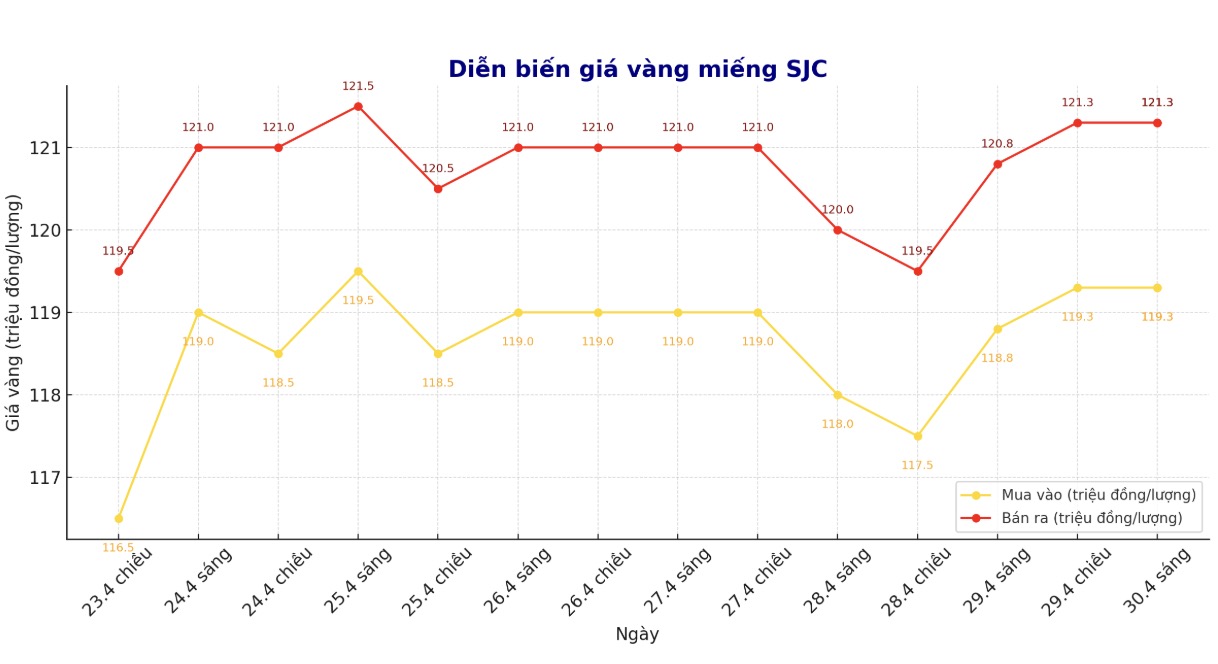

Updated SJC gold price

As of 9:30 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND 119.3-121.3 million/tael (buy in - sell out), an increase of VND 500,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 119.3-121.3 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 119.3-121.3 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 118.3-121.3 million VND/tael (buy - sell), an increase of 500,000 VND/tael for both buying and selling. The difference between buying and selling prices is at 3 million VND/tael.

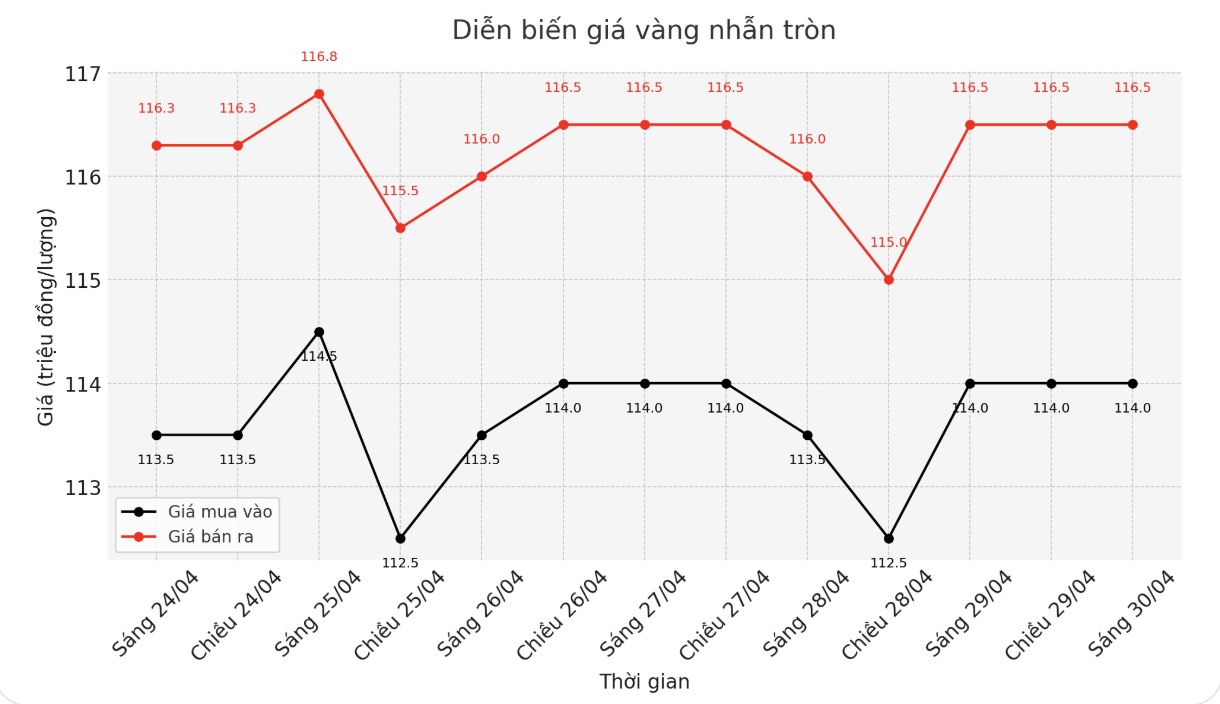

9999 round gold ring price

As of 9:30 a.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 114-116.5 million VND/tael (buy in - sell out), unchanged in both buying and selling directions. The difference between buying and selling prices is at 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 117.1-120.1 million VND/tael (buy - sell), an increase of 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 115-118 million VND/tael (buy - sell), an increase of 200,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

