$3,500/ounce could be the peak of gold prices

Disappointing economic data has pushed gold prices to a four-week high. However, according to a market strategist, the historical peak of 3,500 USD/ounce in April could be the limit for gold prices, at least for now.

Carley Garner - co-founder of brokerage firm DeCarley Trading - said that although she is currently neutral on gold, she is waiting to sell when the price is higher.

Carley Garner's assessment was made in the context of gold attracting strong buying power thanks to safe-haven demand, stemming from economic and geopolitical instability. Although she believes gold is still an attractive asset in the long term, this precious metal has increased too quickly and too far.

Ive been through many cycles of gold, and this time its got me thinking something is not right. I know there are many reasons to explain why gold prices will continue to increase, but I have witnessed this scenario many times and I know what the outcome will be. I don't believe that bigger macro factors are still reflected in prices," she said.

Garner also opened her counter-examination to the US dollar and US Treasury bonds, saying both assets are currently being over-sold. She noted that speculative positions in the futures and options market are at historical pessimism for both the US dollar and long-term bonds.

If you look at the charts, you will see that every time the pessimism towards the US dollar reaches its current level, it then increases strongly. And that will eventually be a disadvantage for gold, she said.

On Treasury bonds, Garner said that despite sharp fluctuations in 10-year yields recently, the stability of the US economy still makes bonds an attractive safe-haven asset.

Although yields rose last month after Moody's downgraded US national debt credit from Aaa to Aa1 due to government spending, Garner said investors are reacting too emotionally to the current public debt level.

Another risk for gold from bonds is that if yields continue to increase, the US Federal Reserve (FED) may be forced to buy long-term bonds. Although this environment supports the long-term upward trend of gold, it has caused strong price fluctuations in the short term.

Not only Carley Garner, before that, Mark Leibovit - founder of VR Metals/Resource Letter news agency felt that gold may have made a short-term peak. "The upcoming risk is that prices could fall to the $2,900/ounce zone," he said.

Gold still plays a good role as a safe haven

Expert Zain Vawda - market analyst at OANDA on June 4 made many important comments on the gold price trend. He said gold prices remained stable as trade tensions between the US and China still caused investors to seek gold as a safe haven.

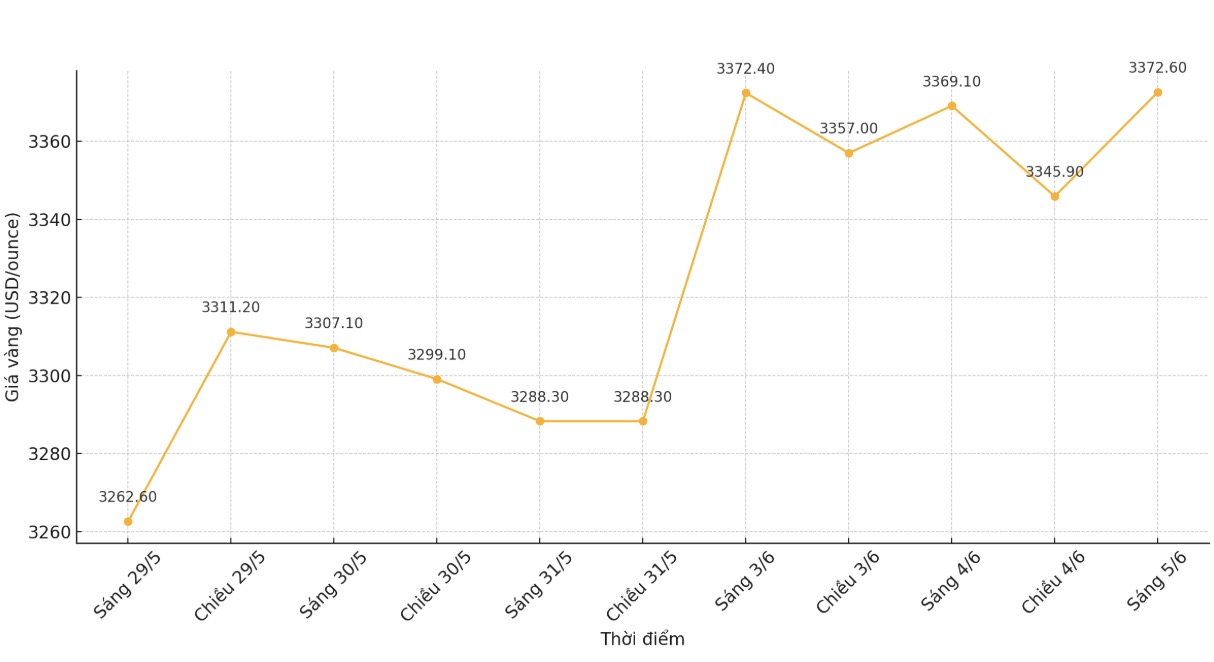

Previously, in early May 2025, Zain Vawda assessed that gold prices were under pressure when market risk sentiment improved, causing the precious metal to slide out of important support zones and trade near the lowest level in two weeks. However, by mid-May 2025, he recorded gold bouncing sharply due to weak US economic data and a weakening USD, helping gold surpass the threshold of 3,200 USD/ounce. He believes that in the short term, gold prices will fluctuate between 3,300 and 3,400 USD/ounce, depending on global economic and geopolitical developments.