Last night, gold and silver prices skyrocketed. Gold prices continue to set new records, while silver is approaching the peak it reached in 1980.

Safe-haven demand amid US government shutdowns and fake sales tightening in the silver market has kept buyers confident, while sellers cautiously do not dare to face it.

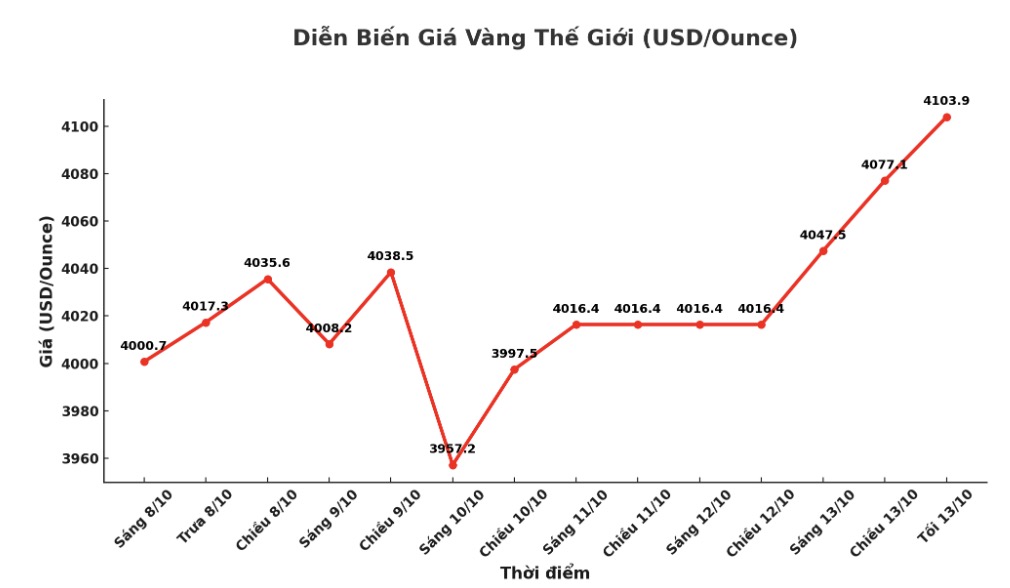

Recent strong fluctuations suggest that the risk level and price fluctuations of these two precious metals will remain high in the short term. December gold futures increased by $95.2 to $4,095.8 an ounce, while December silver futures increased by $2.398 to $49.63 an ounce.

According to Bloomberg, overnight silver prices have hit a multi-decade high as the historic "fake-off" in London has become more intense, forcing investors around the world to actively hunt for physical silver to make up for supply and demand shortages.

Spot gold has increased by 3.1%, to nearly 52 USD/ounce, surpassing last week's peak; spot gold also surpassed 4,070 USD/ounce, setting a new record.

The heat spread to platinum and palladium as investment demand increased sharply, causing liquidity stress in the London market. The standard price here is currently significantly higher than in New York, causing many traders to charter flights across the Atlantic to transport silver, a form of capital used only for gold to take advantage of the large difference - according to Bloomberg.

Meanwhile, the US political situation continues to be complicated as President Donald Trump's firing of federal employees increases the risk of a prolonged government shutdown. According to Bloomberg, the Democrats see this as an opportunity to create pressure to negotiate, focusing on the issue of medical costs to please voters before the midterm election. The Republican Party accused the opponent of taking advantage of the situation to take political advantage.

In addition, the Trump administration has also signaled readiness to negotiate with China to cool down trade tensions, but warned that Beijing's new export control measures are the main barrier. China has previously imposed additional port fees on US ships, opened an antitrust investigation with Qualcomm and tightened exports of rare earths and many other strategic materials.

WTI crude oil price on Nymex dropped more than 3 USD/barrel on Friday, to the lowest level in the last 4.5 months of about 58 USD/barrel due to concerns that the US-China trade conflict will slow global growth and reduce energy demand. Dau sau do phuc hoi nhe len khoang 59,75 USD/thung. Increased global supply, especially from OPEC+ and non-bloc countries, and the progress of a ceasefire in Gaza put even greater downward pressure on prices.

Currently, the USD index has increased slightly, the yield on the 10-year US Treasury note is at 4.04%.

Technically, gold buyers are holding a clear advantage in the short term. The next upside target is to close above the strong resistance zone of 4,200 USD/ounce, while the nearest support zone is at 4,050 USD and 4,011 USD/ounce.

For silver, buyers are also dominating. The next target is to surpass the resistance level of 50 USD/ounce, with important support of 49 USD and 48 USD/ounce.

See more news related to gold prices HERE...