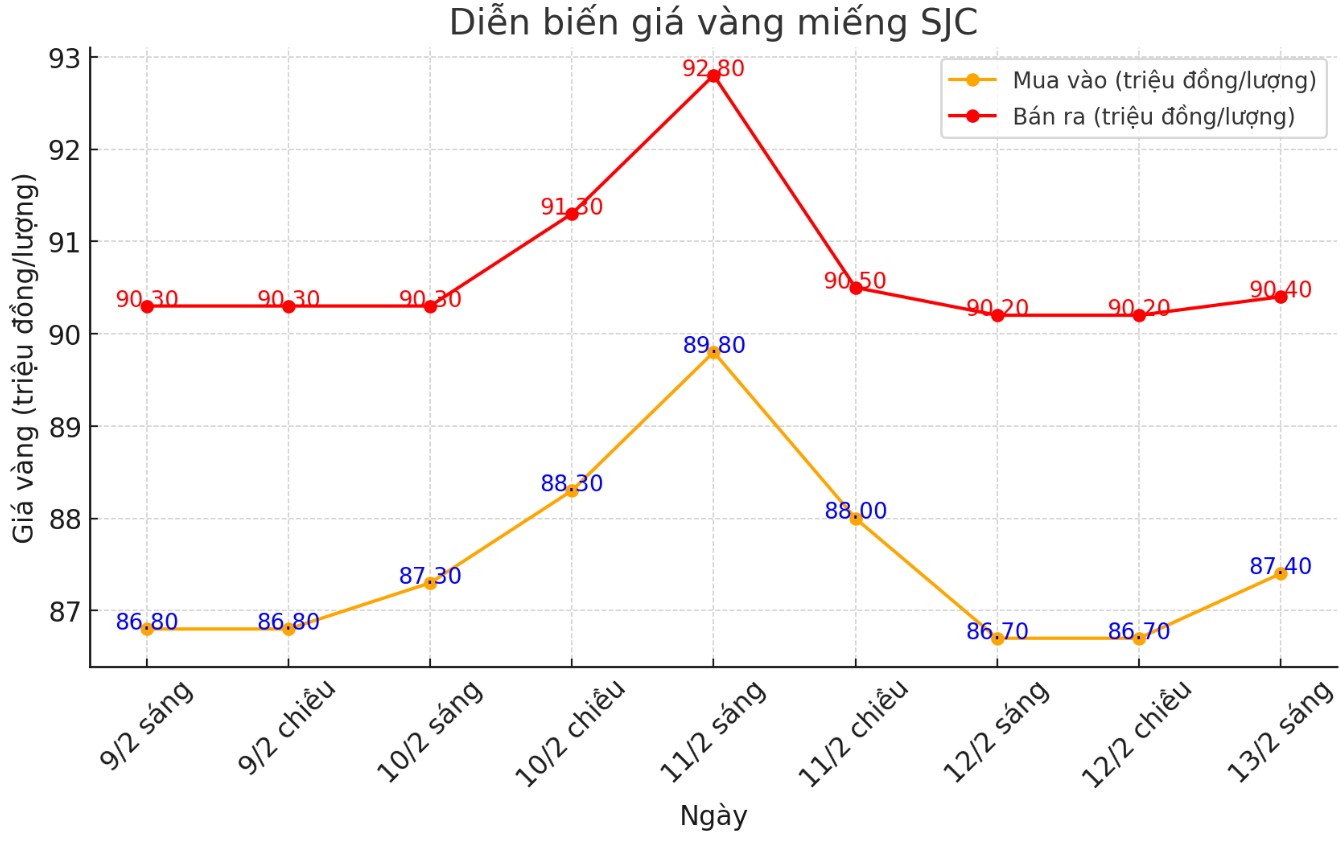

Update SJC gold price

As of 9:30 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND87.4-90.4 million/tael (buy - sell); an increase of VND700,000/tael for buying and VND200,000/tael for selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 3 million VND/tael.

Meanwhile, the price of SJC gold bars listed by DOJI Group is at 87.4-90.4 million VND/tael (buy - sell); an increase of 700,000 VND/tael for buying and an increase of 200,000 VND/tael for selling.

The difference between buying and selling prices of SJC gold at DOJI Group is at 3 million VND/tael.

