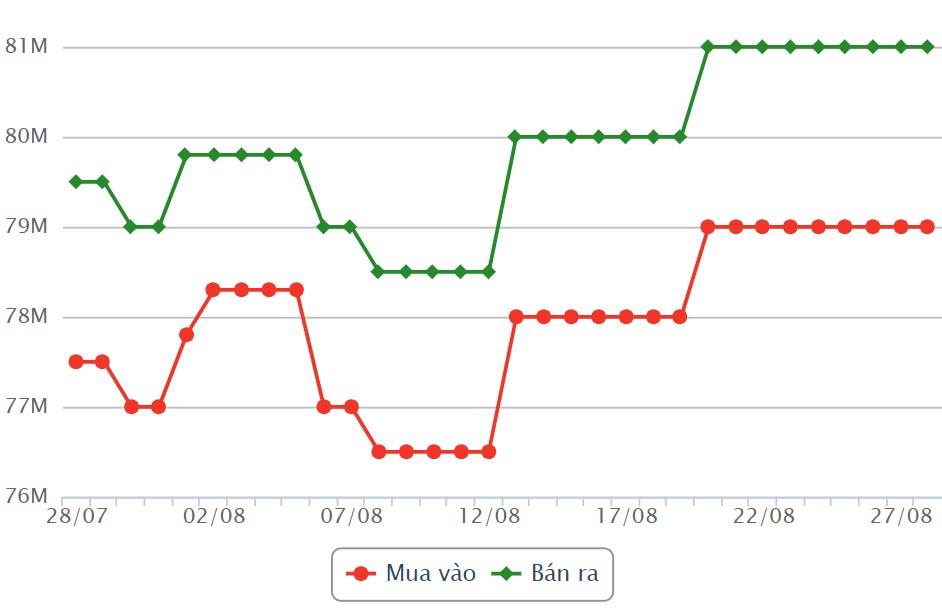

SJC gold bar price

As of 9am, the price of SJC gold bars listed by DOJI Group was at 79 - 81 million VND/tael (buy - sell).

Compared to the beginning of the previous trading session, the gold price at DOJI remained unchanged in both buying and selling directions.

The difference in buying - selling price of SJC gold at DOJI Group is at 2 million VND/tael.

Meanwhile, Saigon SJC VBQ Company listed SJC gold price at 79 - 81 million VND/tael (buy - sell).

Compared to the beginning of the previous trading session, the gold price at VBQ Saigon SJC Company remained unchanged in both buying and selling directions.

The difference in buying - selling price of SJC gold at Saigon SJC VBQ Company is at the threshold of 2 million VND/tael.

Gold ring price 9999

This morning, the price of 9999 Hung Thinh Vuong round gold ring at DOJI was listed at 77.55 - 78.65 million VND/tael (buy - sell); increased by 100,000 VND/tael for both buying and selling directions.

Saigon Jewelry Company lists gold ring prices at 77.4 - 78.65 million VND/tael (buy - sell); Increase the purchase price by 100,000 VND/tael and keep the sale price unchanged.

In recent sessions, gold ring prices often fluctuate in the same direction as the world market. Investors can refer to world markets and expert opinions before making investment decisions.

World gold price

As of 9:30 a.m., the world gold price listed on Kitco was at 2,516.1 USD/ounce, an increase of 9.1 USD/ounce compared to the beginning of the previous trading session.

Gold price forecast

World gold prices increased despite the recovery of the USD index. Recorded at 9:45 a.m. on August 28, the US Dollar Index measuring the fluctuation of the greenback with 6 major currencies was at 100,575 points (up 0.12%).

Gold's new price increase comes amid improving consumer sentiment. The US consumer confidence index in August painted an optimistic picture, increasing to 134.4 from 133.1 in July.

The catalyst for USD/ounce weakness can be traced back to late June when optimism began to build around the US Federal Reserve's (FED) ability to pivot to interest rate normalization. .

This sentiment has been reinforced by the recent speech of Fed Chairman Jerome Powell at the Economic Symposium in Jackson Hole, Wyoming. Powell's comments effectively confirm that the era of strong interest rate increases, which began in March 2022, is over, with the first rate cut likely to take place in September this year.

The market is expecting the US to reduce interest rates. According to CME's FedWatch tool, 66% forecast a 0.25% cut in September, with a 34% chance of a 0.5% cut.

This expected change in monetary policy has important implications for gold markets, cementing its status as a safe haven asset and hedge against economic instability.