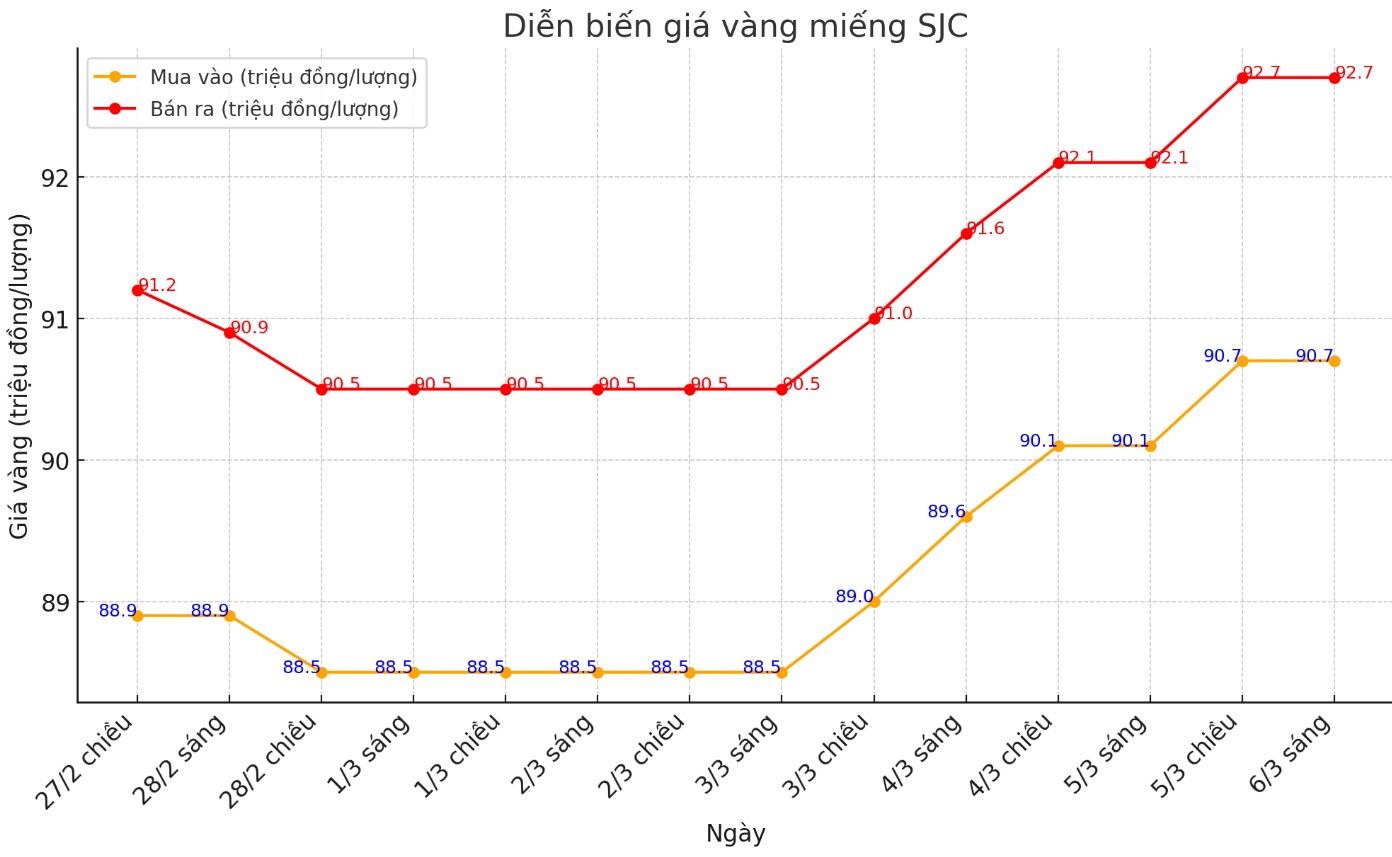

Updated SJC gold price

As of 6:00 a.m., DOJI Group listed the price of SJC gold bars at 90.7-92.7 million VND/tael (buy - sell), an increase of 600,000 VND/tael for both buying and selling. The difference between the buying and selling prices of SJC gold was listed by DOJI at 2 million VND/tael.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company at 90.7-92.7 million VND/tael (buy in - sell out), unchanged in both buying and selling directions. The difference between the buying and selling prices of SJC gold was listed by Saigon Jewelry Company at VND2 million/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 90.9-92.7 million VND/tael (buy - sell), an increase of 200,000 VND/tael for buying and kept the same for selling. The difference between the buying and selling prices of SJC gold was listed by Bao Tin Minh Chau at 1.8 million VND/tael.