At the same time, Bao Tin Minh Chau listed the price of SJC gold bars at 87.4-90.4 million VND/tael (buy - sell); an increase of 700,000 VND/tael for buying and an increase of 200,000 VND/tael for selling.

The difference between buying and selling SJC gold at Bao Tin Minh Chau is at 3 million VND/tael.

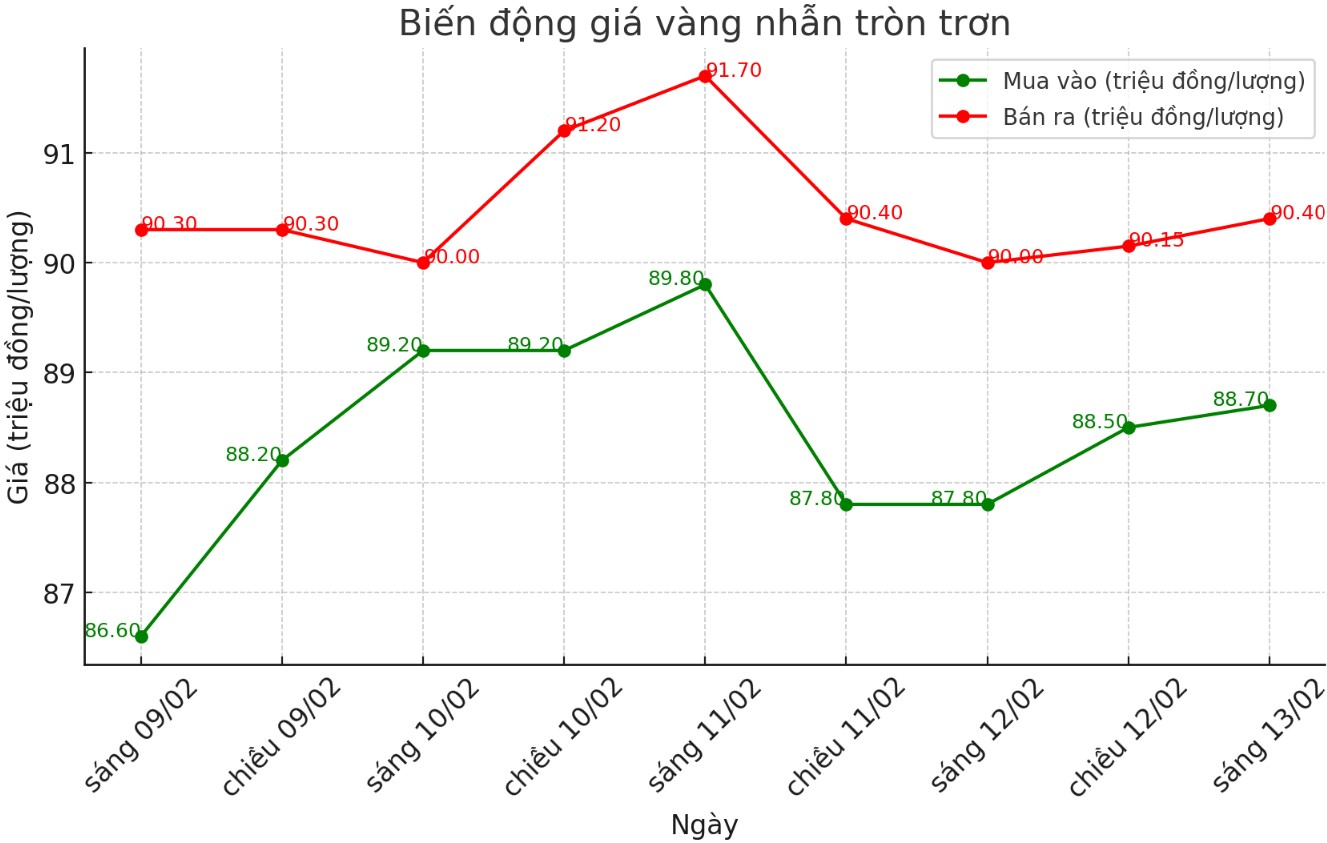

Price of round gold ring 9999

As of 9:00 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 88.7-90.4 million VND/tael (buy - sell); an increase of 900,000 VND/tael for buying and an increase of 400,000 VND/tael for selling compared to early this morning.

