Domestic silver price

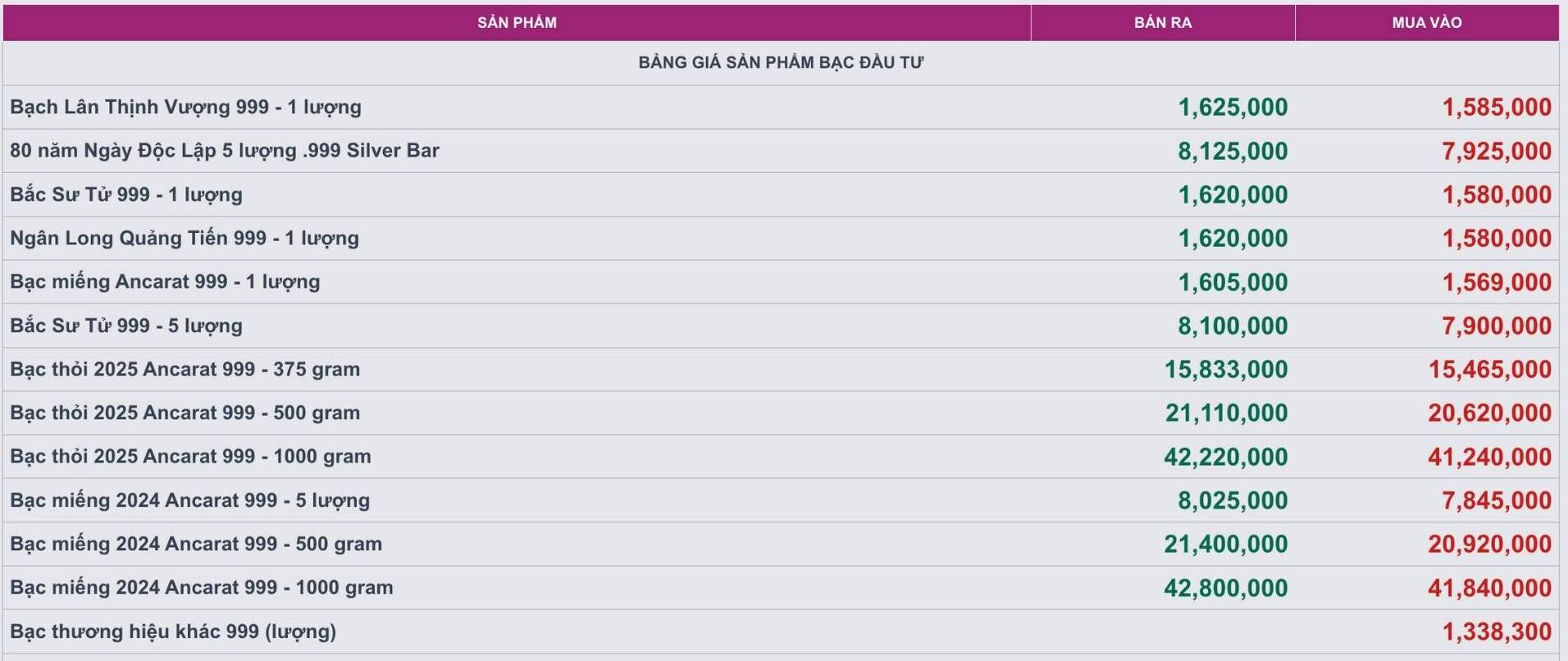

As of 9:50 a.m. on September 11, the price of 999 999 coins (1 tael) at Ancarat Metallurgy Company was listed at 1.569 - 1.605 million VND/tael (buy - sell).

The price of 999 999 Ancarat silver bars (1kg) at Ancarat Metallurgy Company is listed at 41.240 - 42.220 million VND/kg (buy - sell).

The price of 2024 Ancarat 999 (1kg) silver bars at Ancarat Metallurgy Company was listed at 41.840 - 42.800 million VND/kg (buy - sell).