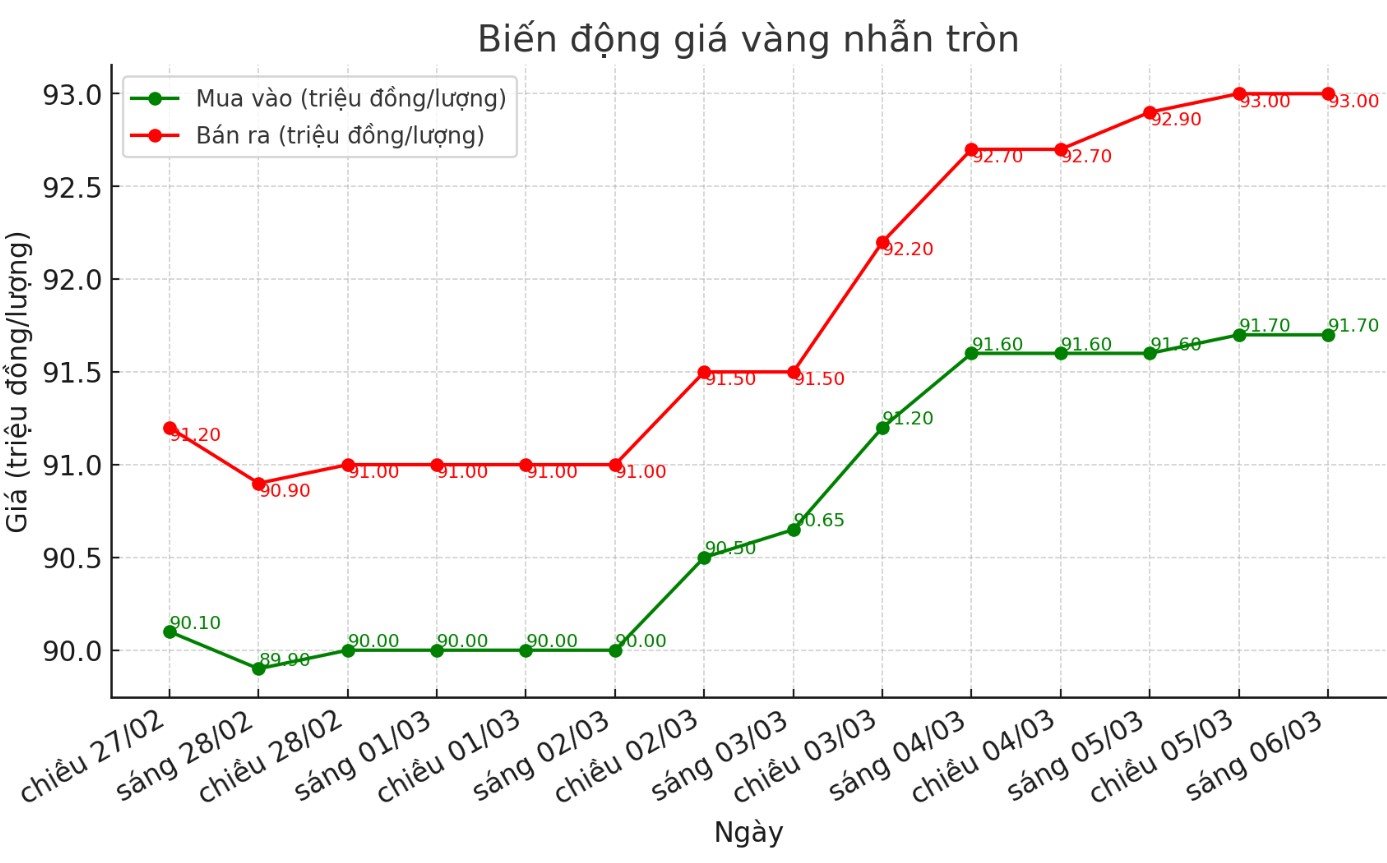

9999 round gold ring price

As of 6:00 a.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at VND91.7-93 million/tael (buy - sell); increased by VND100,000/tael for buying and increased by VND300,000/tael for selling. The difference between buying and selling is listed at 1.3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 92-93.2 million VND/tael (buy - sell); increased by 400,000 VND/tael for both buying and selling. The difference between buying and selling is 1.2 million VND/tael.

