Update SJC gold price

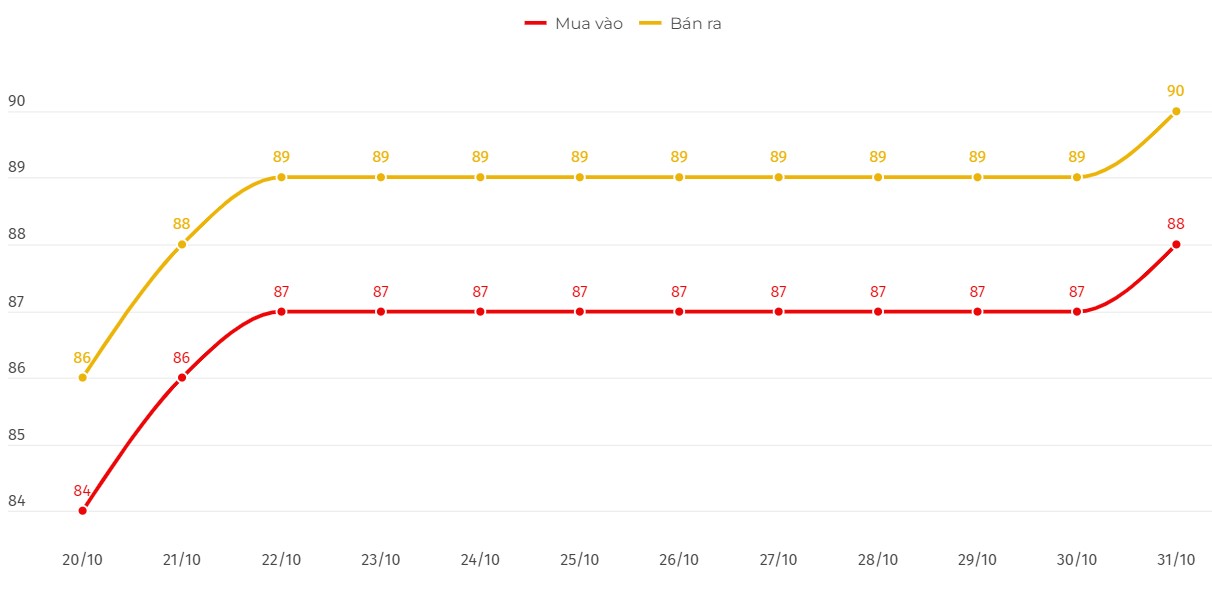

As of 9:00 a.m., the price of SJC gold bars was listed by DOJI Group at 88-90 million VND/tael (buy - sell).

Compared to the beginning of the previous trading session, gold price at DOJI increased by 1 million VND/tael for both buying and selling.

The difference between buying and selling prices of SJC gold at DOJI Group is at 2 million VND/tael.

Meanwhile, Saigon Jewelry Company listed the price of SJC gold at 88-90 million VND/tael (buy - sell).

Compared to the beginning of the previous trading session, the gold price at Saigon Jewelry Company SJC increased by 1 million VND/tael for both buying and selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Currently, the difference between buying and selling gold prices is listed at around 2 million VND/tael. Experts say that this difference is very high, causing investors to face the risk of losing money when investing in the short term.

