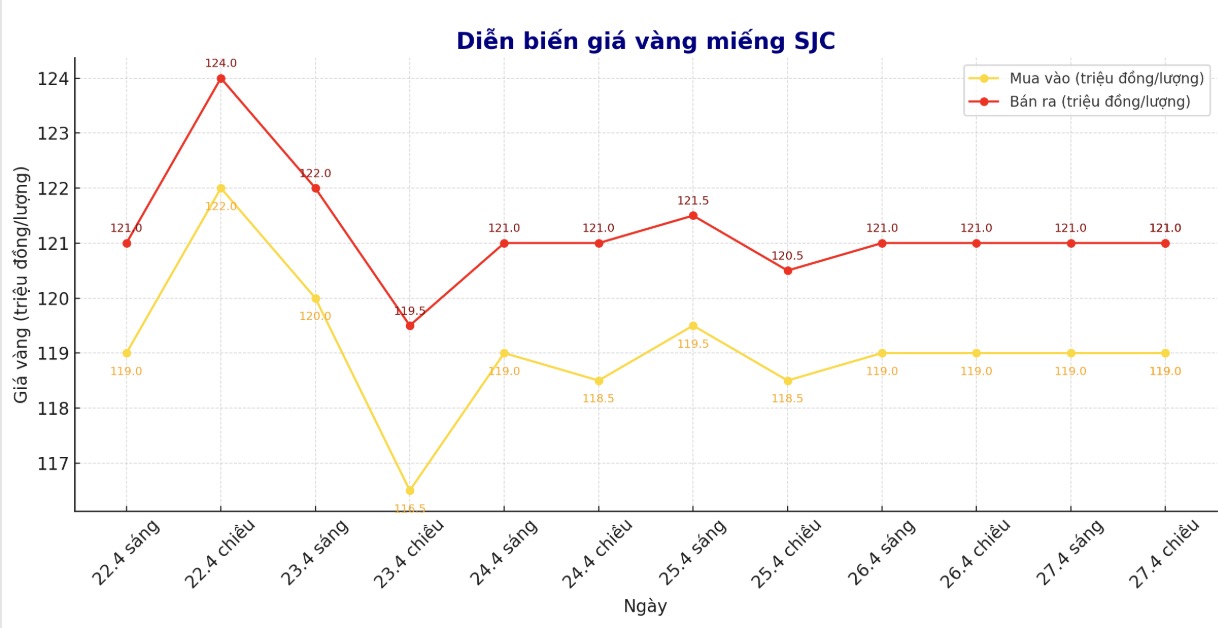

Updated SJC gold price

As of 5:00 p.m., the price of SJC gold bars was listed by DOJI Group at 119-121 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 119-121 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 118.5-121 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 2.5 million VND/tael.

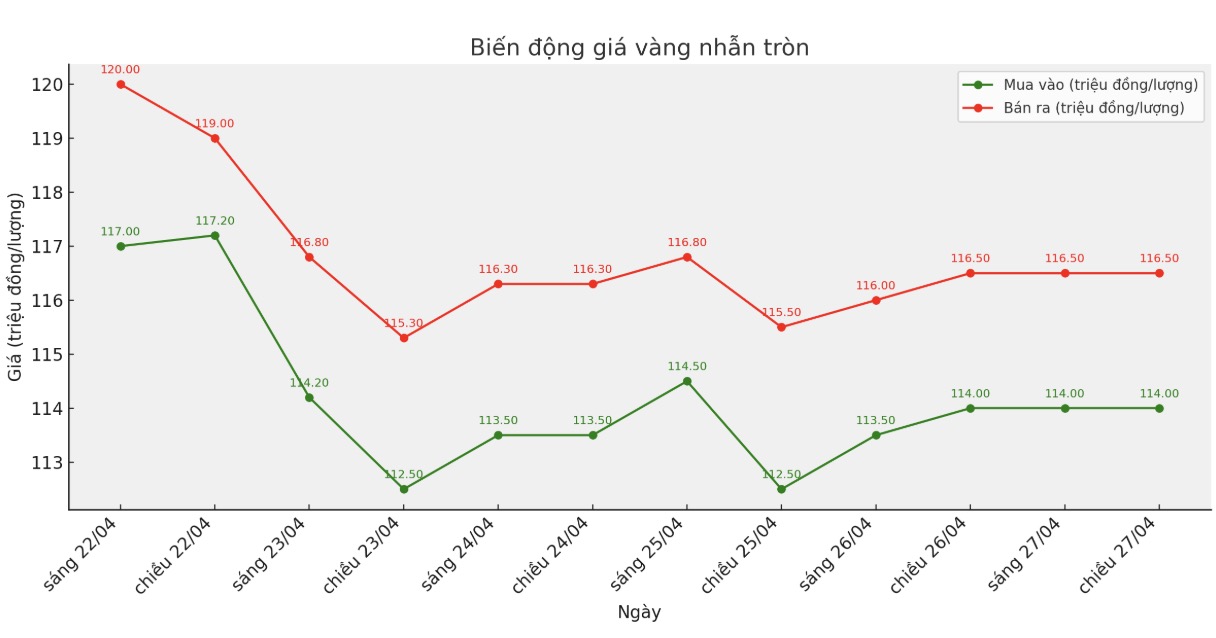

9999 round gold ring price

As of 5:00 p.m., the price of 9999 Hung Thinh Vuong round gold rings at DOJI was listed at 114-116.5 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 117-120 million VND/tael (buy in - sell out). The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 115.5-118.5 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

