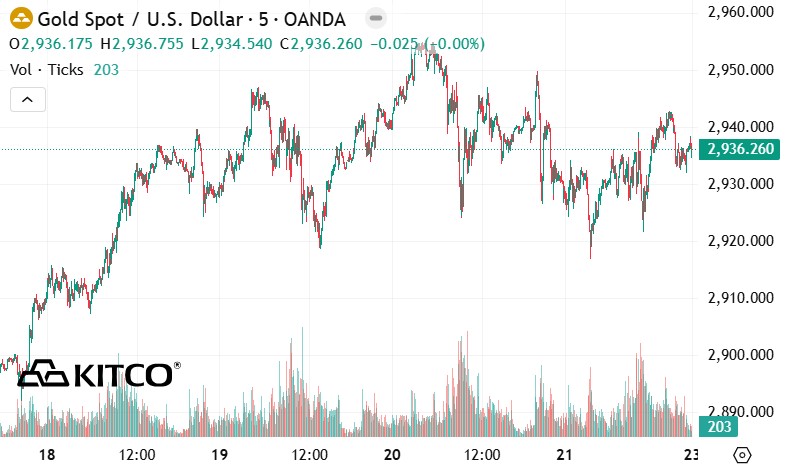

Gold prices are rising steadily, what will happen after the $3,000/ounce mark?

The gold market has just had an explosive week as prices set a new record, marking a series of consecutive increases for eight weeks. With this increase, analysts said that it is only a matter of time before prices reach the $3,000/ounce mark.

Neils Christensen - an analyst at Kitco News raised the question: "The question is, what will happen next? The $3,000/ounce level has become an important psychological threshold, meaning that prices may face strong resistance when investors take profits.

The gold market has had a rally that has lasted for more than a year, easily overcoming resistance levels. However, if we look back at history, we can see similar strong price increases".

According to Neils Christensen, gold also had a big rally in 2020 and reached $2,000/ounce for the first time. Despite strong momentum, it took four years and three challenges for this price to really break.

"Another example was in 2008, when gold prices entered a three-year cycle of increase and peaked above $1,900/ounce in 2011. But by 2013, gold prices fell into the market and it took 5 years to accumulate.

Not to reduce investor excitement, but it is important to manage expectations properly" - Neils Christensen said.

Mining industry is booming but is underrated

Neils Christensen believes that while gold may enter the accumulation phase, the new gold mining industry is the more notable area.

The profit reporting season of mining companies is taking place and the results are very impressive. The whole industry is operating at full capacity as manufacturers announce strong output in the context of high gold prices.

In fact, there are hardly enough words to describe the impressions of some companies in the fourth quarter of 2024. Thursday, Newmont Corp. - the world's largest gold mining company announced a 115% increase in free cash flow compared to last year, with profits far exceeding expectations.

Although the gold mining industry is gradually attracting the attention of investors, the valuation is still very low. VanEck Gold Miners portfolio exchange-traded fund (NYSE: GDX) has yet to return to its peak in 2011. Gold prices have now risen $1,000 an ounce from their historical high in 2011, but mining companies still have difficulty mobilizing capital because the market has not paid enough attention.

According to many analysts, if investors want to seek value in the precious metals sector, they should pay attention to gold mining companies.

Upcoming economic events affect gold prices

Sunday: Election in Germany.

Tuesday: US consumer confidence.

Wednesday: New home sales in the US.

Thursday: US Q4 preliminary GDP, US long-term goods orders, US weekly jobless claims, US pending home sales.

Friday: US core PCE index, personal income and spending.