Update SJC gold price

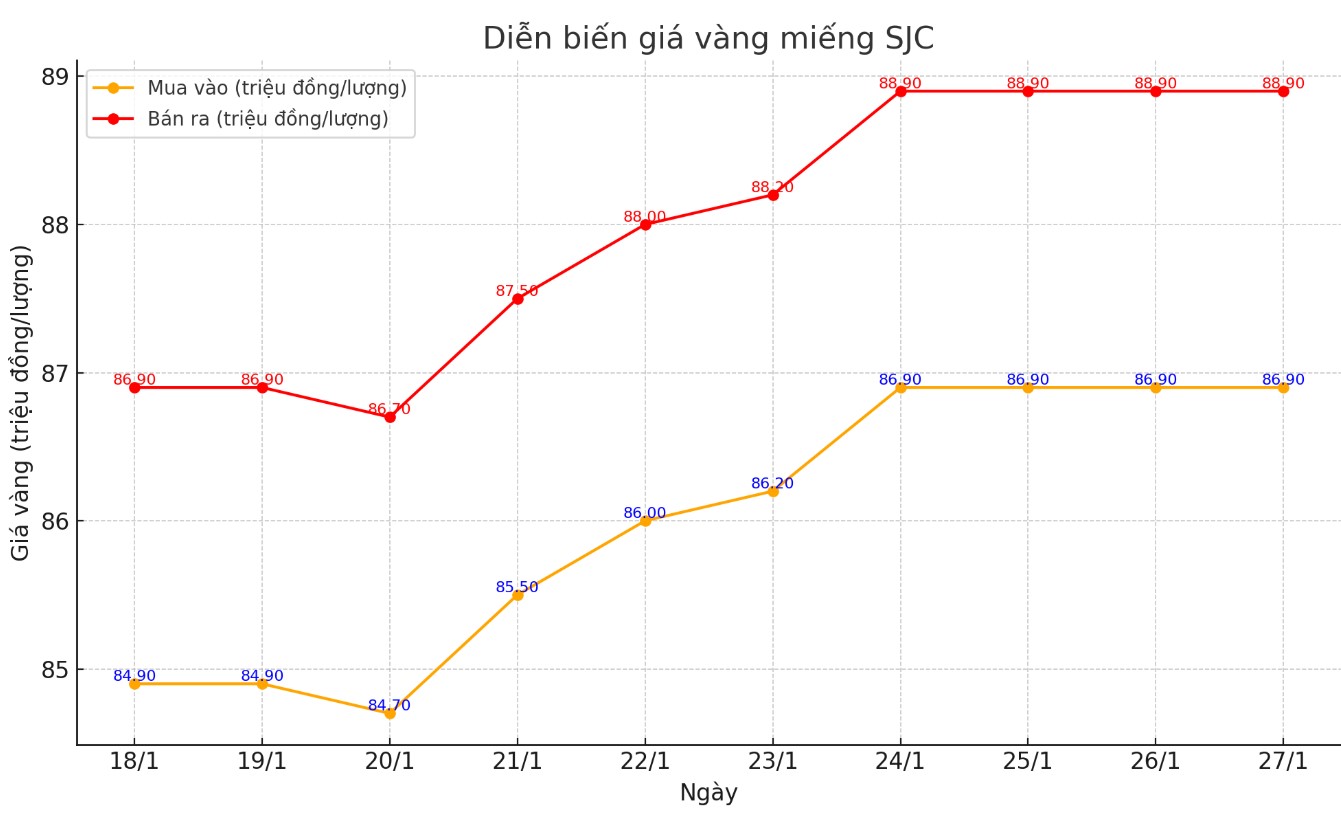

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND86.8-88.8 million/tael (buy - sell); both buying and selling prices remained unchanged compared to the beginning of the previous trading session.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Meanwhile, DOJI Group listed the price of SJC gold at 86.9-88.9 million VND/tael (buy - sell); both buying and selling prices remained unchanged compared to the beginning of the previous trading session.

