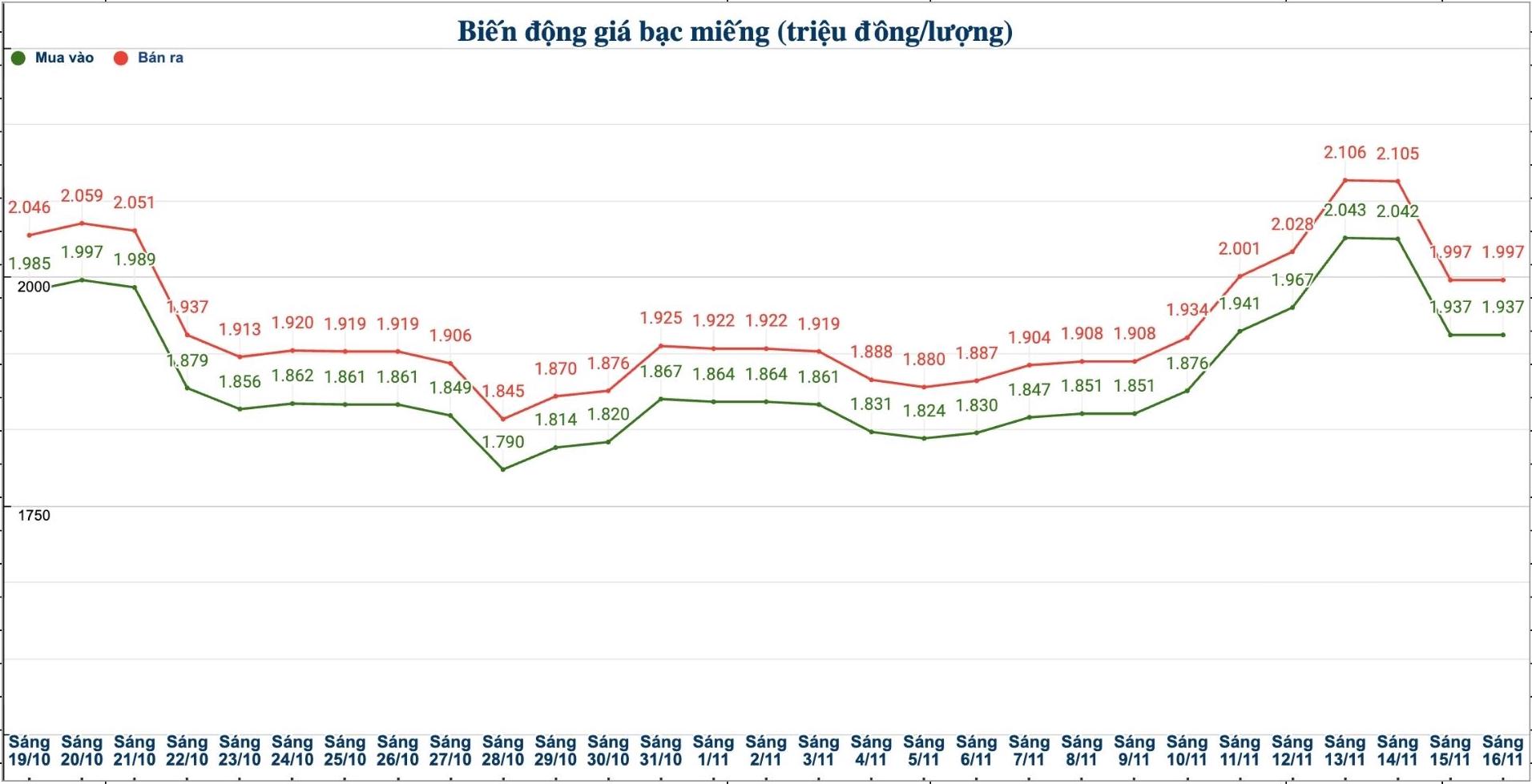

Domestic silver price

As of 11:10 a.m. on November 16, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Metallurgy Company was listed at 1.936 - 1.978 million VND/tael (buy - sell); unchanged in both directions compared to yesterday morning.

The price of 999 Ancarat 999 (1kg) of silver bars at Ancarat Metallurgy Company was listed at 50.776 - 52.296 million VND/kg (buy - sell); unchanged in both directions compared to yesterday morning.

The price of 999 gold bars of the Golden Rooster Bank of Saigon-SBJ (Sacombank-SBJ) was listed at VND1.995 - 2.046 million/tael (buy - sell); unchanged in both directions compared to yesterday morning.

At the same time, the price of 999 coins (1 tael) at Phu Quy Jewelry Group was listed at 1,937 - 1.997 million VND/tael (buy - sell); unchanged in both directions compared to yesterday morning.

The price of 999 taels (1kg) at Phu Quy Jewelry Group was listed at 51.653 - 53.253 million VND/kg (buy - sell); unchanged in both directions compared to yesterday morning.

