SJC gold bar price

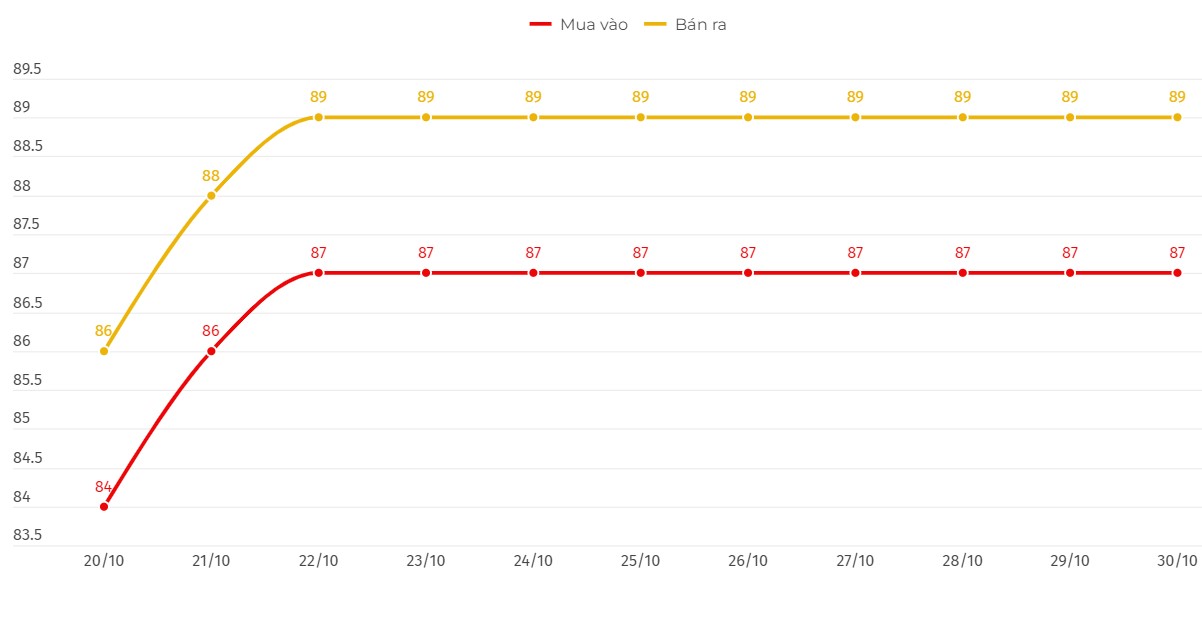

As of 6:00 a.m. on October 30, the price of SJC gold bars listed by DOJI Group was at 87-89 million VND/tael (buy - sell).

Compared to the close of the previous trading session, gold prices at DOJI remained unchanged in both buying and selling directions.

The difference between buying and selling prices of SJC gold at DOJI Group is at 2 million VND/tael.

Meanwhile, Saigon Jewelry Company listed the price of SJC gold at 87-89 million VND/tael (buy - sell).

Compared to the previous trading session, the gold price at Saigon Jewelry Company SJC remained unchanged in both buying and selling directions.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Currently, the difference between buying and selling gold prices is listed at around 2 million VND/tael. Experts say that this difference is very high, causing investors to face the risk of losing money when investing in the short term.

