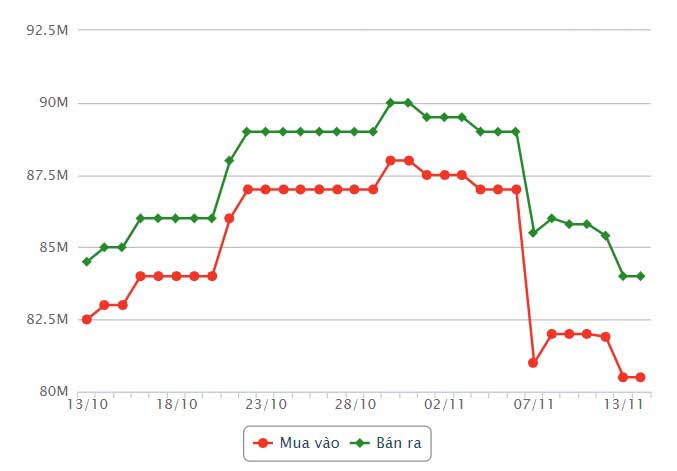

Update SJC gold price

As of 5:45 p.m., the price of SJC gold bars listed by DOJI Group was at 80.5-84 million VND/tael (buy - sell).

Compared to the previous trading session, gold prices at DOJI remained unchanged in both buying and selling directions. The difference between buying and selling prices of SJC gold at DOJI Group is at 3.5 million VND/tael.

Meanwhile, Saigon Jewelry Company listed the price of SJC gold at 80.5-84 million VND/tael (buy - sell).

Compared to the previous trading session, the gold price at Saigon Jewelry Company SJC remained unchanged in both buying and selling directions. The difference between the buying and selling price of SJC gold at Saigon Jewelry Company SJC was at 3.5 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 80.7-84 million VND/tael (buy - sell).

Compared to the previous trading session, the gold price at Bao Tin Minh Chau increased by VND200,000/tael for buying and remained unchanged for selling. The difference between the buying and selling price of SJC gold at Bao Tin Minh Chau is at VND3.3 million/tael.

Currently, the difference between the buying and selling price of gold is listed at around 3.5 million VND/tael. Experts say that this difference is very high, causing investors to face the risk of losing money when investing in the short term.

Price of round gold ring 9999

As of 5:40 p.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI was listed at 81.1-83.2 million VND/tael (buy - sell), an increase of 600,000 VND/tael for buying and unchanged for selling compared to the close of the previous trading session.

Bao Tin Minh Chau listed the price of gold rings at 81.18-83.18 million VND/tael (buy - sell); increased by 660,000 VND/tael for buying and increased by 60,000 VND/tael for selling.

World gold price

As of 5:42 p.m., the world gold price listed on Kitco was at 2,608.6 USD/ounce, up 11.2 USD/ounce compared to the close of the previous trading session.

Gold Price Forecast

World gold prices recovered slightly despite the high USD index. Recorded at 5:42 p.m. on November 13, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 105.962 points (up 0.01%).

OANDA senior market analyst for Asia Pacific - Kelvin Wong said that investors are taking advantage of the price falling below the $ 2,600 / ounce mark.

In recent sessions, gold prices have been under pressure as the US dollar has strengthened amid concerns that President-elect Donald Trump's policies will impact the US Federal Reserve's (FED) interest rate cycle.

Traders see a 62% chance of the Fed cutting rates by 25 basis points at its December 2024 meeting, up from 77.3% a week ago, according to CME's FedWatch Tool.

Gold is a hedge against inflation, but higher interest rates will reduce the appeal of the precious metal.

Mr. Wong said that the report on the US consumer price index will be released on November 13 and if it shows that the inflation trend is under control, the price of gold could increase to $2,650/ounce.

According to Kitco, the gold price rally has been delayed, retesting the $2,600/ounce threshold since Donald Trump won the US presidential election. Many investors have taken profits and switched to stocks and cryptocurrencies.

However, with many obstacles still facing the global economy, analysts at the World Gold Council say the pullback is only temporary.

See more news related to gold prices HERE...