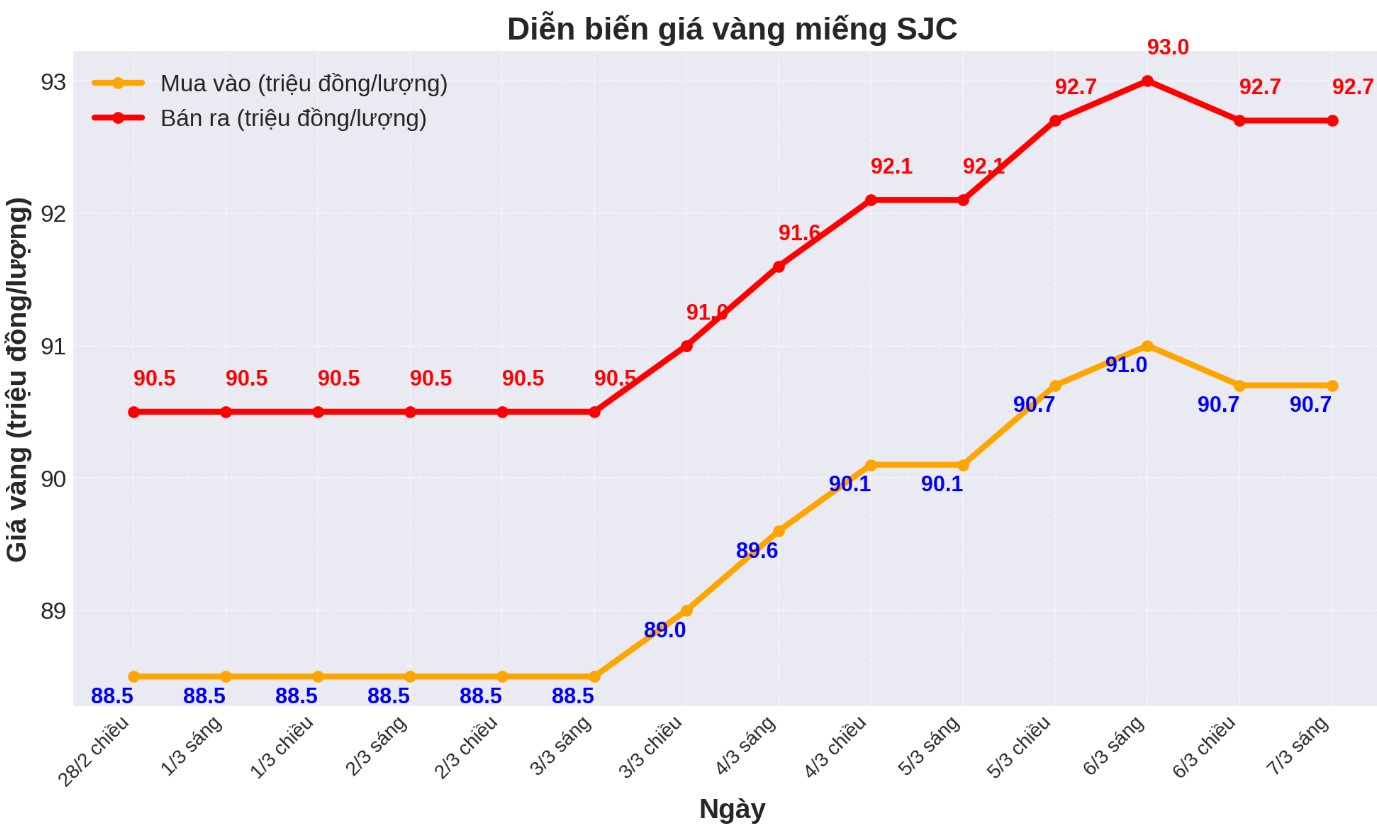

Updated SJC gold price

As of 9:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 90.7-92.7 million VND/tael (buy in - sell out), down 300,000 VND/tael for both buying and selling.

The difference between the buying and selling prices of SJC gold at Saigon Jewelry Company SJC is at 2 million VND/tael.

Meanwhile, the price of SJC gold bars was listed by DOJI Group at 90.7-92.7 million VND/tael (buy - sell), down 300,000 VND/tael for both buying and selling.

The difference between the buying and selling prices of SJC gold at DOJI is at 2 million VND/tael.

At the same time, Bao Tin Minh Chau listed the price of SJC gold bars at 90.7-92.7 million VND/tael (buy - sell); down 200,000 VND/tael for buying and kept the same for selling.

The difference between buying and selling SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