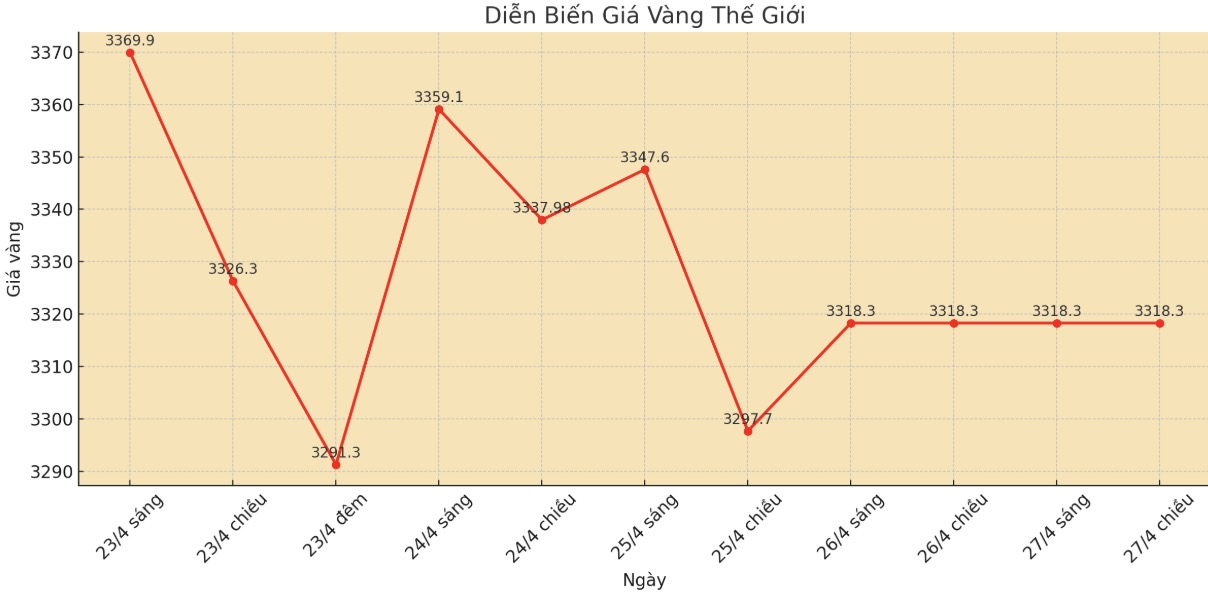

World gold price

At 5:00 p.m., the world gold price was listed on Kitco around 3,318.3 USD/ounce.

Gold price forecast

The global precious metals market has gone through many volatile trading sessions. Spot gold prices opened the week at $3,338.38/ounce. In the first two sessions, gold increased without any obstacles. The precious metal surged to $3,385 an ounce on Sunday evening. By the time the North American market opened, prices had reached $3,420/ounce, although trading volumes were quite thin due to the holiday season.

The Asian market then led the increase, pushing gold from $3,417/ounce at 8:00 p.m. EDT on Monday to a new record high of $3,500/ounce at 2:00 a.m. on Tuesday - one of the most impressive increases during the multi-year price increase cycle.

However, this peak was quickly broken. Profit-taking activities along with softer statements from the Trump administration caused gold to turn around and fall sharply, to nearly 3,410 USD/ounce when the North American stock market opened and hit a bottom of 3,318 USD at 6:00 p.m.

Asian traders continued to push gold prices back to $3,386/ounce on Tuesday evening, but then gold prices fell sharply. Half an hour after the North American market opened on Wednesday morning, gold prices fell to a weekly low of $3,270/ounce.

Gold continued to be supported in the Asian market, but this time it only reached a peak of 3,362 USD/ounce before fluctuating within a narrow range of 3,320 to 3,365 USD/ounce throughout the trading session on Thursday.

Early Friday morning, gold continued its final sell-off, from $3,323/ounce after midnight, down to $3,289 at 2:00 a.m. and to $3,278/ounce when the North American market opened.

After re-checking the bottom around $3,270/ounce, spot gold has recovered to $3,300/ounce at the end of the trading session in North America, ending a volatile week.

In a recent interview with Kitco News, Ryan McIntyre, managing partner at Sprott Inc, said that when compared to the over- Valuated stock market, gold has room to increase in the long term.

McIntyre said the stock market will continue to struggle as inflation remains high, forcing the US Federal Reserve (FED) to maintain a neutral monetary policy. Many investors are worried about an economic downturn.

In the current context, gold has the potential to build a new foundation of over 3,000 USD/ounce. Investors do not need to worry about gold at current levels.

After a rather quiet week on economic data, the market will focus on a series of US employment reports next week. Job opportunities (JOLTS) data will be released on Tuesday, the ADP jobs report on Wednesday, weekly jobless claims on Thursday and close with the April non-farm payrolls report on Friday morning.

Investors will also closely monitor the Canadian federal election on Monday, the US consumer confidence index on Tuesday, preliminary US Q1 GDP data, pending home contracts and the Bank of Japan's monetary policy meeting on Wednesday, along with the ISM manufacturing index on Thursday.

See more news related to gold prices HERE...