Update SJC gold price

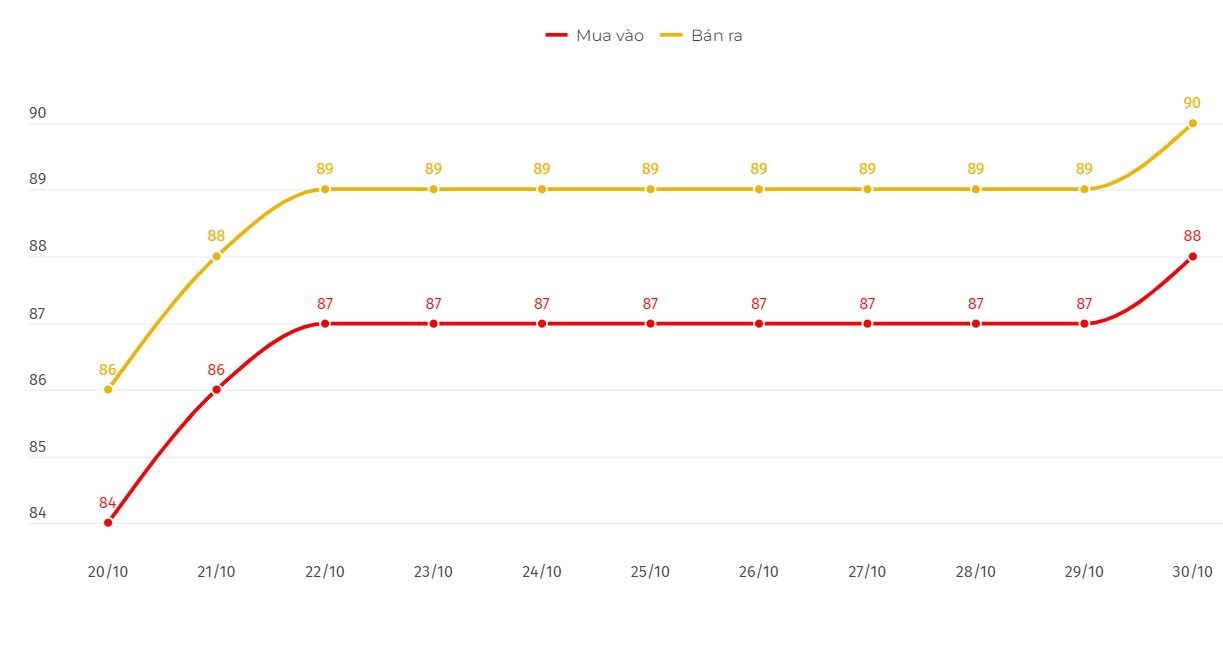

As of 6:20 p.m., the price of SJC gold bars was listed by DOJI Group at 88-90 million VND/tael (buy - sell).

Compared to the previous trading session, gold price at DOJI increased by 1 million VND/tael for both buying and selling.

The difference between buying and selling prices of SJC gold at DOJI Group is at 2 million VND/tael.

Meanwhile, Saigon Jewelry Company listed the price of SJC gold at 88-90 million VND/tael (buy - sell).

Compared to the previous trading session, the gold price at Saigon Jewelry Company SJC increased by 1 million VND/tael for both buying and selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Currently, the difference between buying and selling gold prices is listed at around 2 million VND/tael. Experts say that this difference is very high, causing investors to face the risk of losing money when investing in the short term.

Price of round gold ring 9999

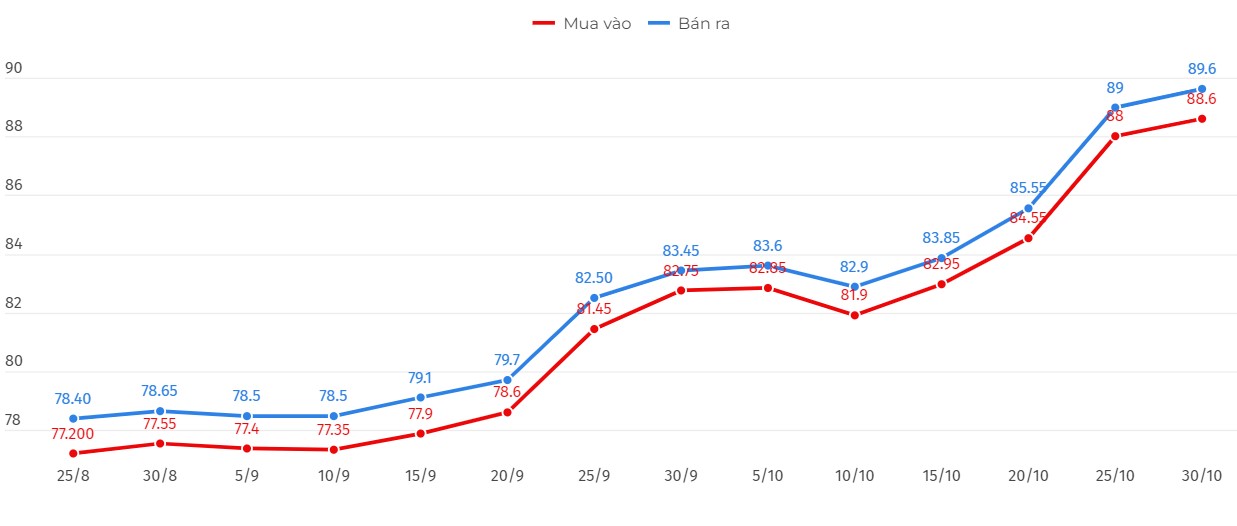

As of 6:00 p.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 88.6-89.6 million VND/tael (buy - sell); an increase of 600,000 VND/tael in both directions compared to the close of the previous trading session.

Bao Tin Minh Chau listed the price of gold rings at 88.58-89.58 million VND/tael (buy - sell); an increase of 600,000 VND/tael for both buying and selling compared to the close of the previous trading session.

World gold price

As of 7:20 p.m., the world gold price listed on Kitco was at 2,780.7 USD/ounce, up more than 28 USD/ounce compared to the close of the previous trading session.

Gold Price Forecast

World gold prices increased as the USD index cooled down. Recorded at 6:05 p.m. on October 30, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 104.077 points (down 0.1%).

According to Kitco, the world gold price is rising vertically, breaking new records in the context of many major events. Political conflicts, interest rate adjustments by the US Federal Reserve (FED), continued strong demand from global central banks and uncertainty about the outcome of the upcoming US presidential election and the possibility of additional fiscal stimulus measures are the main ingredients driving the gold price higher.

Safe-haven demand is keeping a floor for the precious metal ahead of key U.S. economic data later this week and next week’s U.S. presidential election, said Jim Wyckoff, senior analyst at Kitco. Technical buying in gold is also taking place amid bullish charts.

"The big US jobs report on Friday and then the US election next week have the market focused on now. That anxiety is supporting demand for gold - an item always considered a safe haven" - Jim Wyckoff said.

Notably, TD Securities commodity strategist Daniel Ghali said that gold is certain to hit $2,800 an ounce this week. According to him, the elections are hampering selling demand, so any catalyst for increased buying will have a significant impact on prices.

Economic Data to Watch This Week

Wednesday: ADP jobs data, third-quarter GDP and US pending home sales. Bank of Japan monetary policy decision.

Thursday: Core PCE, Personal Income and Spending and US Weekly Jobless Claims.

Friday: US non-farm payrolls and manufacturing PMI gauges the health of economic activity in the manufacturing sector.