Experts predict more cautious

Last week, a survey by Kitco News with 14 experts showed that 71%, (10 people) predicted gold prices would increase, with 14% (2 people) saying prices would decrease and the remaining 14% saying that gold would go sideways.

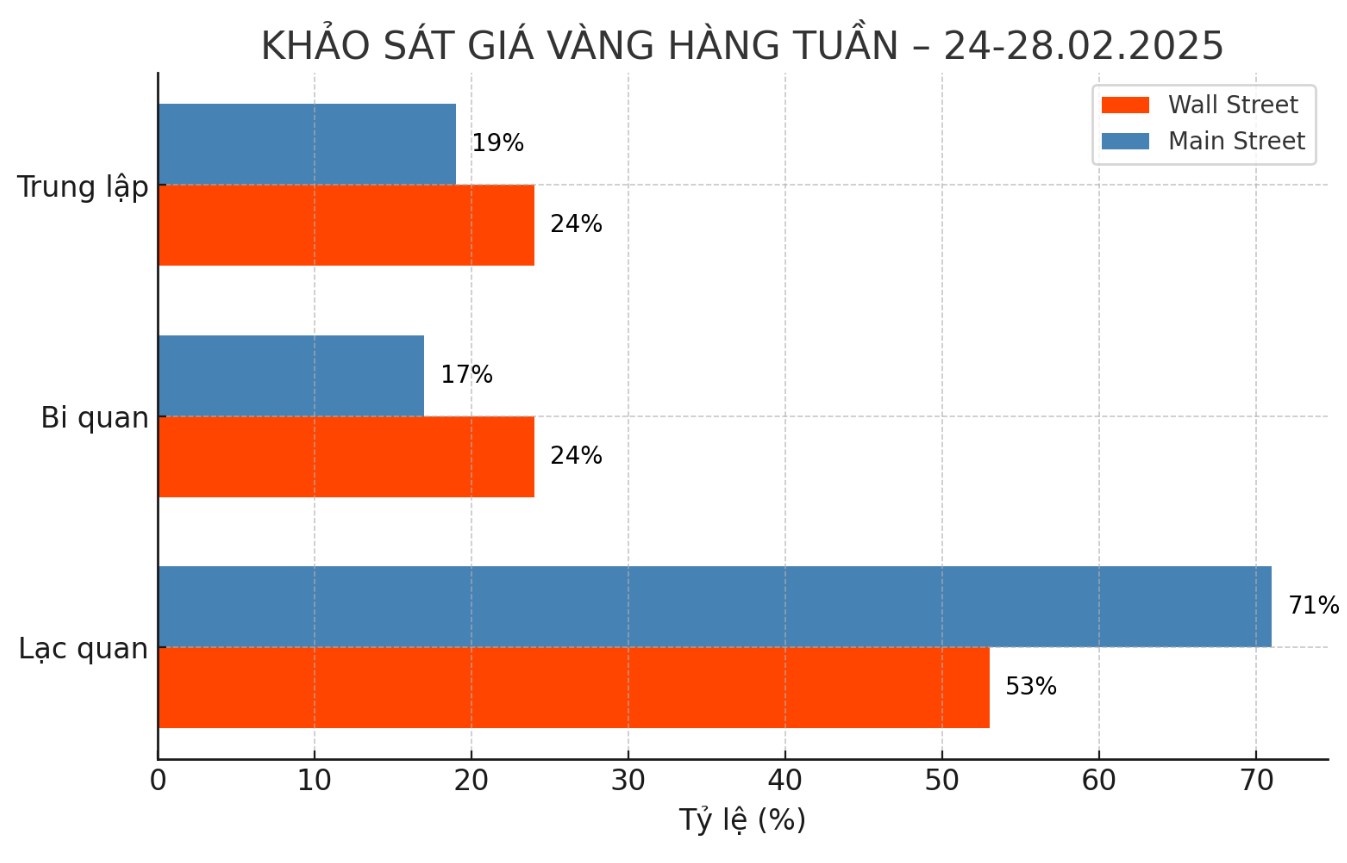

This week, the latest survey with 17 experts shows that optimism on Wall Street is showing signs of being contained. Only 53% (9 people) predict gold prices will increase. The percentage of experts who believe that prices will decrease and go sideways will reach 24% (4 people per group).

This change shows that the level of optimism has decreased compared to last week, when optimism dominated with more than 70% of the price increase forecast, and now analysts are more cautious in their assessment of the trend of the precious metal.

Meanwhile, Kitco's online survey shows clear signs of positive change in the sentiment of individual investors towards gold prices.

In last week's survey with 201 votes, 65% of traders expect gold prices to increase next week, while 24% predict prices will decrease and 11% believe that gold will only move sideways in the short term.

By this week, of the 204 survey participants, 71%, investors predict gold prices will increase, only 17% think prices will decrease and 13% say prices will go sideways.

Experts predict price increase

James Stanley - senior strategist at Forex.com predicted gold prices will increase: "Buying has not shown any signs of slowing down and this week continues to be a strong candle on the weekly chart. I think there is a high chance that gold will reach $3,000/ounce in the near future, but there may also be a big change around that level."

Rich Checkan - chairman and CEO of Asset Strategies International commented that gold could soon test the $3,000/ounce mark due to the uncertainty in the market and geopolitics: "I believe that next week prices will continue to approach this threshold".

Barbara Lambrecht from Commerzbank remains optimistic about gold next week: "Gold is benefiting from instability, with prices continuously setting new peaks. The $3,000/ounce mark is getting closer and likely to be reached soon."

Lukman Otunuga - head of market analysis at FXTM believes that a weak USD could push gold prices to new highs: "If the USD continues to be pressured next week, this could boost gold's rally - bringing the dream of $3,000/ounce closer to reality".

Sean Lusk - co-head of commercial risk prevention at Walsh Trading commented: "There may not be much too new in the overall picture, but gold is still supported quite well. The USD is rising, but shows signs of slowing down."

Lusk also emphasized: "I think there is too much uncertainty, and that is why gold has skyrocketed and set a new peak in the past two months, because no one knows where it will go. A 10% increase in just the first half of a financial quarter is a fairly fast pace, but not unprecedented."

Jim Wyckoff - senior analyst at Kitco expects gold prices to continue to increase in the short term: "Gold will increase due to safe-haven demand and positive technical factors will create a solid foundation for the gold market".

Experts predict prices will decrease

Adrian Day - chairman of Adrian Day Asset Management believes that gold prices will decrease: "The increase in gold in the past two months has far exceeded the usual trend, so there may be a correction. However, I think this decline will be short and insignificant. The reasons for investors to buy gold are still there, while North American investors are not yet taking a strong stance."

Marc Chandler - CEO of Bannockburn Global Forex warned about the possibility of a short-term correction: "Gold hit a record high of nearly 2,955 USD/ounce on February 20. However, technically, it is starting to show signs of being easily adjusted down. The increase of more than 13% since the beginning of the year may make investors hesitate and slow down their buying momentum".

Experts predict prices will remain stable

"I am neutral on gold this week," said Colin Cieszynski, strategist at SIA Wealth Management. I think gold is still absorbing the gains of recent weeks."

Adam Button - head of currency strategy at Forexlive.com maintains a neutral view on gold: "Gold may have another increase to $3,000/ounce, but the current risk - profit is not attractive enough to open new buy orders"