 million VND/tael (buy - sell).

The price of 999 Ancarat 999 (1kg) at Ancarat Metallurgy Company is listed at 42.294 - 43.394 million VND/kg (buy - sell).

The price of 2024 Ancarat 999 (1kg) silver bars at Ancarat Metallurgy Company was listed at 42.960 - 43.974 million VND/kg (buy - sell).

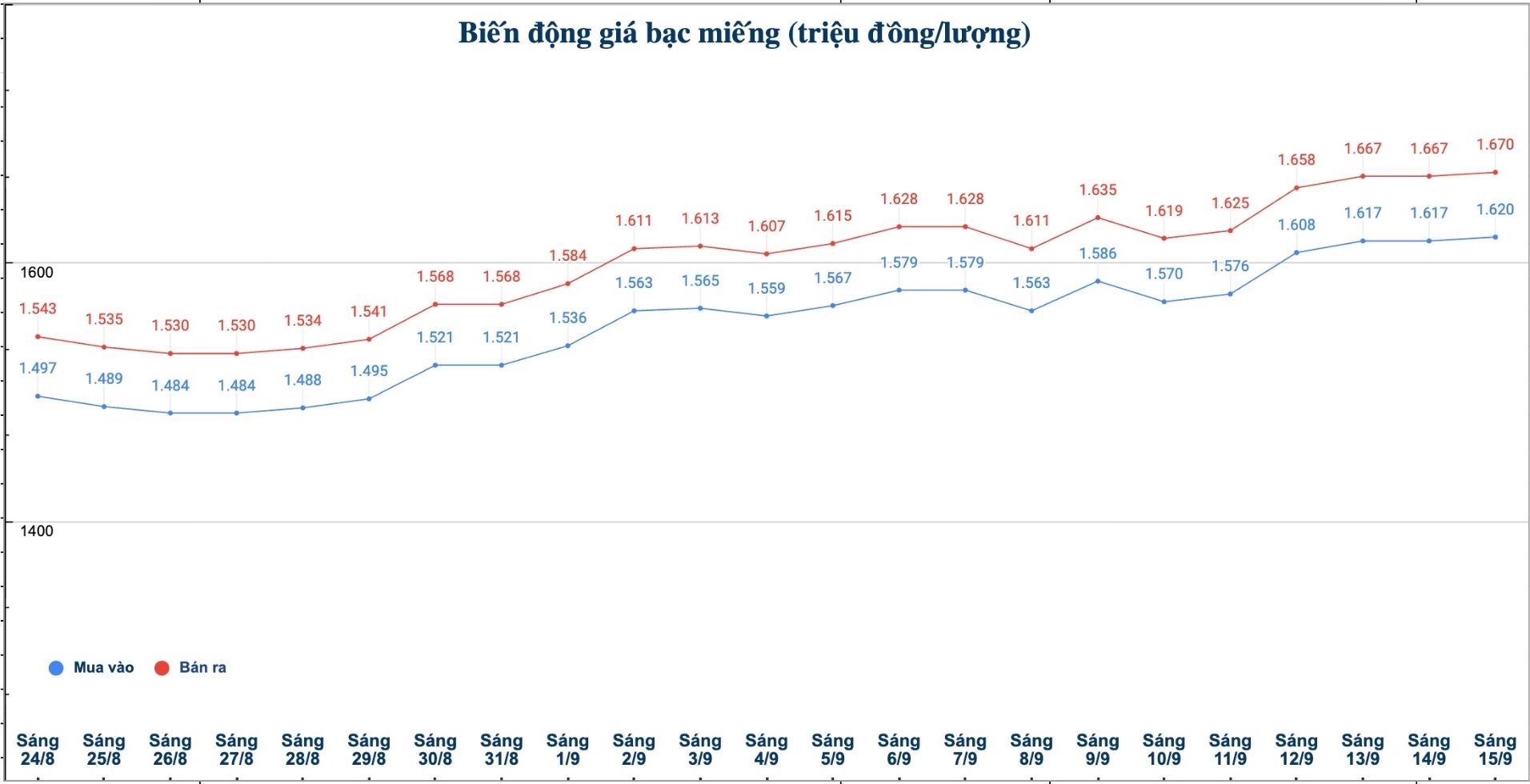

At the same time, the price of 999 999 coins (1 tael) at Phu Quy Jewelry Group was listed at 1.620 - 1.670 million VND/tael (buy - sell); an increase of 3,000 VND/tael for both buying and selling compared to yesterday morning.

The price of 999 gold bars (1 tael) at Phu Quy Jewelry Group was listed at 1.620 - 1.670 million VND/tael (buy - sell); an increase of 3,000 VND/tael for both buying and selling compared to yesterday morning.

The price of 999 taels (1kg) at Phu Quy Jewelry Group was listed at 43,199 - 44,533 million VND/kg (buy - sell); an increase of 80,000 VND/kg in both buying and selling directions compared to yesterday morning.

