Update SJC gold price

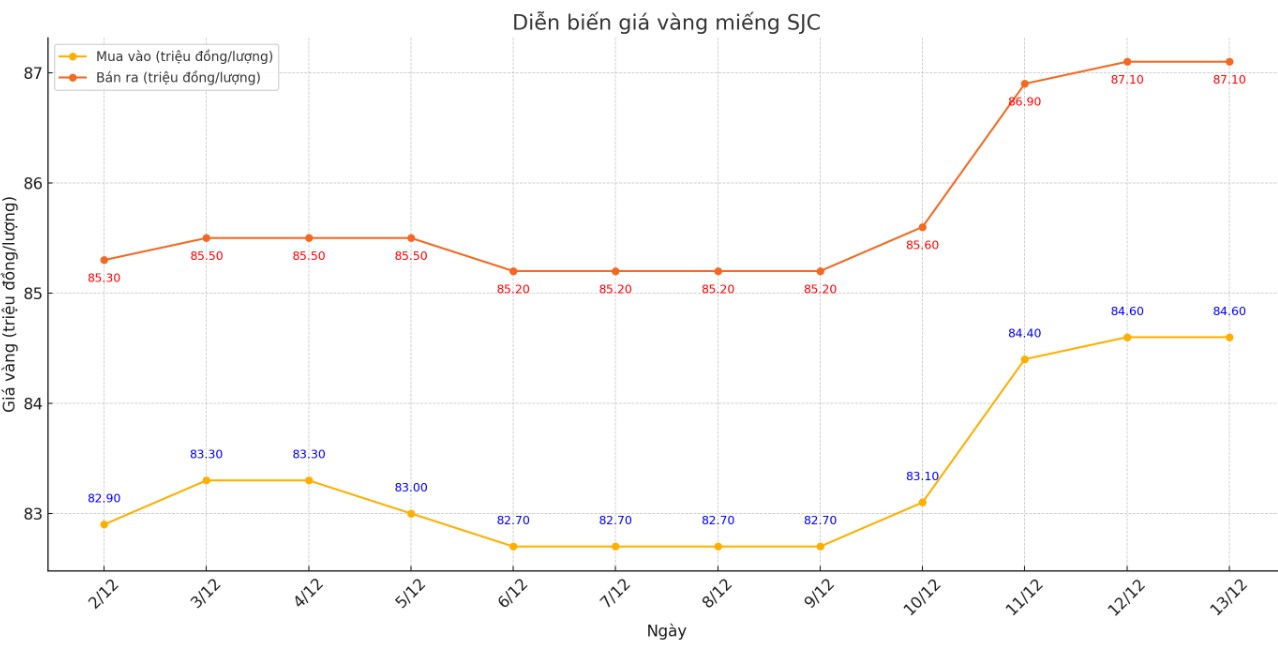

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 84.6-87.1 million VND/tael (buy - sell), an increase of 200,000 VND/tael for both buying and selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2.5 million VND/tael.

Meanwhile, DOJI Group listed the price of SJC gold at 84.8-87.3 million VND/tael (buy - sell), an increase of 400,000 VND/tael for both buying and selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2.5 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 84.8-87.3 million VND/tael (buy - sell), an increase of 400,000 VND/tael for both buying and selling.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

The difference between the buying and selling price of gold is listed at around 2.5 million VND/tael. This price difference is a factor that investors need to consider when participating in the gold market. It directly affects the ability to make a profit, especially in the short term.

