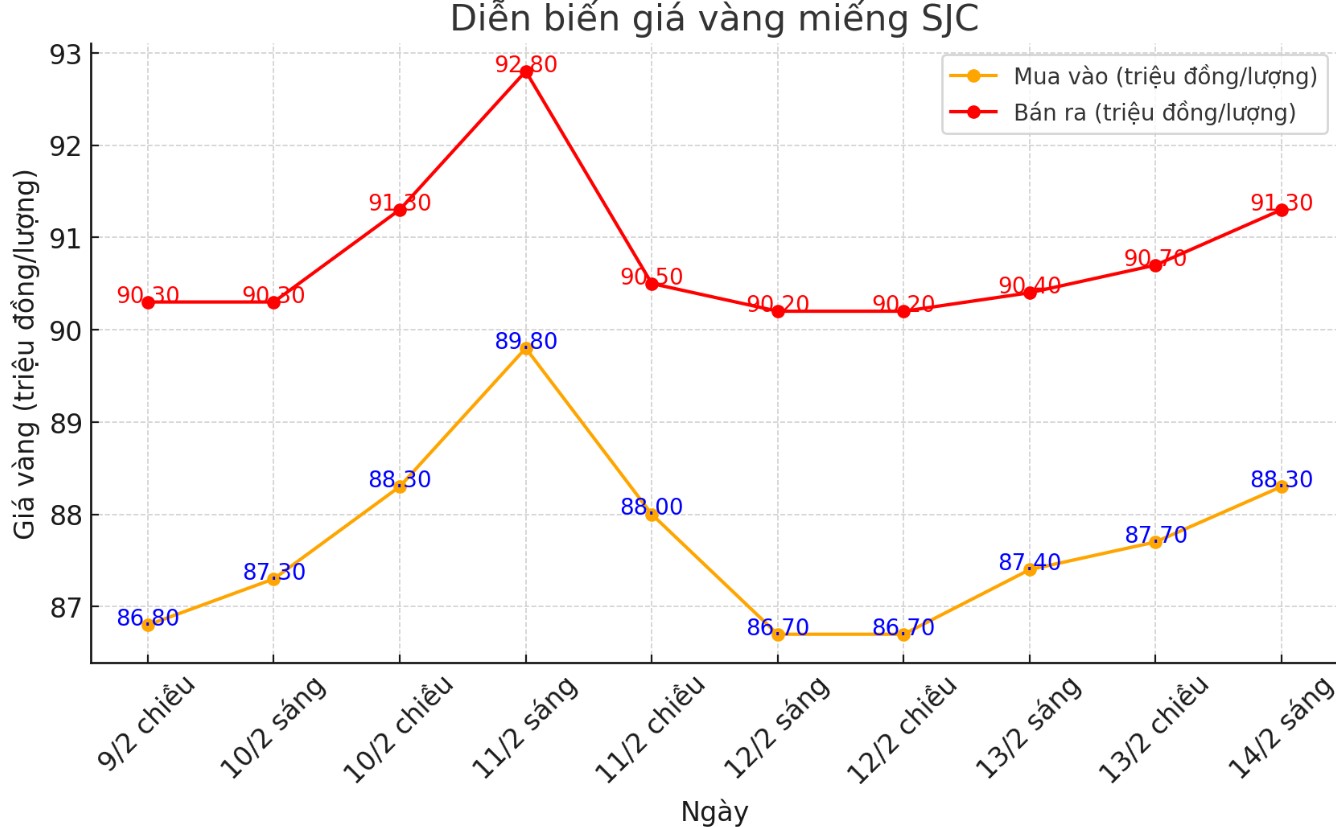

Updated SJC gold price

As of 9:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND 88.3-91.3 million/tael (buy in - sell out); increased by VND 900,000/tael for both buying and selling.

The difference between the buying and selling prices of SJC gold at Saigon Jewelry Company SJC is at 3 million VND/tael.

DOJI Group listed the price of SJC gold bars at 88.3-91.3 million VND/tael (buy - sell); increased by 900,000 VND/tael for both buying and selling.

The difference between the buying and selling prices of SJC gold at DOJI Group is at 3 million VND/tael.

At the same time, Bao Tin Minh Chau listed the price of SJC gold bars at 88.3-91.3 million VND/tael (buy - sell); increased by 900,000 VND/tael for both buying and selling.

The difference between buying and selling SJC gold at Bao Tin Minh Chau is at 3 million VND/tael.