The difference between buying and selling price of SJC gold at DOJI Group is at 2 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 86.9-88.9 million VND/tael (buy - sell); increased by 100,000 VND/tael for both buying and selling compared to the beginning of the previous trading session.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

Price of round gold ring 9999

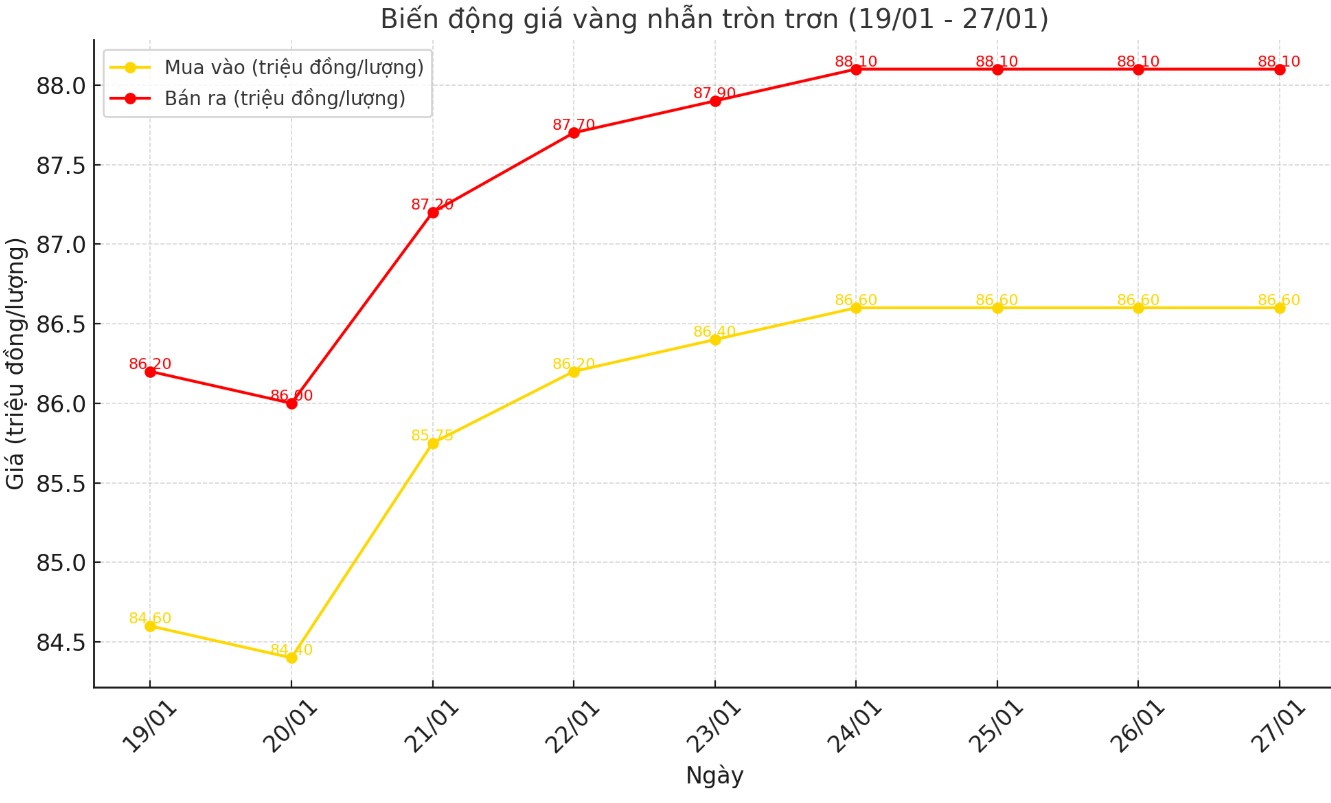

As of 6:00 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 86.6-88.1 million VND/tael (buy - sell); both buying and selling prices remain the same compared to the beginning of the trading session yesterday morning.

Bao Tin Minh Chau listed the price of gold rings at 86.6-88.9 million VND/tael (buy - sell), keeping both buying and selling prices unchanged compared to early this morning.

World gold price

As of 6:00 a.m. on January 27, the world gold price listed on Kitco was at 2,770.8 USD/ounce, unchanged from early this morning.

Gold Price Forecast

World gold prices are anchored high amid a decline in the USD index. Recorded at 6:00 a.m. on January 27, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 107.250 points (down 0.57%).

According to Kitco - President Trump's aggressive trade policies have attracted great interest from investors, thanks to gold's strategic role in offsetting the impact of rising inflation.

Gary Wagner, a commodities broker and market analyst, told Kitco that Trump’s initial policy actions were characterized by a series of bold executive orders, including proposed tariffs, immigration reform and withdrawals from international agreements. These actions had a ripple effect in financial markets, especially in how investors viewed inflation hedges and safe-haven assets.

Goldman Sachs analysts predict that this inflationary pressure could significantly boost investment demand for gold. As import costs rise and consumer prices climb, investors are likely to allocate more capital to gold as a financial hedge.