9999 gold ring price

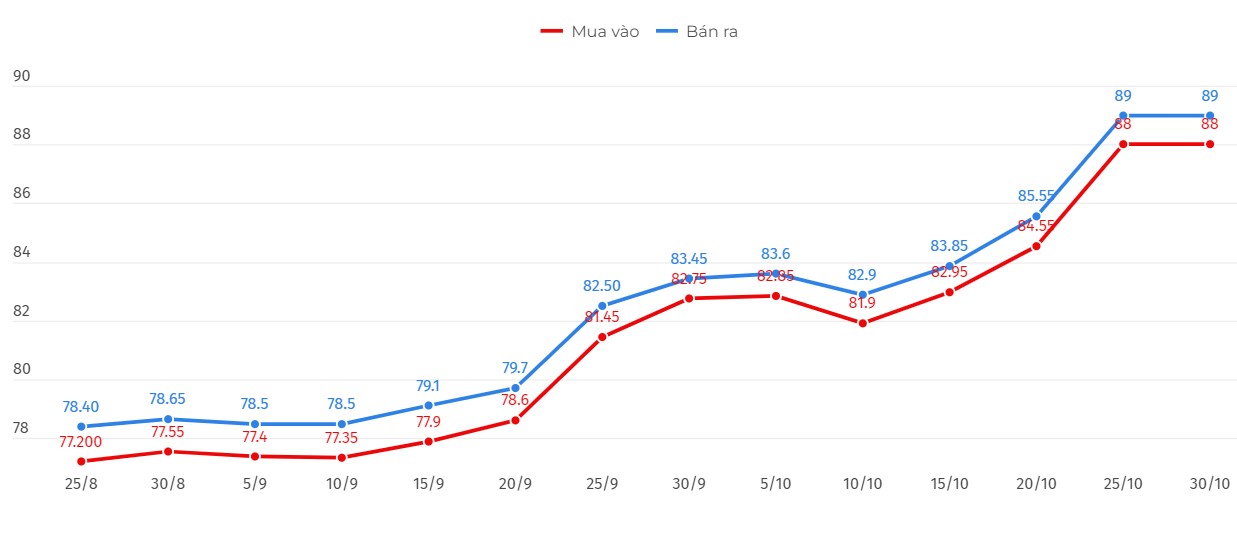

As of 6:00 a.m. on October 30, the price of 9999 Hung Thinh Vuong round gold rings at DOJI was listed at VND 88-89 million/tael (buy - sell); an increase of VND 300,000/tael in both directions compared to the beginning of the previous trading session.

Bao Tin Minh Chau listed the price of gold rings at 87.98-88.98 million VND/tael (buy - sell); an increase of 100,000 VND/tael for both buying and selling compared to the beginning of the previous trading session.

This is the highest price ever for gold rings. In recent sessions, gold ring prices have often fluctuated in the same direction as the world market.

In the context of the world gold price increasing sharply, the domestic plain gold ring price may soon be adjusted to increase sharply.

World gold price

As of 1:20 a.m. on October 30, the world gold price listed on Kitco was at 2,770.8 USD/ounce, a sharp increase of 29.9 USD/ounce compared to the beginning of the previous trading session.

Gold Price Forecast

World gold prices increased despite the increase in the USD index. Recorded at 1:20 a.m. on October 30, the US Dollar Index, which measures the fluctuations of the greenback against 6 major currencies, was at 104.245 points (up 0.06%).

Today’s key outside markets saw the USD index edge up slightly; Nymex crude oil futures edged lower and traded around $67/bbl.

The yield on the benchmark 10-year U.S. Treasury note is currently at 4.324%. U.S. bond yields have been rising recently. The Wall Street Journal reported that concerns about the growing U.S. federal deficit are helping to push bond yields up.

Investors “are betting that the challenging financial situation is only likely to get worse after the election,” the report said.

The fact that gold prices are anchored to record highs despite a strong US dollar and rising Treasury yields could also be due to safe-haven demand related to the possibility of further increases in US government debt.

Technically, December gold bulls have the strong overall near-term technical advantage. Prices are in a four-month uptrend on the daily chart.

The next upside price objective for the bulls is to create a close above $2,800/oz. The next near-term downside price objective for the bears is to push futures below $2,700/oz.

Gold prices hit an all-time high as US consumer confidence rose to 108.7 in October, according to Ernest Hoffman, market analyst at Kitco News.

Meanwhile, Ole Hansen - Head of Commodity Strategy Division at Saxo Bank said that information about US politics is the driving force for new safe-haven demand across commodity markets.

See more news related to gold prices HERE...