The difference between buying and selling prices increased to 1.7 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 88.6-90.35 million VND/tael (buy - sell), an increase of 200,000 VND/tael for buying and a decrease of 100,000 VND/tael for selling compared to early this morning.

The difference between buying and selling prices increased sharply to 1.75 million VND/tael.

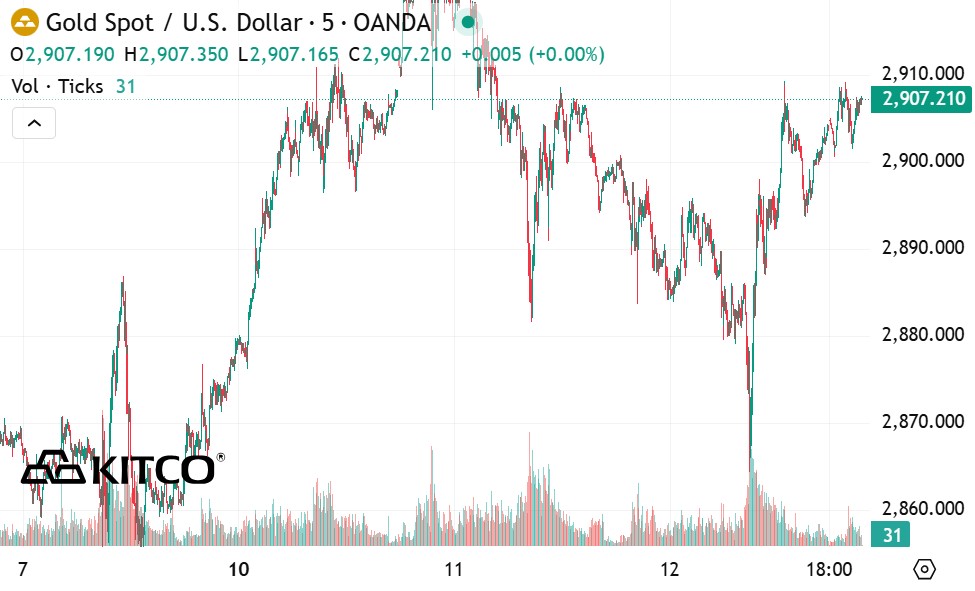

World gold price

As of 9:30 a.m., the world gold price listed on Kitco was at 2,907.2 USD/ounce, up 12.7 USD/ounce compared to the beginning of the previous trading session.

Gold Price Forecast

World gold prices fell amid a stronger US dollar. At 9:30 a.m. on February 13, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, stood at 107.715 points (down 0.17%).

"Gold prices fell after the testimony of Federal Reserve Chairman Jerome Powell, but traders immediately jumped in to buy. They wait for such dips to take advantage of buying opportunities," said Gary Wagner in a recent interview with Kitco News.

According to Wagner, US President Donald Trump's imposition of 25% tariffs on steel and aluminum has increased inflation risks, increasing demand for safe haven gold. "The tariffs raise the risk of re-inflation," Wagner said.

Gold prices are now approaching the psychologically important $3,000 an ounce mark. “Round numbers like $1,000, $2,000 or $3,000 an ounce are always important psychological thresholds,” Wagner said.

He believes that gold reaching $3,000 an ounce is just a matter of time: "It's not if, but when. And I think it will happen soon."

Despite the strong uptrend in gold, Wagner acknowledged the possibility of a correction. However, he noted that “there have never been two consecutive down days” in this rally, suggesting that the momentum remains strong.

Jim Wyckoff, senior analyst at Kitco, said that gold prices quickly recovered from the decline due to hotter-than-expected CPI data showing that safe-haven demand for gold remains strong, despite high inflation reports - a factor that often causes US bond yields to rise and boosts the USD index.

The market reaction showed investors were focused on rising inflation and monetary policy. As a result, optimism remained high as gold continued to act as a hedge against economic uncertainty. While Powell’s remarks and better-than-expected inflation data did dampen gold’s gains, the rapid rebound from the day’s lows showed investors were still holding on to the precious metal amid economic and geopolitical uncertainty.

See more news related to gold prices HERE...