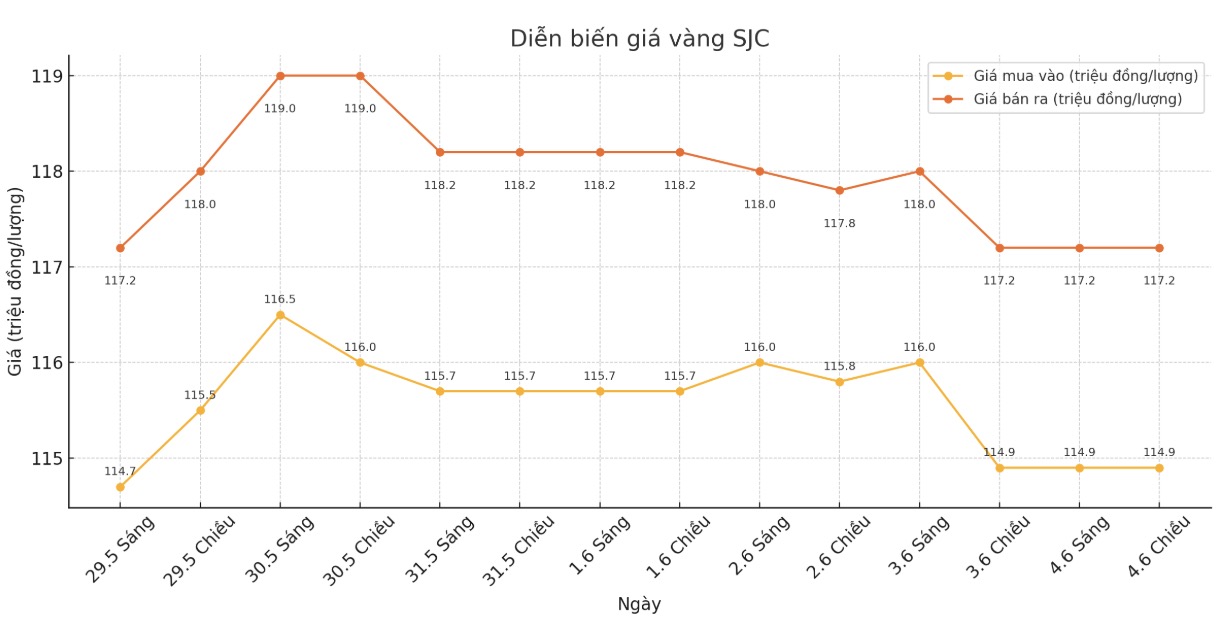

SJC gold bar price

As of 5:30 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND114.9-117.2 million/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 2.3 million VND/tael.

At the same time, the price of SJC gold bars listed by DOJI Group was at VND 114.9-117.2 million/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 2.3 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 114.9-117.2 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 2.3 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at VND 114.4-117.2 million/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 2.8 million VND/tael.

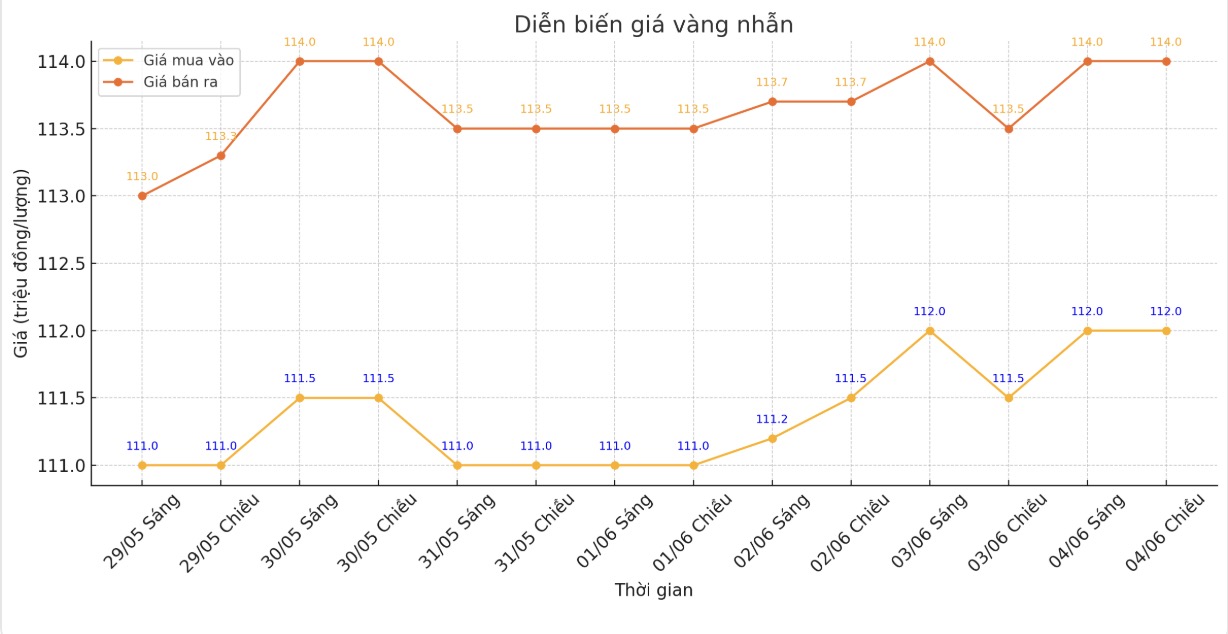

9999 gold ring price

As of 5:50 p.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at VND112-114 million/tael (buy in - sell out), an increase of VND500,000/tael for both buying and selling. The difference between buying and selling prices is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 113.2-116.2 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 111.2-124.2 million VND/tael (buy in - sell out), an increase of 200,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

