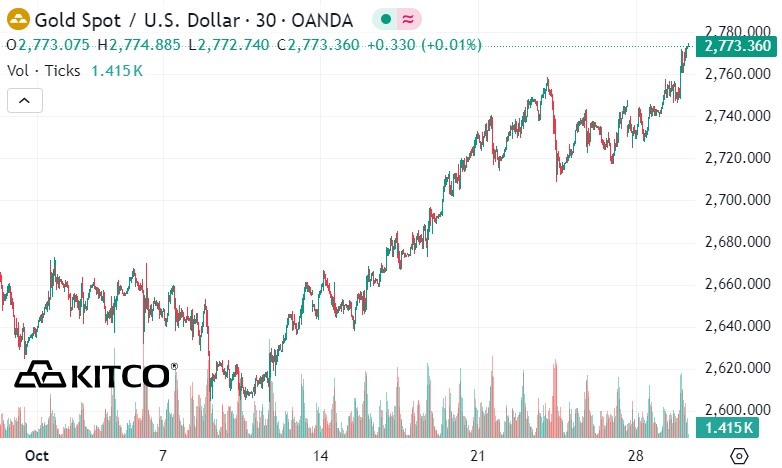

According to Kitco - in a week, Americans will officially go to the polls to elect a new Congress and President. Information surrounding the election fuels instability in financial markets, causing investors to turn to gold as a safe-haven asset.

Increased safe-haven demand for gold has helped push prices to all-time highs.

Krishan Gopaul, senior market analyst at the World Gold Council, noted that the ETF market (exchange-traded funds backed by gold) saw inflows of about 15 tonnes, worth $1.4 billion, last week.

Meanwhile, ETF demand has turned positive this year, rising by about eight tonnes. “Asia led the inflows into gold, driven largely by Chinese funds, followed by North America,” he said.

Ole Hansen, head of commodity strategy at Saxo Bank, said the news about US politics was a driver of renewed safe-haven demand across commodity markets.

However, given the shocking rise in gold prices, Hansen said the precious metal is facing increasing downside risks. "Next week, gold could see a rapid correction of $100 to $150 an ounce."

Looking further ahead, though, Hansen said the price action, while high, did not appear to be excessive: “I don’t see any signs of euphoria in the gold market,” he said. The metal has risen more than 30% this year as investors around the world seek protection from uncertainty.

The main drivers of this bullish phase include concerns about financial instability, safe-haven demand, geopolitical tensions, de-dollarization driving strong demand from central banks, Chinese investors turning to gold amid record low savings rates and concerns about the real estate market, and more recently, the news surrounding the US presidential election," Hansen said.

Hansen also noted that gold still has room to move higher as institutional investors are only just starting to re-enter gold-backed exchange-traded funds.

See more news related to gold prices HERE...