Geopolitical uncertainty also adds to the appeal of gold. Trump’s assertive foreign policy approach has made gold an attractive safe-haven asset. Investors are closely watching the correlation between inflation trends and potential moves by the US Federal Reserve.

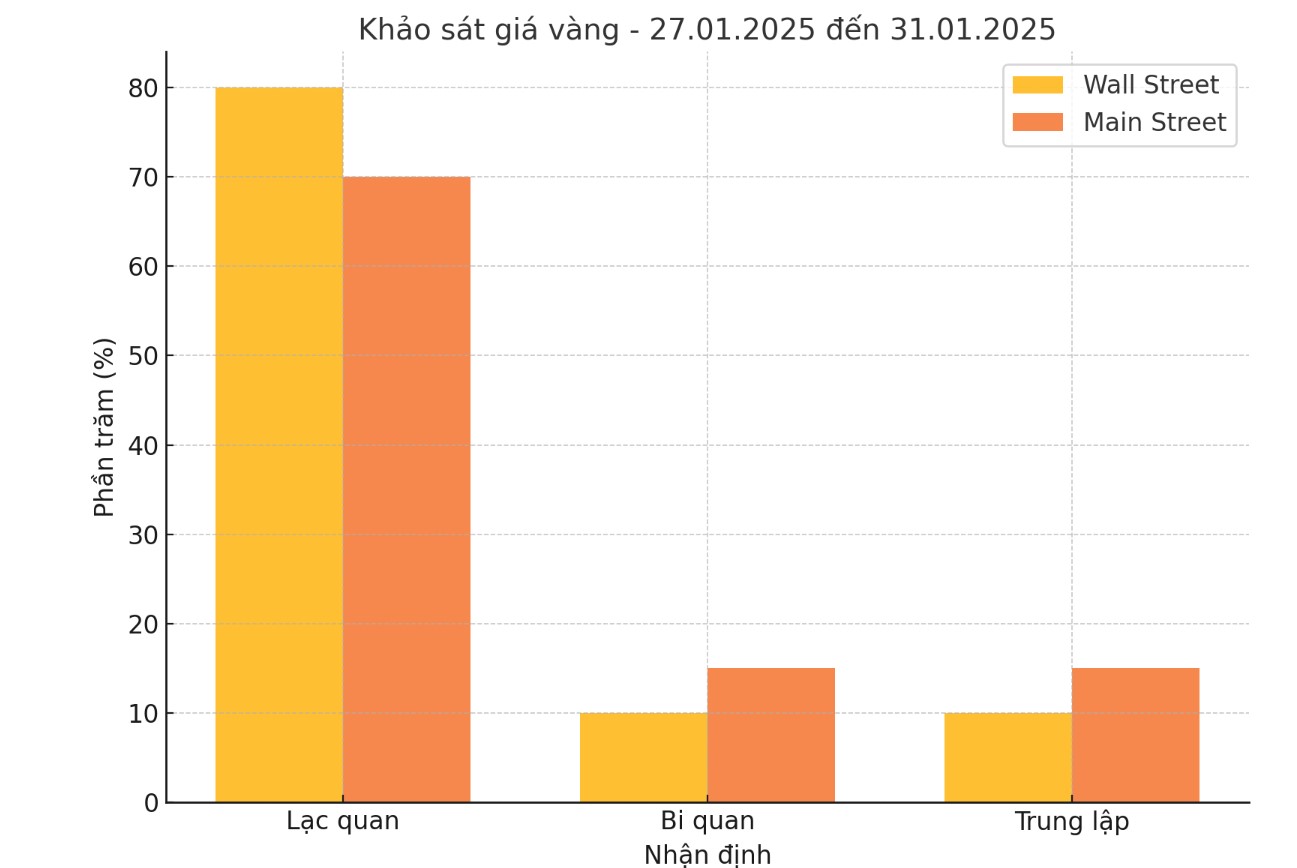

The latest Kitco News survey shows that industry experts are extremely bullish on gold prices, with retail investors also increasing their confidence in the precious metal's ability to re-establish record highs.

Ten analysts participated in the Kitco News gold survey. Eight (80%) expect gold prices to rise next week, while one (10%) expects prices to fall and another sees a sideways trend in the short term.

Meanwhile, 169 votes were cast in Kitco’s online poll. 118 retail traders (70%) predicted gold prices would rise next week, while 25 (15%) said they expected gold prices to fall. The remaining 26 (15%) predicted gold prices would fluctuate sideways in the coming period.

See more news related to gold prices HERE...