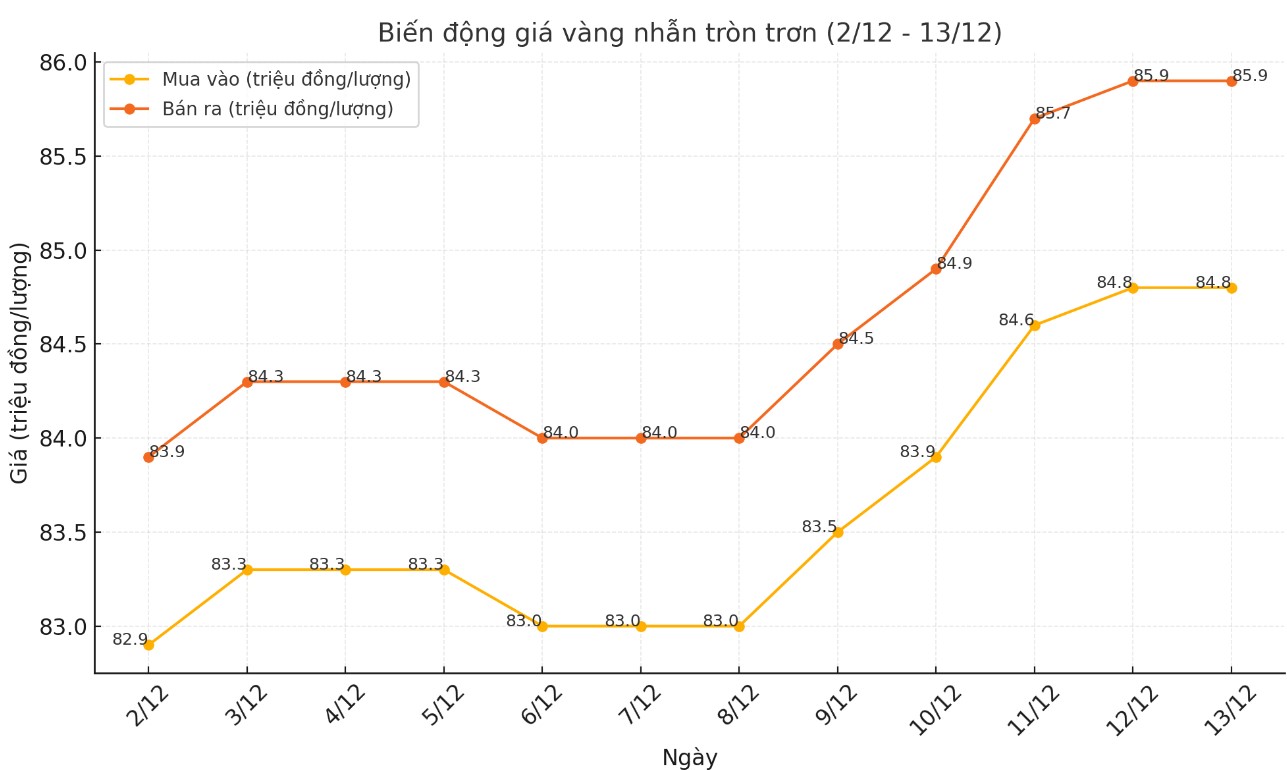

Price of round gold ring 9999

As of 6:00 a.m. today, the price of Hung Thinh Vuong 9999 gold rings at DOJI is listed at 84.8-85.9 million VND/tael (buy - sell); an increase of 200,000 VND/tael for both buying and selling compared to the close of the previous trading session.

Bao Tin Minh Chau listed the price of gold rings at 84.46-86.16 million VND/tael (buy - sell); increased by 980,000 VND/tael for buying and increased by 180,000 VND/tael for selling.

World gold price

As of 6:30 a.m. on December 13 (Vietnam time), the world gold price listed on Kitco was at 2,680.4 USD/ounce, down 36.2 USD/ounce compared to the opening of the previous trading session.

Gold Price Forecast

World gold prices fell sharply as the USD index increased. Recorded at 6:30 a.m. on December 13, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 106.680 points (up 0.27%).

World gold prices fell more than 1% on Thursday as investors rushed to take profits after prices hit a five-week high.

According to Zain Vawda - an expert at OANDA, although the short-term uptrend remains, gold prices may correct before the US Federal Reserve's (FED) policy meeting due to profit-taking pressure.

According to CME's FedWatch tool, the probability of the US Central Bank cutting interest rates next week is 98%.

Alex Ebkarian - CEO of Allegiance Gold, commented that the FED is having difficulty with rising inflation, while pressure to cut interest rates is increasing.

A new report showed U.S. producer prices rose more than expected in November, with food prices soaring. Midweek inflation showed consumer prices rose the most in seven months.

The number of applications for unemployment benefits increased, showing that the labor market was loosening, increasing the possibility of a third interest rate cut, although inflation has not yet reached the 2% target.

In other developments, the European Central Bank (ECB) cut interest rates for the fourth time this year, by 0.25 percentage points, and may continue to cut.

See more news related to gold prices HERE...