World silver price

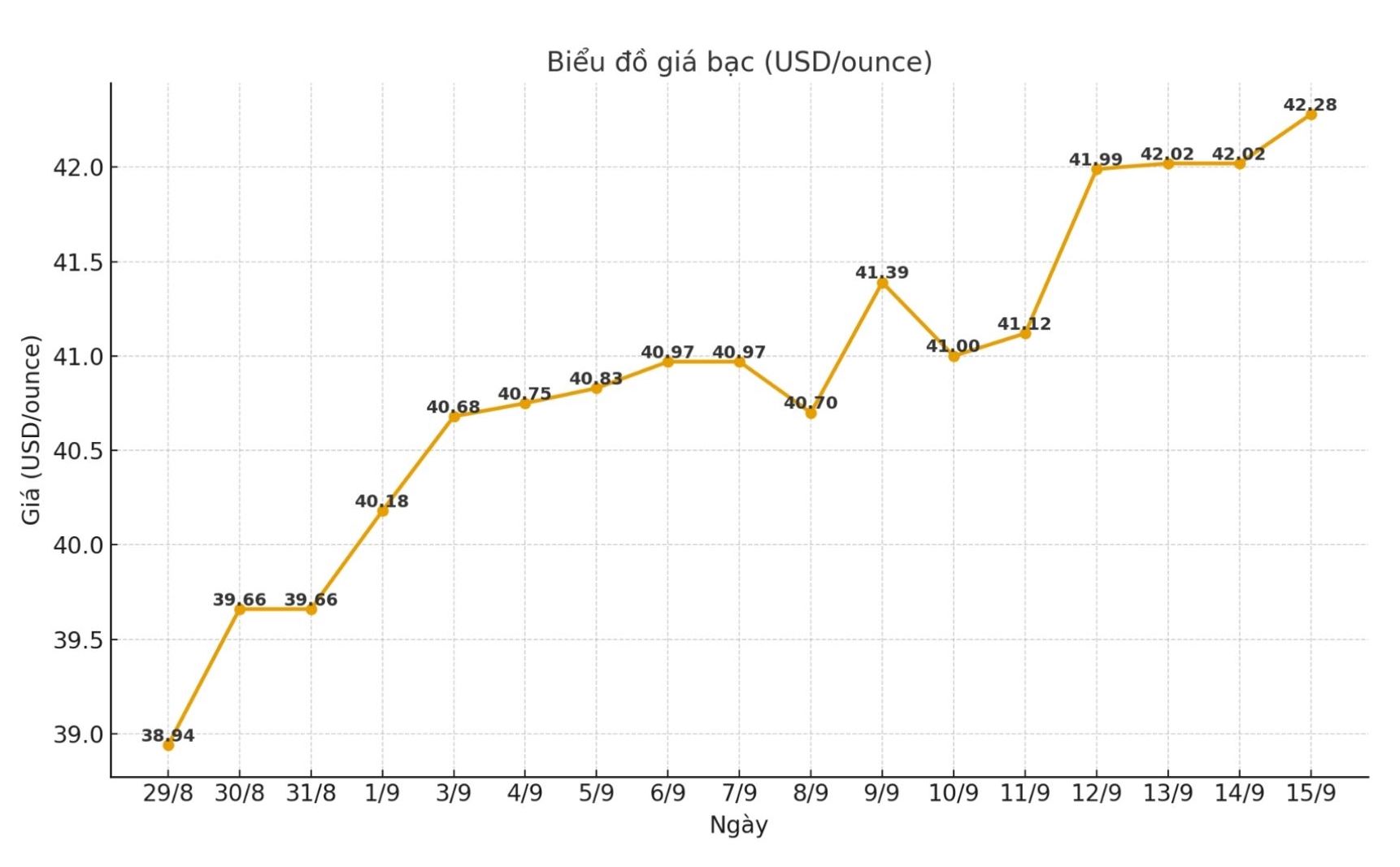

On the world market, as of 11:10 a.m. on September 15 (Vietnam time), the world silver price was listed at 42.28 USD/ounce; up 0.26 USD compared to yesterday morning.

Causes and predictions

In the context of the precious metal increasing sharply and gold continuously setting new records almost every day, silver is still outstanding over gold in 2025.

Expert Peter Krauth (SilverStockInvestor) said that in addition to benefiting from expectations of the US Federal Reserve (FED) cutting interest rates and concerns about inflation - factors that are pushing up precious metal prices - silver also have its own momentum that gold does not have. He emphasized: A part of the reason is gold, but the rest is completely different: it is scarcity. Gold is also scarce, but silver is under clearer pressure to lack supply".

According to Krauth, gold and silver prices have both increased since August as the market predicted the Fed would cut interest rates in September. This is the macro driver that has caused the prices of both metals to increase.

In particular, silver is also boosted by a shortage of supply. The silver market is scarce, secondary sources have been falling sharply for the past 4 - 4.5 years, Krauth said. He reiterated that the price of silver from 22 USD/ounce in February last year has nearly doubled, a clear demonstration of this trend.

In the long term, Peter Krauth predicts: "Crystal prices could reach around $45/ounce by the end of this year and are likely to reach $50/ounce next year."

See more news related to silver prices HERE...