Recent trading sessions of plain gold rings have often fluctuated in the same direction as the world. In the context of the world market recording a strong increase, the domestic gold ring price this morning may increase.

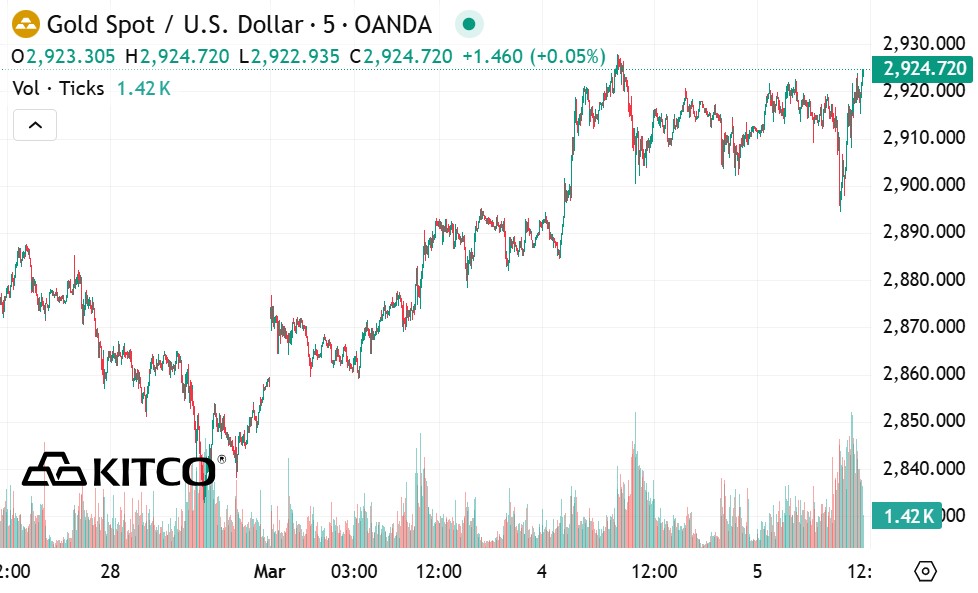

World gold price

As of 6:15 p.m. on March 5, the world gold price listed on Kitco was at 2,924.7 USD/ounce, up 18.2 USD/ounce.

Gold price forecast

World gold prices increased in the context of the USD plummeting. Recorded at 23:20 on March 5, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 104.450 points (down 1.21%).

Safe-haven demand amid rising geopolitical tensions and a sharp decline in the US dollar is helping to keep gold prices high.

Gold futures for April fell $3.2 to $2,917.4 an ounce, while silver futures for May rose $0.414 to $22.795 an ounce.

Gold market buying failed to find momentum after the ADP's national employment report showed only 77,000 new jobs in February, much lower than the forecast of 148,000 jobs. This report is considered a warning for the important US Department of Labor employment data released on Friday.

The Asian and European stock markets mainly increased their points in the overnight trading session. US stock indexes are also heading for higher opening as the trading session in New York begins.

Part of the increased momentum comes from US Secretary of Commerce Howard Lutnick's speech, suggesting that there may be flexibility to new trade tariffs.

In other developments, China has begun the annual session of the National People's Congress, reaffirming the economic growth target of 5% for 2025.

The January producer price index (PPI) of the Eurozone increased more strongly than expected, up 0.8% compared to the previous month and up 1.8% compared to the same period last year.

Gold futures for April continued to maintain short-term advantage as buyers continued to control the market. The next target for buyers is to conquer and maintain the closing price above the important resistance level of 2,974 USD/ounce.

Meanwhile, the sellers are trying to push prices below the important support level of 2,844.1 USD/ounce. The upcoming resistance levels were determined at 2,933.7 USD/ounce, then at 2,939.8 USD/ounce. In contrast, the nearest support zone is at $2,900/ounce, followed by $2,892.5/ounce.

The price trend in the coming time will depend on the ability of buyers to maintain the increase as well as the pressure of adjustment from selling pressure in the market.

In the outside market, WTI crude oil prices on Nymex also decreased, trading around 67.25 USD/barrel. The yield on the 10-year US Treasury note is currently at 4.24%.

See more news related to gold prices HERE...