Sean Lusk, co-head of commercial defense at Walsh Trading, said that gold prices are being pushed up by the psychology of finding every reason to buy.

In my opinion, investors only need an excuse to push prices up, and they have it when the US government continues to close, he said. The gold market should have cooled down like energy, but that didnt happen. The temporary easing of tensions in the Middle East is not enough to reduce prices."

He admitted that the metal market is becoming crazy, as cash flow continues to flow into buying positions even though gold has increased by more than 50% since the beginning of the year. "Now the question is: is this price too high, or is there still room for increase? With silver at $50 an ounce and gold above $4,000 an ounce, what could continue to push prices higher? - Lusk asked.

He believes that the FOMO (fear of missing out) mentality is spreading. Many retail investors, through Robinhood online platforms, are rushing to buy gold just because they heard the forecast that prices would increase to $4,700 or $4,900/ounce. They looked at the price of $3,900 and thought, "If it was real, I would have to buy it right away."

Lusk warned that this phenomenon is similar to a stock or real estate bubble before the crisis. The market has changed a lot after the pandemic: more participants, easier transactions, lower costs, and even day-to-day options contracts something unprecedented. The game is different now".

However, he was still cautious: Nothing increases forever. The question is only when the market will adjust. The more obvious the factors are in the long term, the more difficult it is for gold to stay at the current high level. I used to think prices would fall below $3,000/ounce by the end of July, but the market is still going up."

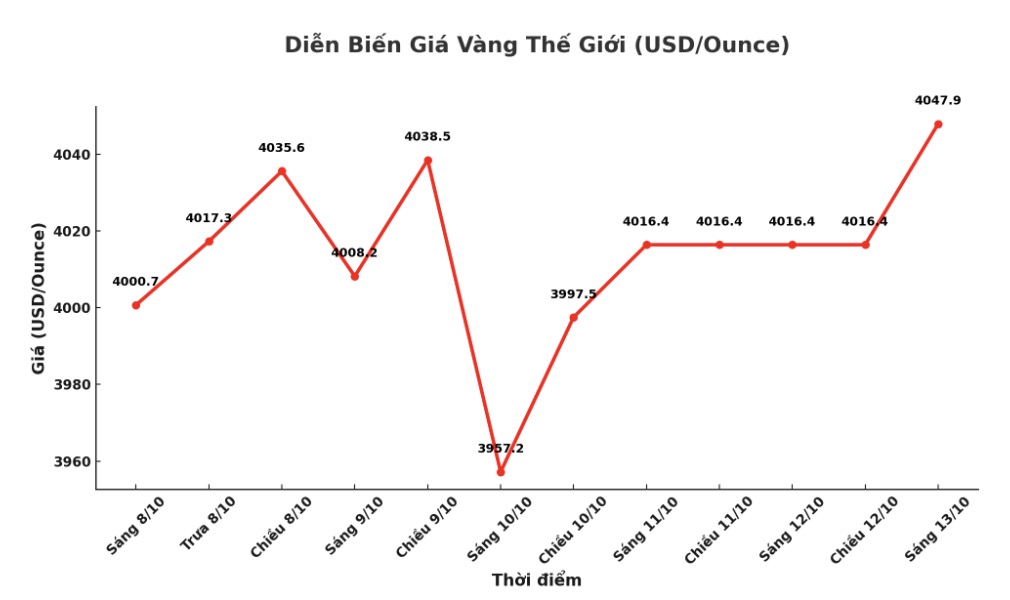

In the short term, Rich Checkan - Chairman and CEO of Asset Strategies International believes that gold prices will continue to increase: "It is not difficult to see the current momentum leaning towards buyers. Just look at today's recovery from yesterday's strong profit-taking in both gold and silver - one day later, everything seems like never-before-adequacy."

Intability in the Middle East, new drone and missile attacks in Ukraine, US government shutdowns, weakening USD and another rate cut at the end of the month all make the direction of gold too clear, Checkan added. Restore the old song.

