The Institute for Supply Management (ISM) said on Monday that its manufacturing Purchasing Managers' Index (PMI) rose to 48.4, up from 46.5 in October. While the sector remained in contraction territory, the headline figure was better than expected, with consensus forecasts expecting the index to rise to 47.7.

In diffusion indices like the PMI, a reading above 50% indicates economic growth, while a reading below 50% indicates contraction. The further the index is from the 50% mark, the greater or lesser the rate of change.

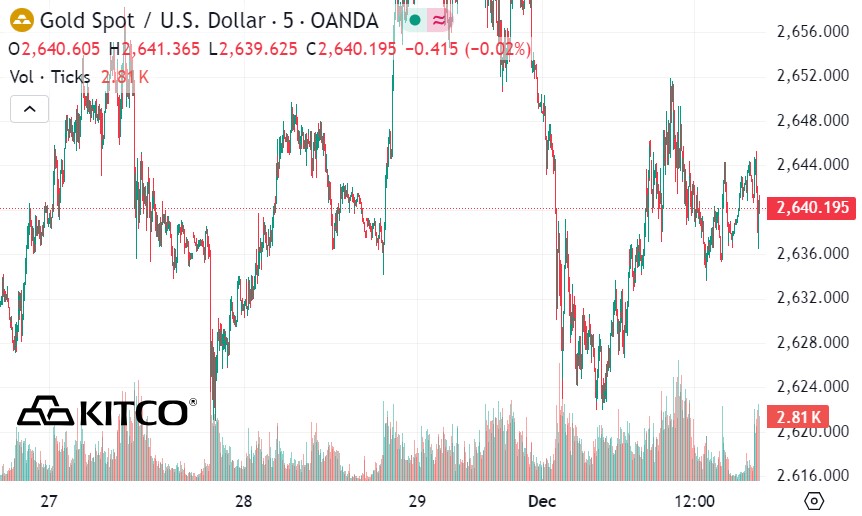

Gold prices are trading in a narrow range after falling sharply by 91 USD last Monday.

The US dollar showed strength, rising 0.54% to 106.450. The growth was attributed to growing expectations that the US Federal Reserve (FED) may maintain its current interest rate stance at its upcoming policy meeting. Markets remain cautious, with investors closely watching for potential changes in monetary policy.

After hitting a record high above 2,800 USD/ounce, the metal fell sharply to 2,568.1 USD/ounce, down 255 USD or 9.03%.

Gold has recovered somewhat, however, rising 174 USD/ounce from its low. Analysts at Saxo Bank noted that the market is still trading in a narrow range, with expectations for fresh US economic data and more clarity on the possibility of a rate cut. The recently released US personal consumption expenditure (PCE) index for October rose 2.3% year-on-year, complicating the Fed’s decision-making process.

The CME FedWatch tool shows that market sentiment is quite interesting, with a 74.5% probability of a 25 basis point rate cut at the upcoming meeting. That's up from 52.3% last week, though down from 83% a month ago. At the same time, expectations for keeping rates unchanged have also been adjusted accordingly.

Treasury yields also responded to these market moves. The yield on the 2-year note rose 4.3 basis points to 4.202%, while the yield on the 10-year note rose 1.8 basis points to 4.193%. These moves reflect ongoing uncertainty and potential economic shifts in the near term.

As the financial world awaits a new US President and the Fed's final meeting of the year, investors and analysts continue to analyze economic indicators and potential policy implications.

The gold market remains an important barometer of global economic sentiment, with its movements providing insight into broader financial trends.

See more news related to gold prices HERE...