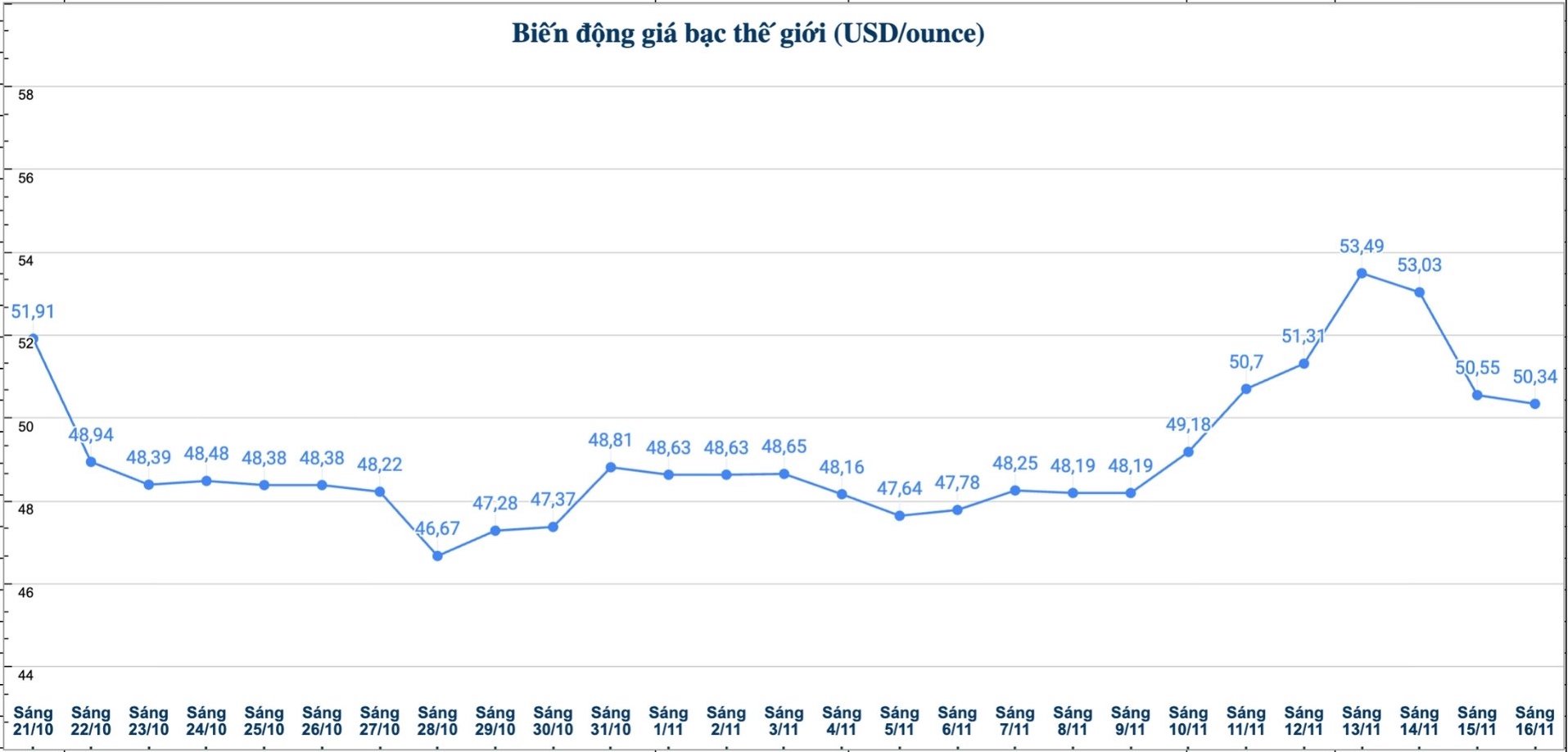

World silver price

On the world market, as of 11:10 a.m. on November 16 (Vietnam time), the world silver price was listed at 50.34 USD/ounce; down 0.21 USD compared to yesterday morning.

Causes and predictions

Spot silver prices ended the week in a state of weakness as expectations of the US Federal Reserve (FED) cutting interest rates almost disappeared and investors simultaneously withdrew from risky assets.

According to FX Empire precious metals analyst James Hyerczyk, after two consecutive sessions of decline, the silver market is in a sensitive period, with the risk of continuing to decline if important support zones are broken.

The expert added that silver had previously increased sharply to nearly 54.39 USD/ounce, but quickly reversed when a wave of sell-offs occurred in many markets.

"Not only silver, technology stocks, the AI group, cryptocurrencies and gold all fell sharply, showing a widespread mentality of divestment," he said.

James Hyerczyk said that despite the slight decline in the US dollar over the weekend and rising US bond yields - factors that often have a mixed impact on silver prices - the market has not responded positively.

"Investors are cautious and focusing on the Fed's tough stance, amid a lack of important economic data as the US government has just gone through a period of closure," he said.

The increase in silver has weakened significantly and the selling side is dominating. Until the market has new economic data or the Fed signals a softer signal, James Hyerczyk believes that the short-term trend of silver is likely to continue to be under downward pressure.

"Investors monitoring the market are advised to be cautious until the return of buying power is clearer" - James Hyerczyk gave his opinion.

See more news related to silver prices HERE...