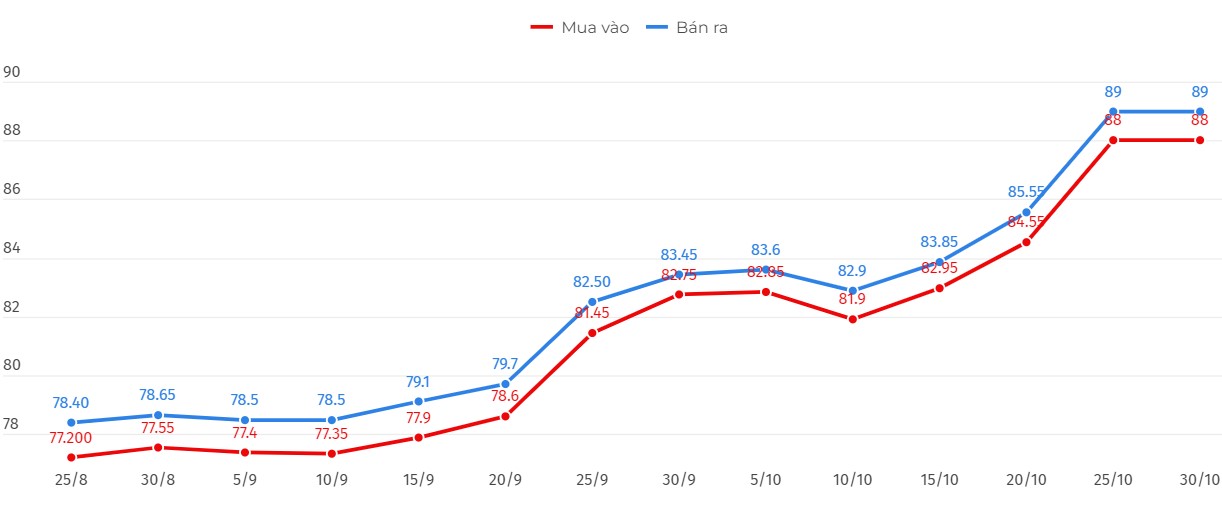

Price of round gold ring 9999

As of 9am today, the price of 9999 Hung Thinh Vuong round gold ring at DOJI is listed at 88.6-89.6 million VND/tael (buy - sell); increased by 600,000 VND/tael in both directions.

Bao Tin Minh Chau listed the price of gold rings at 88.58-89.58 million VND/tael (buy - sell); increased by 600,000 VND/tael in both directions.

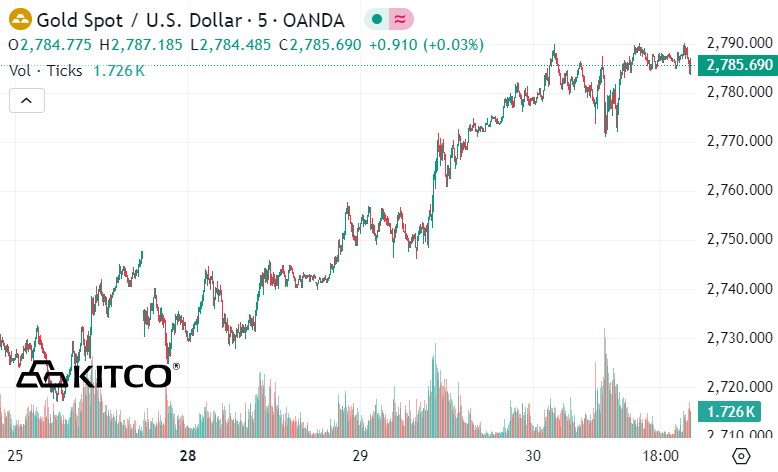

World gold price

As of 9:00 a.m., the world gold price listed on Kitco was at 2,785.6 USD/ounce, up 4.1 USD/ounce compared to the beginning of the previous trading session.

Gold Price Forecast

World gold prices increased despite the increase in the USD index. Recorded at 9:05 a.m. on October 31, the US Dollar Index, which measures the fluctuations of the greenback against 6 major currencies, was at 104.114 points (up 0.22%).

Analysts say the approaching US presidential election is driving demand for safe-haven gold. The latest polls show the two US presidential candidates, Donald Trump and Kamala Harris, are neck and neck. Investors are also waiting for economic data for further clues on the US Federal Reserve's policy decisions.

"We have the US election, the possibility of further Fed rate cuts and the Russia-Ukraine war. There are too many factors out there that are driving gold higher. I think the precious metal is heading towards $2,850 an ounce," said Daniel Pavilonis, strategist at RJO Futures.

In the longer term, Dominik Sperzel - Head of Trading at Heraeus Metals Germany - predicts that gold will hit $3,000/ounce next year, due to concerns about the outlook in emerging economies, buying by gold ETFs and post-election market corrections.

According to Kitco, the world gold price is increasing vertically, continuously breaking records. However, some experts say this is still a good time to buy.

Mr. Robert Minter - Director of ETF strategy commented that investors should ignore the potential fluctuations of the market in the short term. He said that they should focus on the big picture including the interest rate trending down.

Lower interest rates and persistent inflationary pressures mean real interest rates could fall faster than expected. “In this case, investors should focus on commodities, with a specific allocation to gold,” Robert Minter stressed.

However, many investors still choose to stay on the sidelines. According to Robert Minter, this is one of the biggest factors that increases the price of gold and supports the price of the precious metal in the long term.

See more news related to gold prices HERE...