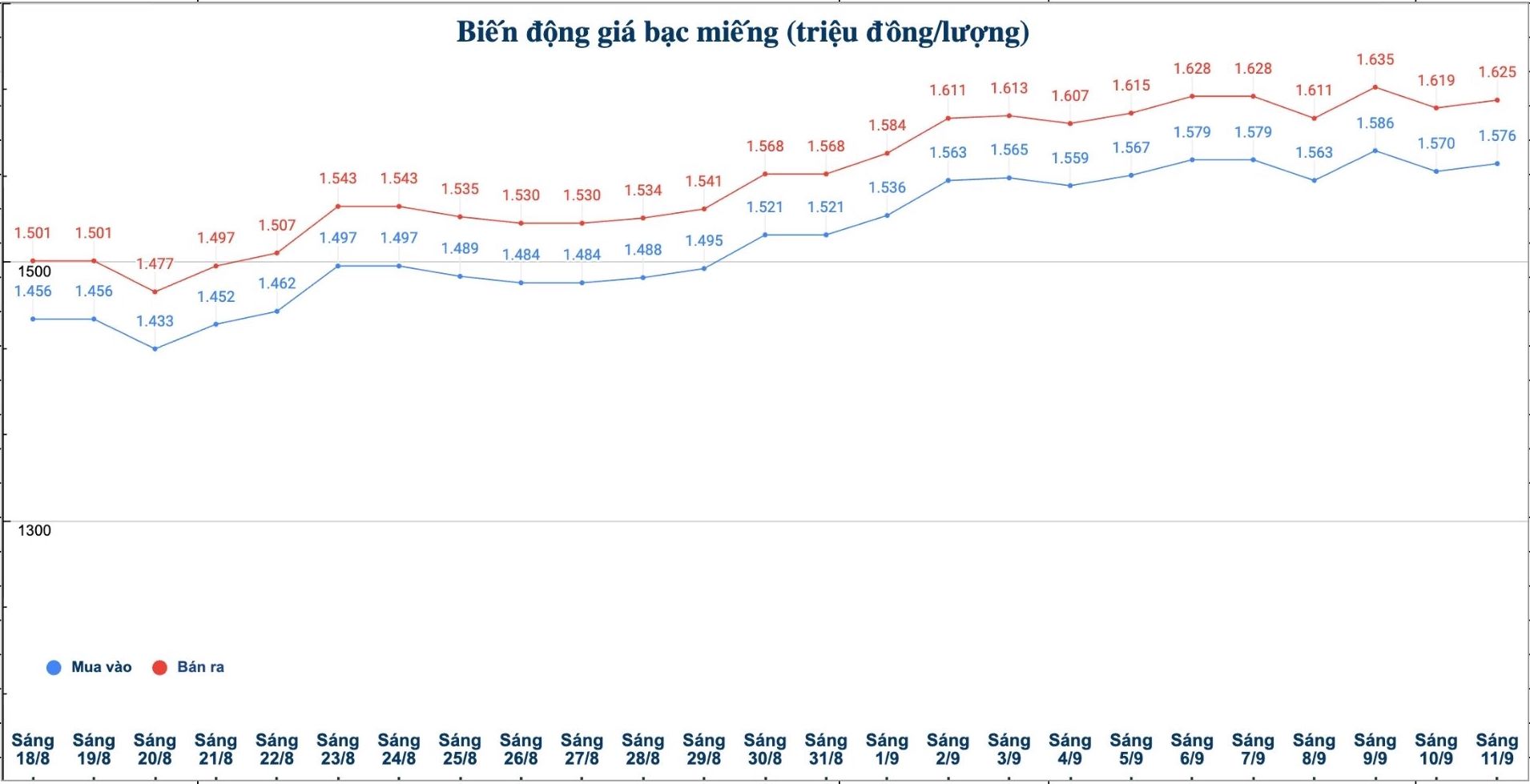

At the same time, the price of 999 999 coins (1 tael) at Phu Quy Jewelry Group was listed at 1.576 - 1.625 million VND/tael (buy - sell); an increase of 6,000 VND/tael for both buying and selling compared to yesterday morning.

The price of 999 gold bars (1 tael) at Phu Quy Jewelry Group was listed at 1.576 - 1.625 million VND/tael (buy - sell); an increase of 6,000 VND/tael for both buying and selling compared to yesterday morning.

The price of 999 gold bars (1kg) at Phu Quy Jewelry Group was listed at 42.026 - 43.333 million VND/kg (buy - sell); an increase of 160,000 VND/kg in both buying and selling directions compared to yesterday morning.

