Updated SJC gold price

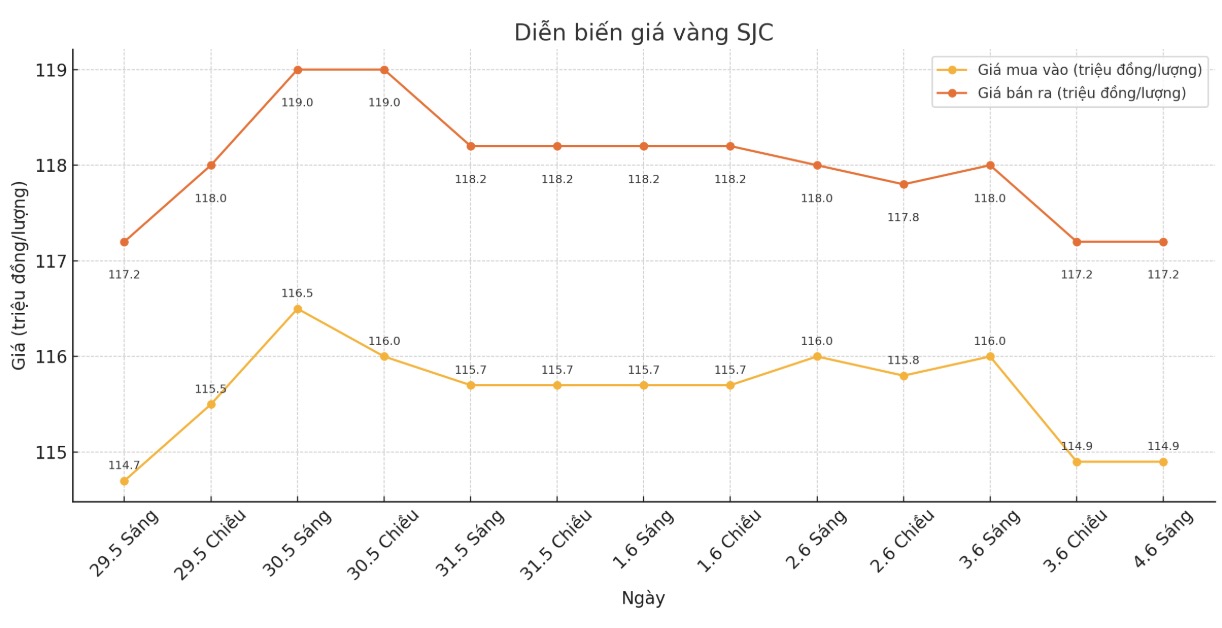

As of 9:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND 114.9-117.2 million/tael (buy - sell), down VND 1.1 million/tael for buying and down VND 800,000/tael for selling. The difference between buying and selling prices is at 2.3 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 114.9-117.2 million VND/tael (buy - sell), down 1.1 million VND/tael for buying and down 800,000 VND/tael for selling. The difference between buying and selling prices is at 2.3 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 114.9-117.2 million VND/tael (buy - sell), down 1.1 million VND/tael for buying and down 800,000 VND/tael for selling. The difference between buying and selling prices is at 2.3 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at VND 114.4-117.2 million/tael (buy - sell), down VND 1.1 million/tael for buying and down VND 800,000/tael for selling. The difference between buying and selling prices is at 2.8 million VND/tael.

9999 round gold ring price

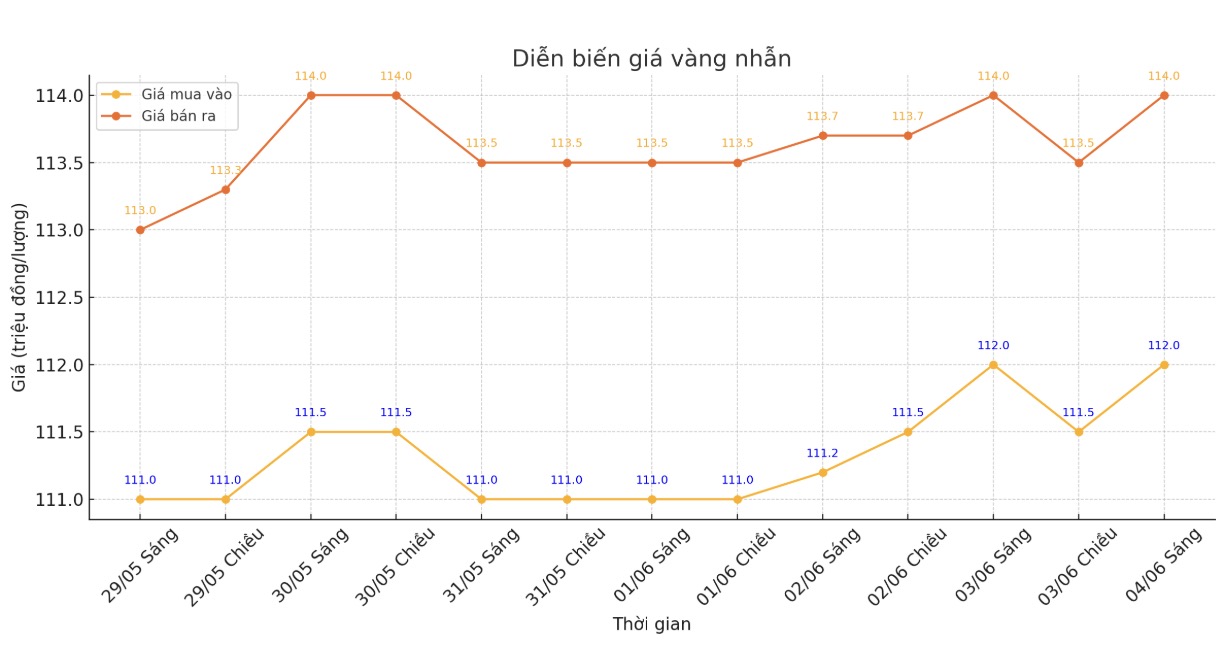

As of 9:00 a.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 112-114 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 113.2-116.2 million VND/tael (buy - sell), down 600,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 111.2-124.2 million VND/tael (buy in - sell out), down 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

