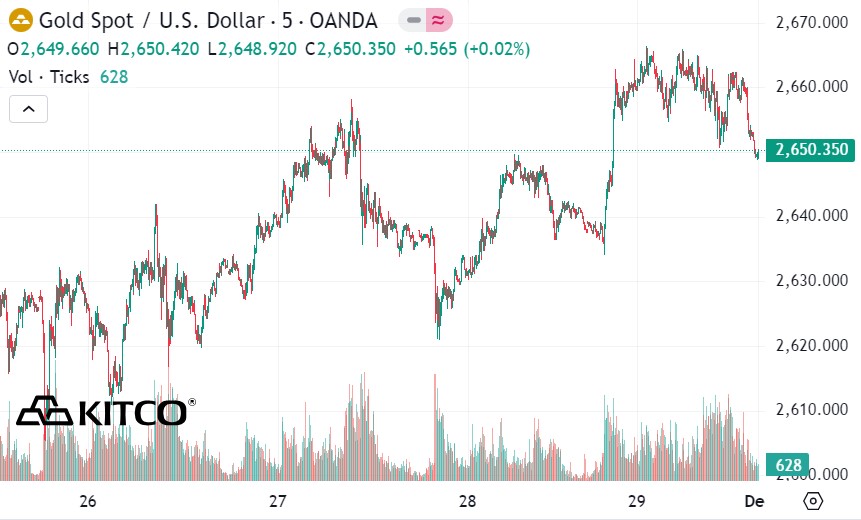

Although the precious metal has proven resilient, holding key support at $2,600 an ounce, the market is still on edge as investors and traders await new information.

The US economy is in a state of “adequacy”

The US economy is currently in a “just right” state – not too hot and not too cold. This “warm” environment does not provide much incentive for gold as a safe haven asset.

Inflationary pressures in the US continued to show signs of rising last week. The core personal consumption expenditures (PCE) index - the Fed's preferred inflation measure - rose 2.8% over the past 12 months, well above the 2% target.

While inflation is not hot enough to make the market completely rule out a rate cut, this is still a positive for gold. However, the overall picture is still unclear. The next thing to watch is the US labor market, which is also proving to be quite resilient.

If next week’s nonfarm payrolls report is positive, the market could expect a shorter rate-cutting cycle. Conversely, if the labor market disappoints, gold could continue to rally. Unsurprisingly, gold volatility is high, as the market appears to be “at the mercy of the wind.”

Geopolitics adds pressure to gold prices

Not only are US economic conditions and interest rates driving gold’s volatility, but so are changes in the global geopolitical landscape. In particular, as President-elect Donald Trump continues to make policy statements and tweets, market sentiment is becoming increasingly unpredictable.

The world could be just one post away from starting a new trade war on Platform X (formerly Twitter), which economists predict could lead to higher inflation and stunt economic growth, according to Kitco News analyst Neils Christensen.

Buying opportunity amid volatility

While the gold market will be difficult to navigate, analysts say the volatility could create buying opportunities for investors who missed out on this year's rally.

While many analysts have temporarily stood on the sidelines as the uncertainty subsides, the long-term sentiment remains bullish, with a growing number of analysts expecting gold prices to hit $3,000 an ounce next year.

Notably, strong central bank buying will continue to be a key driver of the precious metal. With 100 tonnes of gold purchased in 2024, Poland’s central bank has become the largest buyer of gold at the national level. However, the country is not alone.

“We need to reduce volatility,” Ales Michl, governor of the Czech Central Bank, told Bloomberg earlier this month after visiting the country’s gold vault in London. “And to do that, we need an asset that is not correlated with stocks, and that is gold.”

Ales Michl has set a goal of doubling the Czech Republic's gold reserves, currently at 100 tonnes, within the next three years. Since taking office in 2022, he has increased the country's gold reserves fivefold.

Meanwhile, Adam Glapinski, governor of the Central Bank of Poland, has said that gold and foreign exchange reserves are an important safeguard for the country's economy. Under his leadership, Poland has increased its gold reserves to around 420 tonnes by the end of September, about half the total reserves of India or Japan.

See more news related to gold prices HERE...