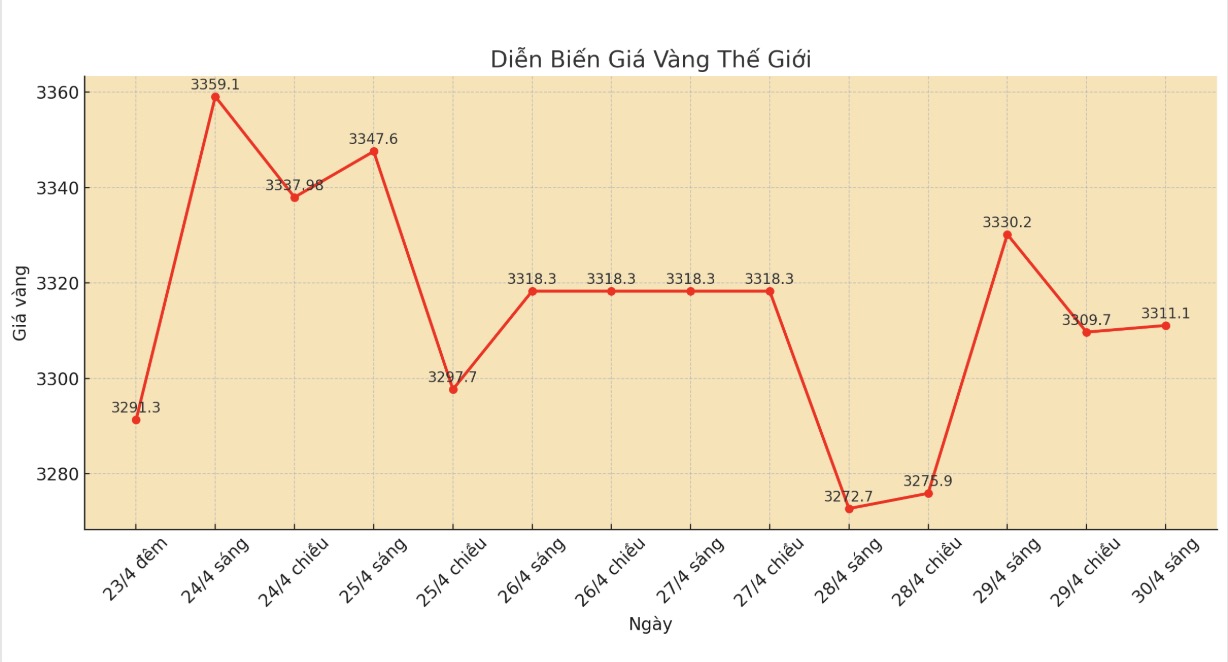

World gold price

At 9:30 a.m., the world gold price listed on Kitco was around 3,311.1 USD/ounce, down 19.1 USD.

Gold price forecast

According to Kitco, world gold prices are under pressure as investors' risk-taking sentiment has increased slightly. In addition, the strengthening of the US dollar and falling crude oil prices also put pressure on the precious metal. Meanwhile, silver prices increased slightly.

The risk level has decreased slightly after the news that the US is negotiating trade agreements with a number of countries. However, if the corporate profit report continues to be unsatisfactory, the stock market may face downward pressure.

Senior analyst Ricardo Evangelista of brokerage ActivTrades said that gold prices are being pulled down due to optimism in the financial market about the possibility of cooling down the trade war between China and the US as well as the modest recovery of the USD.

In the latest commodity outlook report, World Bank experts predict that the average gold price this year will reach about 3,250 USD/ounce, up 36% compared to the average last year. This is a big change from the forecast in November, when they thought gold prices would move sideways.

It is expected that by 2026, the average gold price will decrease slightly to about 3,200 USD/ounce, down 1.5% compared to this year. However, in the broader context, gold is still predicted to be the most prominent asset in the commodity group in the next two years.

Thanks to the continued high demand for safe havens in the short term due to uncertainty, geopolitical tensions and concerns about fluctuations in major financial markets, gold prices are expected to remain high, around 155% compared to the average of 2015-2019. If geopolitical tensions and policy uncertainty continue to rise, gold prices could well exceed current forecasts, the report said.

Technically, the gold contract in June is still having technical advantages in the short term. The next increase of the buyer is to close the resistance threshold of 3,509.9 USD/ounce. In contrast, the seller is aiming to bring the price below the support of US $ 3,200/ounce.

Important economic data for the week

Wednesday: ADP Employment Report, Preliminary Q1 GDP, US pending housing contracts; Japanese Central Bank monetary policy meeting.

Thursday:Weekly jobless claims and the US Manufacturing across Market Management Index (ISM Manufacturing PMI).

Friday: Non-farm Payrolls report in the US.

See more news related to gold prices HERE...