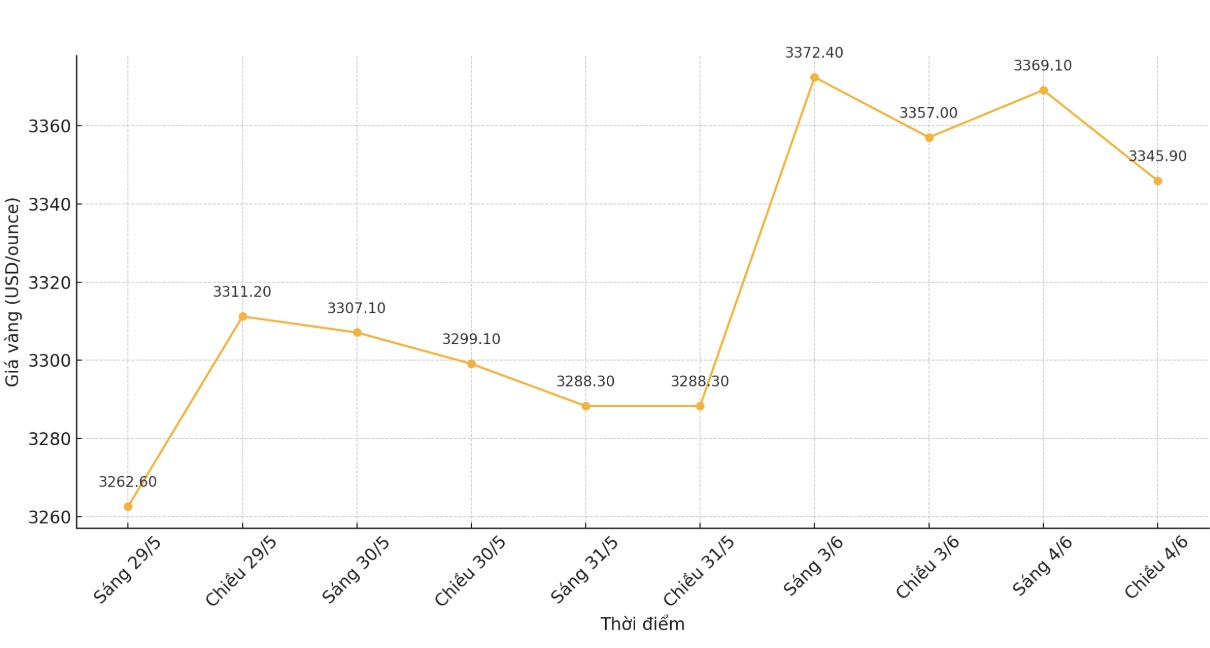

World gold price

The world gold price was listed at 5:52 p.m. at 3,345.9 USD/ounce, down 11.1 USD.

Gold price forecast

Although gold prices have declined, the pressure has eased as the US dollar weakened and trade tensions between the US and China continued to stagnate, boosting demand for safe-haven metals.

The $5.25 index, which measures the strength of the greenback against a basket of six other major currencies, fell 0.1%, making gold more attractive to investors holding other currencies.

Nitesh Shah - commodity strategist at WisdomTree commented: "I think we are seeing familiar concerns surrounding trade negotiations, not much progress and that makes the market more uncertain about what the final tax rate will be - that is the factor pushing gold prices up at the moment".

Donald Trump said on Wednesday that Chinese President Xi Jinping was tough and extremely unlikely to reach a deal, just days after he accused China of violating its pledge to lift tariffs and limit trade.

Washington has doubled tariffs on imported steel and aluminum on the same day, at a time when the Trump administration also expected trade partners to make Best Proposals to avoid other sanctions expected to come into effect in early July.

Investors are now paying attention to the US non-farm payrolls report released on Friday for further clues on the policy direction of the US Federal Reserve (FED). FED officials have repeatedly emphasized a cautious policy stance, citing risks from trade tensions and economic instability.

Commerzbank analyst Carsten Fritsch said: If the data is stronger than expected, expectations of a rate cut could decline, which will put pressure on gold prices. We expect gold to trade in the $3,300 to $3,400 an ounce range in the short term.

Gold, which is a safe haven asset in times of political and economic uncertainty, often benefits in a low interest rate environment.

In other precious metals, spot silver prices moved sideways at 34.49 USD/ounce, platinum increased by 1% to 1,084.8 USD/ounce while palladium decreased by 1.2% to 998.30 USD/ounce.

Notable economic data for the week

Wednesday: US ADP Employment Report, Bank of Canada monetary policy decision, US ISM Services Index.

Thursday: European Central Bank (ECB) monetary policy meeting, US weekly jobless claims.

Friday: US Non-farm Payrolls.

See more news related to gold prices HERE...