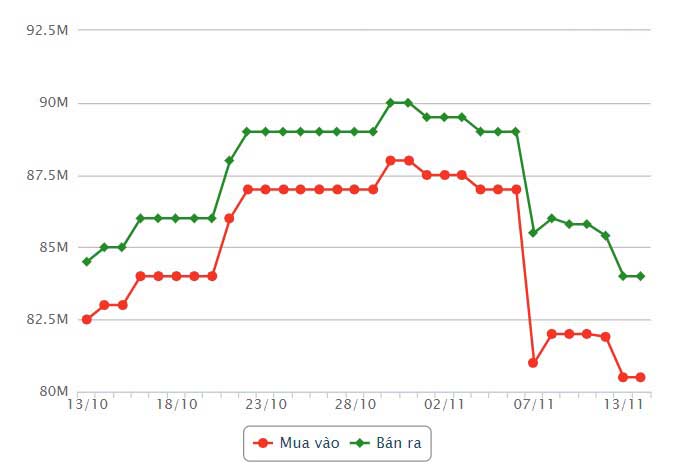

Update SJC gold price

As of 9:00 a.m., the price of SJC gold bars listed by DOJI Group was at 80.5-84 million VND/tael (buy - sell).

Compared to the beginning of the previous trading session, gold price at DOJI decreased by 100,000 VND/tael for both buying and selling.

The difference between buying and selling price of SJC gold at DOJI Group is at 3.5 million VND/tael.

Meanwhile, Saigon Jewelry Company listed the price of SJC gold at 80.5-84 million VND/tael (buy - sell).

Compared to the beginning of the previous trading session, the gold price at Saigon Jewelry Company SJC decreased by 100,000 VND/tael for both buying and selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 3.5 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 80.5-84 million VND/tael (buy - sell).

Compared to the beginning of the previous trading session, gold price at Bao Tin Minh Chau decreased by 300,000 VND/tael for buying and decreased by 100,000 VND/tael for selling.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 3.5 million VND/tael.

Currently, the difference between the buying and selling price of gold is listed at around 2 million VND/tael. Experts say that this difference is very high, causing investors to face the risk of losing money when investing in the short term.

Price of round gold ring 9999

As of 9:00 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 81.4-83.4 million VND/tael (buy - sell); down 900,000 VND/tael for buying and down 600,000 VND/tael for selling compared to early this morning.

Bao Tin Minh Chau listed the price of gold rings at 80.52-83.12 million VND/tael (buy - sell), down 910,000 VND/tael for buying and down 260,000 VND/tael for selling compared to early this morning.

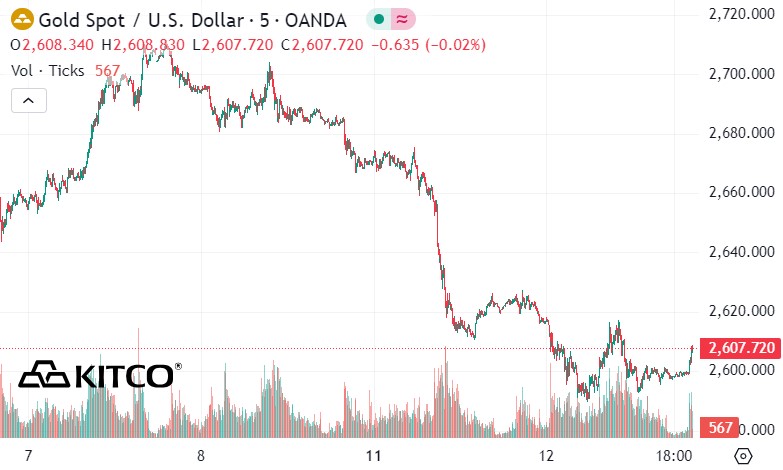

World gold price

As of 8:30 a.m., the world gold price listed on Kitco was at 2,607.7 USD/ounce, down 14.2 USD/ounce compared to the beginning of the previous trading session.

Gold Price Forecast

World gold prices fell to their lowest level in nearly two months due to pressure from the strong recovery of the USD. Recorded at 8:33 a.m. on November 13, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 105.897 points (up 0.04%).

According to Kitco - in addition to being pressured by a very strong USD, gold prices are also affected by rising US Treasury bond yields, reduced demand for metals from China and a decrease in risk-off sentiment in the general market.

Independent analyst Ross Norman said the strength of the US dollar is weighing on gold. The inverse relationship between gold and the US dollar seemed to have disappeared in recent times. However, since the US presidential election, this relationship has returned strongly.

The USD is expected to benefit from some of the policies of US President-elect Donald Trump, as they are likely to keep US interest rates relatively high for longer, which will be an unfavorable environment for gold.

RJO Futures senior market strategist Daniel Pavilonis said the pullback was just a corrective move in a long-term bull market. He said inflation will rise again and that environment will push gold prices higher.

The economic calendar for the week ahead is fairly bleak, especially compared to last week’s boom. The key economic news event to watch will be the US core CPI on Wednesday. The Federal Reserve is expected to be watching the CPI closely for signs that consumer inflation is continuing its path toward 2%.

Thursday's US PPI report, weekly jobless claims data and Friday morning's US retail sales release for October will also provide concrete data on Americans' purchasing power in the current high-cost environment.

Technically, December gold bulls have lost the overall near-term technical advantage. Gold is trending lower.

The next upside price objective for the bulls is to create a close above $2,700/oz. The next near-term downside price objective for the bears is to push futures below $2,500/oz.

See more news related to gold prices HERE...