Updated SJC gold price

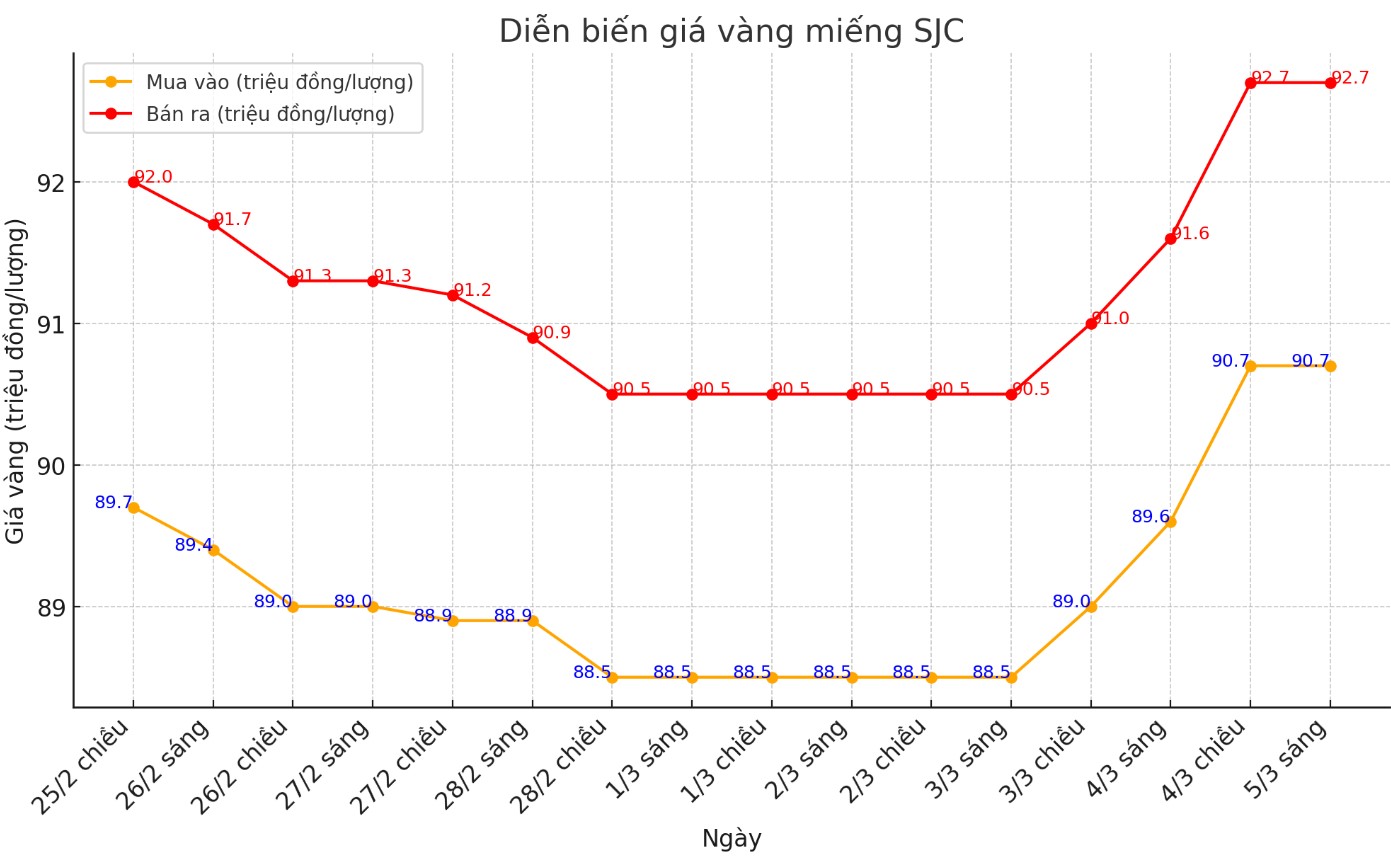

As of 9:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 90.7-92.7 million VND/tael (buy - sell), an increase of 1.1 million VND/tael for both buying and selling.

The difference between the buying and selling prices of SJC gold at Saigon Jewelry Company SJC is at 2 million VND/tael.

Meanwhile, the price of SJC gold bars was listed by DOJI Group at 90.7-92.7 million VND/tael (buy - sell), an increase of 1.1 million VND/tael for both buying and selling.

The difference between the buying and selling prices of SJC gold at Saigon Jewelry Company SJC is at 2 million VND/tael.

At the same time, Bao Tin Minh Chau listed the price of SJC gold bars at 90.9-92.7 million VND/tael (buy - sell); an increase of 1.1 million VND/tael for both buying and selling.

The difference between buying and selling SJC gold at Bao Tin Minh Chau is at 1.8 million VND/tael.