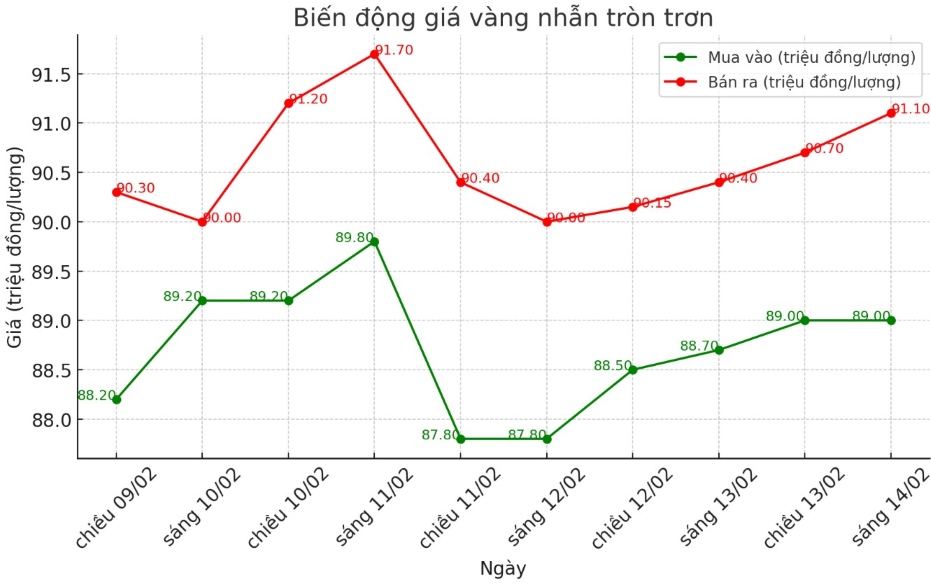

9999 round gold ring price

As of 9:00 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI was listed at 89-91.1 million VND/tael (buy - sell); an increase of 300,000 VND/tael for buying and an increase of 700,000 VND/tael for selling compared to early this morning.

The difference between buying and selling is at 2.1 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 89.3-91.3 million VND/tael (buy - sell), an increase of 700,000 VND/tael for buying and an increase of 950,000 VND/tael for selling compared to early this morning.

The difference between buying and selling is at 2 million VND/tael.

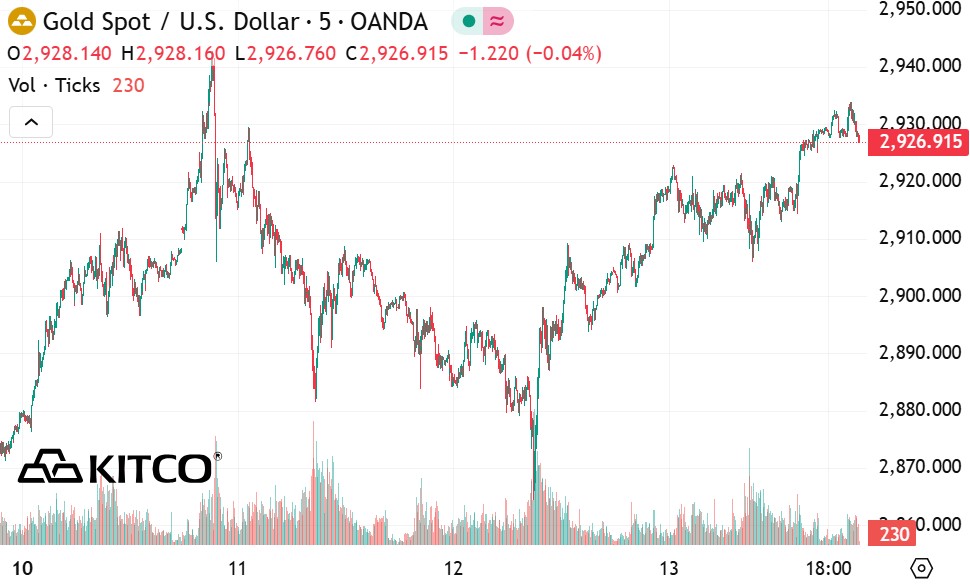

World gold price

As of 9:15 a.m., the world gold price listed on Kitco was at 2,926.9 USD/ounce, up 19.7 USD/ounce compared to the beginning of the previous trading session.

Gold price forecast

World gold prices increased in the context of the USD decreasing. Recorded at 9:15 a.m. on February 14, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 106.980 points (up 0.02%).

According to Kitco, gold has skyrocketed to a new all-time high today, with the busiest April futures currently trading at $2,958.4, up 1.02% after calculating a net gain of $29.7.

Although a weakening US dollar is the main driver for gold prices to move higher, this comes from two factors, including tax concerns and the January Producer Price Index (PPI) report.

Concerns continue to increase after US President Donald Trump's statement about imposing counterpart tariffs on countries that tax imports from the US. In addition, the US has just released the PPI index for January, showing that manufacturing prices increased by 0.4% this month.

In the latest analysis, strategist Daniel Ghali from TD Securities commented that history has proven that a strong USD often causes disadvantages for goods, including precious metals. However, this is no longer true in the current context.

"Gold is having an extremely strong set. As the US dollar strengthens, we see a surge in gold purchases from Asia, including central banks, retail investors, and financial funds, said Ghali.

Currently, those who bet on rising gold prices (by speculating prices) are dominating in the short term, as gold prices continue to trend upward on the daily chart. Their next target is to get gold prices above the important resistance level at $3,000/ounce. On the contrary, those who predict prices to fall (sell) want to pull prices below the strong support level at 2,800 USD/ounce.

See more news related to gold prices HERE...