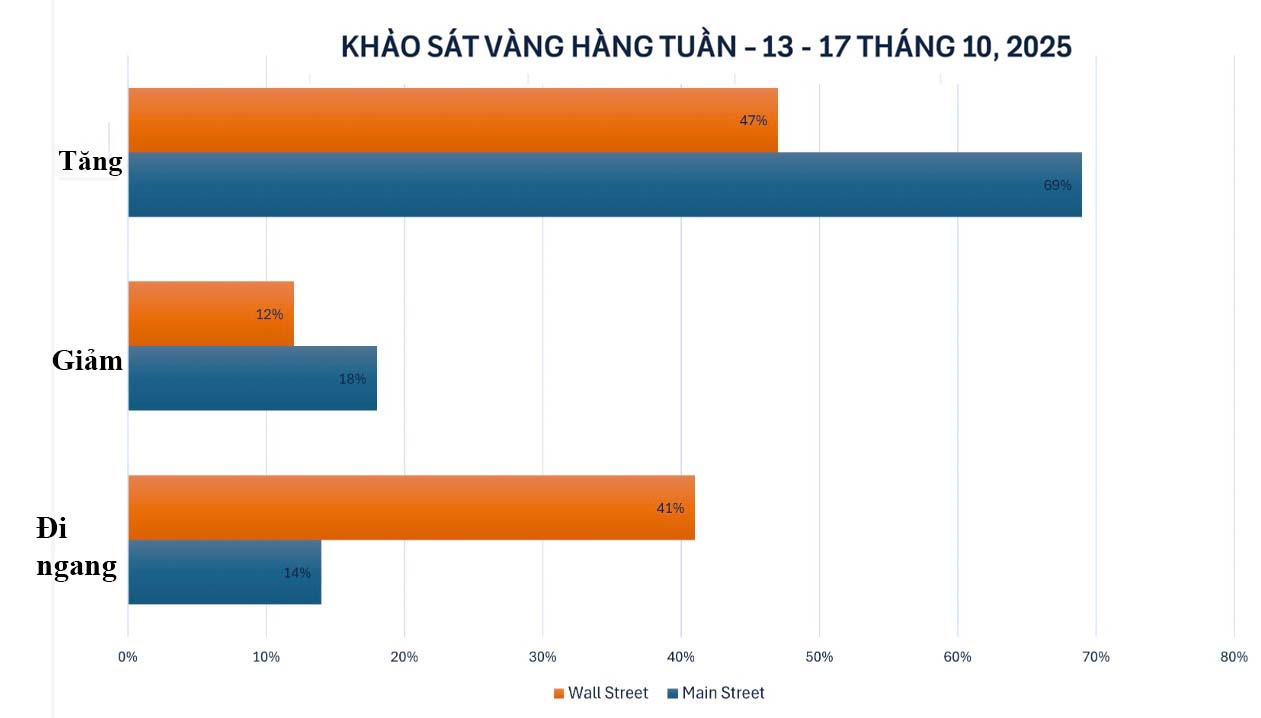

Sharing the same view, Darin Newsom - senior market analyst at Barchart.com also predicted that gold prices will increase this week.

On the other hand, Ole Hansen - head of commodity strategy at Saxo Bank predicted that gold prices would decrease: "Simply because gold prices are unlikely to increase forever and maintain the increase for 9 consecutive weeks. Overall, the outlook remains positive, but the market is at risk of running out of momentum if there is no adjustment. At that time, we will know that part of the recent increase was due to FOMO psychology, and partly due to real long-term holding demand".

Lukman Otunuga - Director of Market Analysis at FXTM - said that in the short term, technical indicators show the possibility of an adjustment if gold prices penetrate the support level of 3,950 USD/ounce.

In the near future, developments surrounding the US governments shutdown and Fed Chairman Jerome Powells speech could affect golds short-term outlook. If US political risks continue to be a major issue, gold could rebound above $4,000/ounce, especially as expectations of a rate cut continue to increase."

Meanwhile, Adrian Day - Chairman of Adrian Day Asset Management predicted that gold prices will move sideways: "We will see gold fluctuating around the $4,000/ounce mark. The ceasefire in Gaza was an excuse for the correction, but in fact gold prices have risen too fast in the past month to reach that number.

He added that if the US government reopens, it could create downward pressure but the impact would not be large or lasting, "because Gaza or the government shutdowns are not the main reasons for gold's increase."

See more news related to gold prices HERE...