9999 round gold ring price

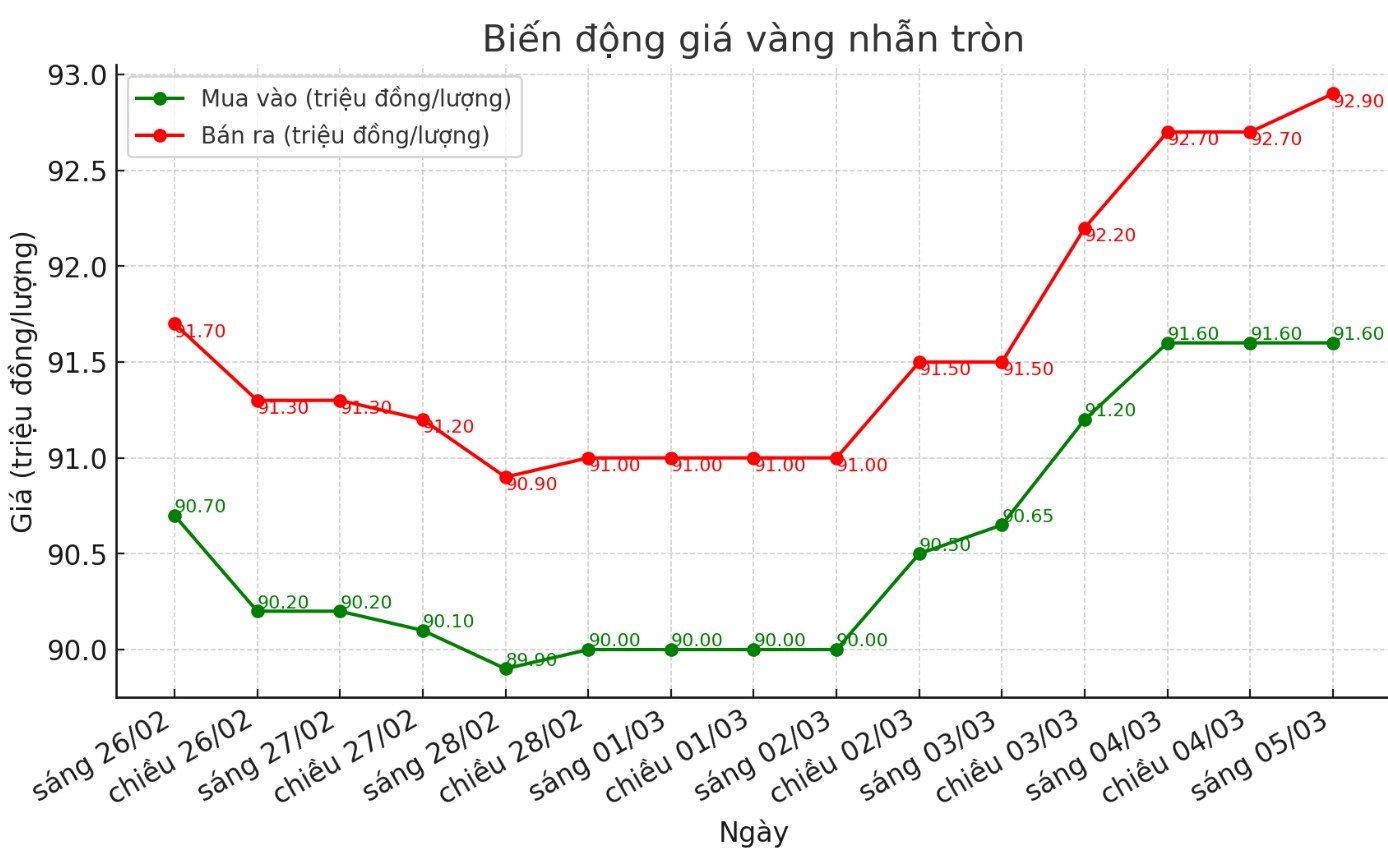

As of 9:00 a.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at VND91.6-92.9 million/tael (buy - sell); an increase of VND700,000/tael for both buying and selling compared to early this morning.

The difference between buying and selling is at 1.3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 91.9-93.1 million VND/tael (buy - sell), an increase of 700,000 VND/tael for both buying and selling compared to early this morning.

The difference between buying and selling is at 1.2 million VND/tael.

World gold price

As of 9:00 a.m., the world gold price listed on Kitco was at 2,906.9 USD/ounce, up 20.5 USD/ounce compared to the beginning of the previous trading session.

Gold price forecast

World gold prices recovered despite the increase of the USD. Recorded at 9:00 a.m. on March 5, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 105.670 points (up 0.15%).

Gold prices continued to increase strongly after the recovery on Monday as safe-haven demand remained strong due to rising geopolitical tensions.

Risk fearing continues to be high. The US has imposed tariffs on Mexico, Canada and China since Tuesday, which these countries have responded to, affecting about $1 trillion in global trade.

According to Kitco - the S&P 500 index began to fall sharply on Monday afternoon after US President Donald Trump announced the imposition of tariffs, pushing the US into a global trade war.

The stock index lost 104 points on Monday and continued to fall on Tuesday, falling below the important support level of 5,800 points.

There is speculation that China could let the yuan depreciate to reduce the impact of tariffs and support exports, said SP Angel.

Currently, analysts predict that the People's Bank of China will maintain a stable exchange rate, but if the yuan weakens further against the USD, Chinese buyers could pour into gold as a safe-haven asset.

SP Angel commented: " 10-year yields have fallen from 4.8% to 4.14% due to expectations that the US Federal Reserve (FED) will cut interest rates sooner amid concerns about slowing economic growth".

Ole Hansen - Head of Commodity Strategy at Saxo Bank - commented that gold still has room to increase after the recent slight correction. According to him, the target of $3,000/ounce is returning to the target.

The outlook for gold remains positive, especially as the recent correction only took place in a short time, showing strong demand even with selling pressure from traders according to technical analysis.

In addition to the need for diversification and safe havens, gold will continue to be supported by central bank purchases amid concerns about rising public debt, Hansen wrote in the latest report on the precious metal.

In addition to geopolitical uncertainties that strengthen gold's safe-haven role, Hansen also pointed out that the USD is weakening as the USD Index tests the important support level at 106 points.

At the same time, the slow growth of the US economy has increased expectations that the US Federal Reserve (FED) will be forced to cut interest rates this year, even if inflation remains high.

See more news related to gold prices HERE...