World gold price

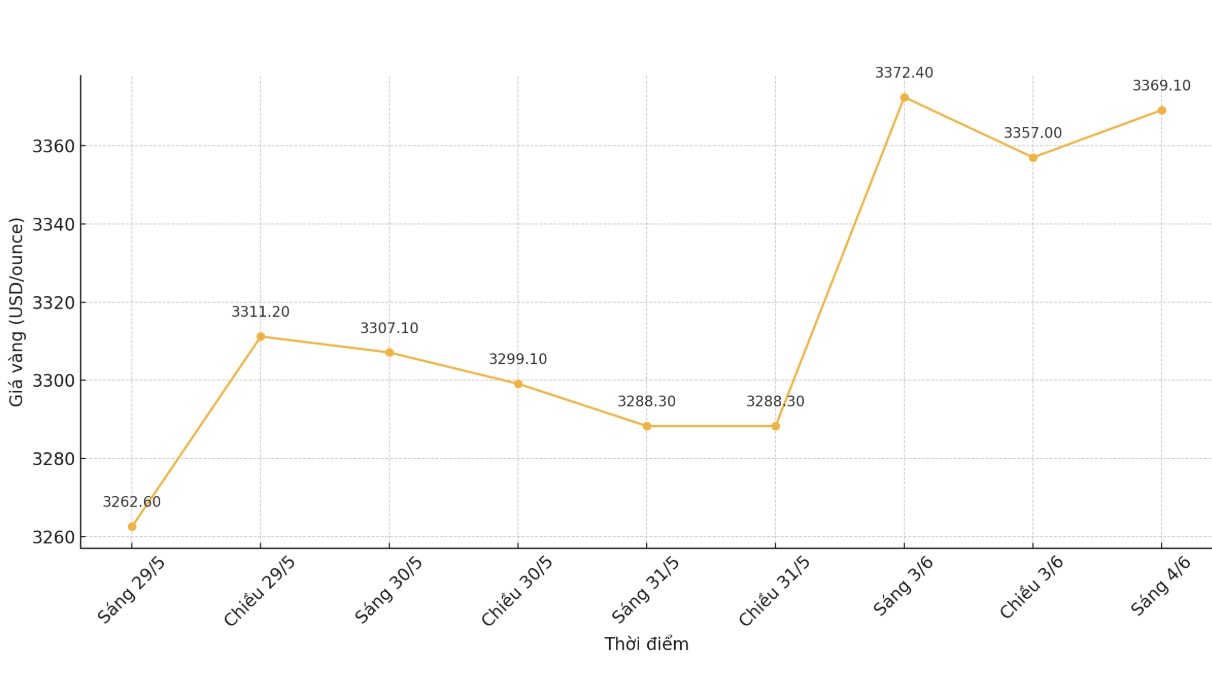

At 9:05, the world gold price listed on Kitco was around 3,369.1 USD/ounce, down 3.3 USD.

Gold price forecast

World gold prices fell after soaring in the first trading session of the week due to profit-taking pressure and the USD recovered.

Some analysts believe that gold may continue to face obstacles, as the latest employment data shows a fairly resilient labor market. The US Federal Reserve (FED) has reiterated that it is in no rush to cut interest rates, as inflationary pressures remain high and the labor market remains relatively healthy.

Investors are paying attention to the US non-farm payroll report, due out on Friday (June 5). This report is expected to provide clearer signals about the economic trajectory and upcoming decisions of the FED,

In another development, the World Gold Council (WGC) report released on Tuesday showed that global central banks net bought 12 tonnes of gold in April - down 12% from the previous month and 28 tonnes lower than the 12-month average.

Mr. Krishan Gopaul, senior EMEA analyst at WGC, commented: "What could be behind the recent decline in monthly purchases? Partly because gold prices have increased rapidly since the beginning of this year.

Although continued increases to record highs are unlikely to stop central banks from buying gold, as they often have long-term strategies, this may partly explain the decline in monthly net buying.

This expert noted that the data fluctuates very strongly every month, so activities in one month do not necessarily reflect the following months. In addition, the data is sometimes delayed.

"Therefore, we recommend not to rush to conclusions from the recent stagnation. Although high prices may cause the proportion of gold in some reserve portfolios to reach near targets, we still expect the buying trend to continue, as the economic and geopolitical prospects are still uncertain, he said.

Technically, August gold buyers still dominated in the short term. The next upside target for buyers is to close above $3,450/ounce. In contrast, the short-term target for the bears is to push prices below $3,200/ounce.

The first resistance level is 3,400 USD/ounce, followed by 3,417.8 USD/ounce. First support was $3,350/ounce, followed by a weekly low of $3,319.4/ounce.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...