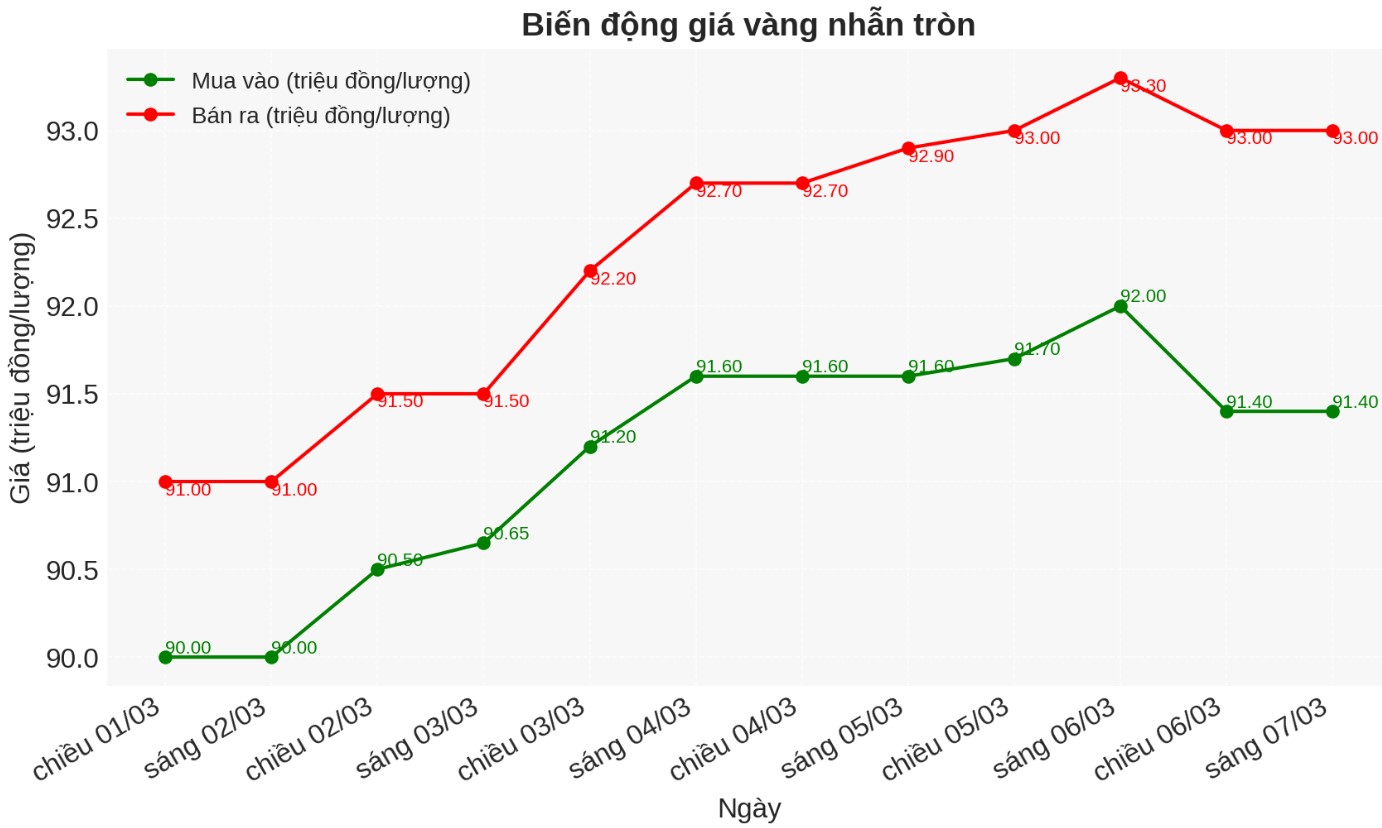

9999 round gold ring price

As of 9:00 a.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at VND91.4-93 million/tael (buy - sell); down VND600,000/tael for buying and down VND300,000/tael for selling compared to early this morning.

The difference between buying and selling is at 1.6 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 91.6-93.1 million VND/tael (buy - sell), down 400,000 VND/tael for buying and down 100,000 VND/tael for selling compared to early this morning.

The difference between buying and selling is at 1.5 million VND/tael.

World gold price

As of 9:00 a.m., the world gold price listed on Kitco was at 2,906.9 USD/ounce, down 16.4 USD/ounce compared to the beginning of the previous trading session.

Gold price forecast

World gold prices fell despite the decline of the USD. Recorded at 9:00 a.m. on March 7, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 104.135 points (down 0.04%).

Yesterday's session, some investors took a slight profit after the increase at the beginning of the week. However, the buying pressure when prices decreased helped the market stabilize again.

Short-term traders tend to stay out of the market waiting for the US jobs report on Friday. The non-farm payroll is forecast to increase by 170,000 jobs, higher than the increase of 143,000 in January.

US stock indexes fell sharply in the middle of the session, as the fear of increasing risks increased. Investors are concerned about retaliatory tax measures between major economies, which could push the global economy into recession.

In an email to customers, David Morrison of Trade Nation commented: US President Donald Trump is pursuing drastic trade policies and is ready to suffer losses to achieve his goals. tariffs may be the cause of the latest downturn, but that is not the only story. There is growing speculation about the possibility of a recession in the US this year.

GDP growth forecasts have been significantly lowered, while inflation is still well above the 2% target set by the US Federal Reserve (FED). Recent economic data have been disappointing, especially consumer confidence, retail sales and weekly jobless claims.

In another development, the World Gold Council (WGC) said that after nearly four years of gloomy market, investment demand for gold is increasing as gold ETFs recorded large purchases in February. This is positive information supporting gold prices.

According to the WGC, investment capital flows into North American listed gold ETFs increased sharply, reaching 72.2 tons of gold (equivalent to 6.8 billion USD). This is the highest monthly net purchase price since July 2020 and the February with the largest purchase ever.

Experts say falling bond yields and a weakening US dollar have created favorable conditions for gold prices to increase, hitting a record 9 times in February before falling slightly at the end of the month.

They say falling opportunity costs, combined with new gold prices, have boosted inflows into gold. In addition, the decline in the stock market and concerns about stagnant inflation also contribute to boosting investment demand.

See more news related to gold prices HERE...