World silver price

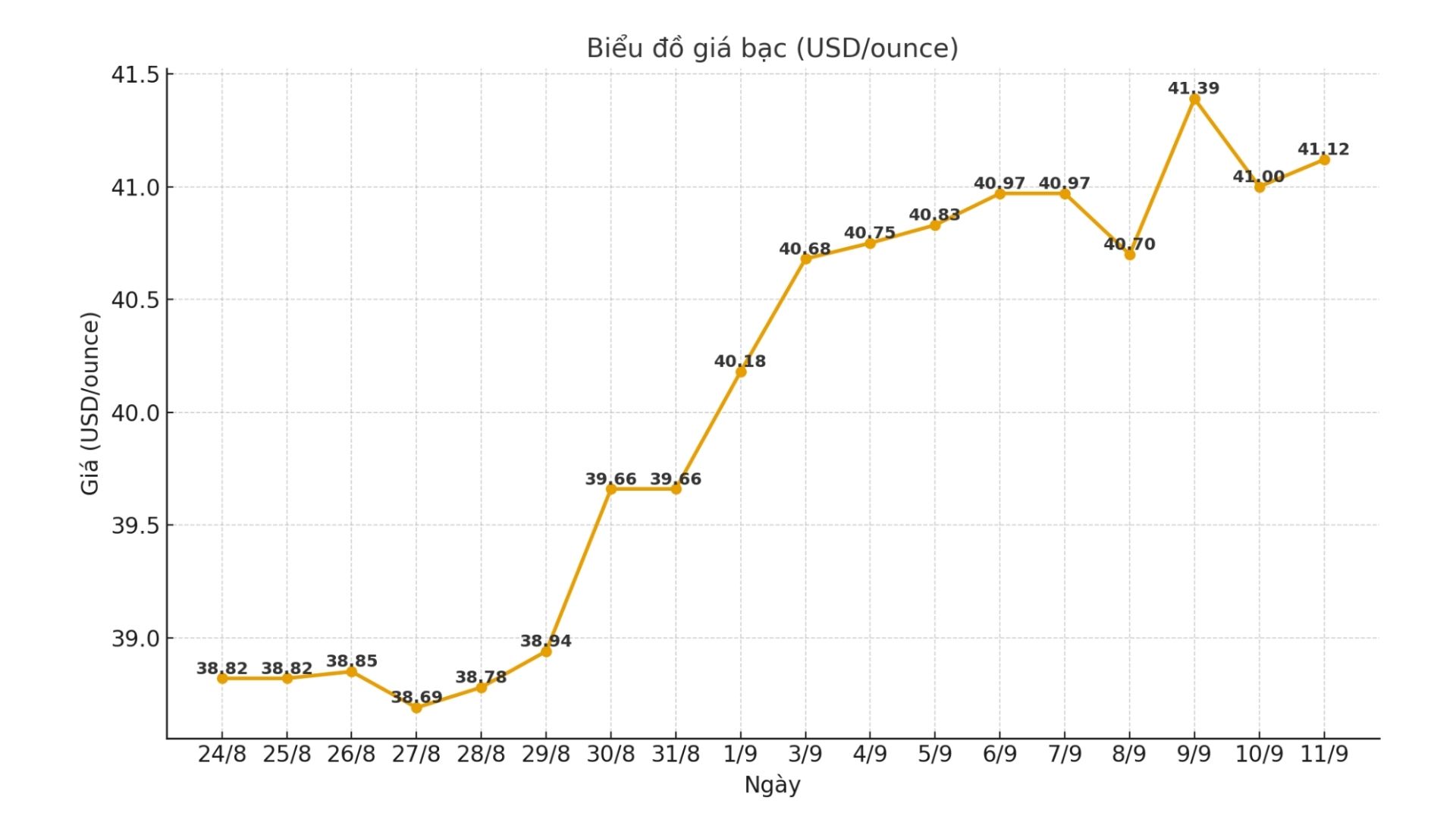

On the world market, as of 9:50 a.m. on September 11 (Vietnam time), the world silver price was listed at 41.12 USD/ounce; an increase of 1.12 USD compared to yesterday morning.

Causes and predictions

Silver prices are fluctuating narrowly between 40.40 - 41.67 USD/ounce, close to important technical thresholds. This shows that the upward momentum still exists, according to analyst James Hyerczyk.

"After hitting a 14-year peak of $41.67/ounce, the market is waiting for a new signal to break out or adjust," said James Hyerczyk.

The expert commented that the US Federal Reserve (FED) is expected to cut interest rates by 25 basis points in September with the possibility that 92% are supporting investment demand for gold and silver. In addition, weaker-than-expected jobs data and a weakening US dollar further reinforced the psychology of buying non-yielding precious metals.

Hyerczyk added that the market is watching the US inflation report, especially the Consumer Price Index (CPI) due today (Thursday). If the CPI increases sharply, expectations of a rate cut could slow down, putting short-term pressure on silver.

"However, before the new data, investors were still prioritizing the strategy of "buying when prices decrease". They believe that the Fed's dovish stance and a weak US dollar will create momentum for silver to soon break out to new highs" - James Hyerczyk expressed his opinion.

See more news related to silver prices HERE...